Price-Watch’s most active coverage of 1,4 Butanediol (BDO) price assessment:

- Industrial Grade(99.7% min purity) FOB Shanghai, China

- Industrial Grade(99.5% min purity) FOB Kaohsiung, Taiwan

- Industrial Grade(99.5% min purity) CIF Santos_Taiwan, Brazil

- Industrial Grade(99.7% purity min) CIF Santos_China, Brazil

- Industrial Grade(99.5% purity min) CIF Haiphong_Taiwan, Vietnam

- Industrial Grade(99.7% purity min) CIF Izmir_China, Turkey

- Industrial Grade(99.5% purity min) CIF JNPT_Taiwan, India

- Industrial Grade(99.7% purity min) CIF JNPT_China, India

- Industrial Grade(99.5% purity min) Ex-Bhiwandi, India

- Industrial Grade(99.7% purity min) CIF Houston_China, USA

1,4 Butanediol (BDO) Price Trend Q3 2025

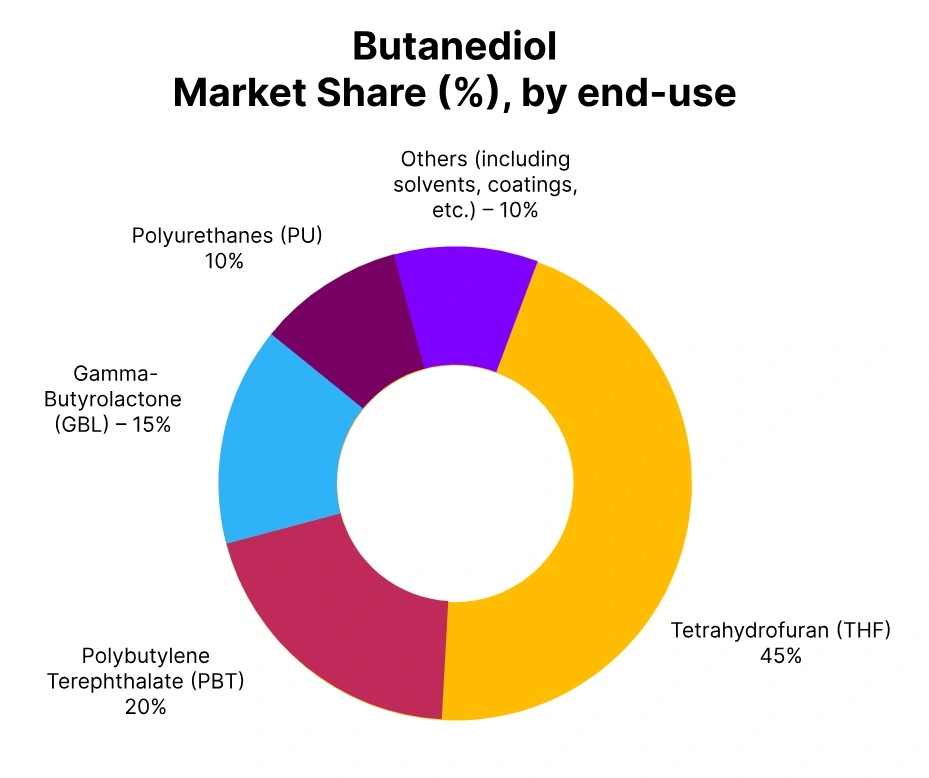

In Q3 2025, the global 1,4-Butanediol (BDO) market experienced a small downward trend with prices declining by around 2–3%. The decrease was mainly influenced by weak feedstock demand and softer downstream consumption across sectors such as tetrahydrofuran (THF) and polybutylene terephthalate (PBT).

Although production levels remained steady, elevated inventories in key markets and cautious purchasing behavior among end-users exerted mild pressure on prices. In the next quarter, a modest recovery in industrial demand and balanced supply fundamentals are expected to stabilize market sentiment.

China: Butanediol Export prices FOB Shanghai, China, Grade-Industrial Grade (99.7% min purity).

According to PriceWatch, in Q3 2025, 1,4-Butanediol (BDO) prices in China displayed a slight downward movement, BDO prices in September 2025 ranging between USD 980–1050/MT. The market trend during the quarter was shaped by fluctuating feedstock costs for acetylene and formaldehyde, alongside stable plant operations across major production hubs. Light demand from downstream tetrahydrofuran (THF) and PBT sectors also weighed slightly on market sentiment.

Despite these pressures, balanced supply conditions and steady export activity helped prevent steeper declines. As the fourth quarter approaches, stable feedstock pricing and improved downstream operating rates are anticipated to lend mild support to BDO price stabilization.

Taiwan: Butanediol Export prices FOB Kaohsiung, Taiwan, Grade Industrial Grade (99.5% min purity).

In Q3 2025, 1,4-Butanediol (BDO) prices in Taiwan witnessed a slight downward trajectory. Butanediol prices in September 2025 settling in the range of USD 1500–1600/MT. The decline was primarily driven by lessened demand from downstream sectors such as tetrahydrofuran (THF) and polybutylene terephthalate (PBT), coupled with ample regional supply.

Feedstock acetylene and formaldehyde costs stayed largely steady, limiting any major cost-push impact. Despite stable production operations, increased inventories and slower offtake from industrial consumers exerted mild downward pressure on prices. Looking forward, market fundamentals are expected to remain balanced, with steady procurement activity likely to stabilize prices in the upcoming quarter.

India: Butanediol import prices CIF JNPT, India, Grade- Industrial Grade (99.5% purity min).

According to PriceWatch, in Q3 2025, 1,4 Butanediol (BDO) imports into India from China and Taiwan reflected a soft market sentiment, largely influenced by feedstock trends and global supply adjustments. The price movement was shaped by moderate fluctuations in acetylene and formaldehyde costs, along with stable operating rates among Asian producers.

BDO import prices from China ranged between USD 1100–1200/MT, while imports from Taiwan were comparatively higher, averaging USD 1600–1700/MT, reflecting differences in production costs and freight rates. Domestic demand from downstream THF and PBT sectors remained cautious while ample availability and steady inflows exerted mild downward pressure on the market.

As a result, BDO prices in India declined by around 3–4% in September 2025. Going forward, steady feedstock trends and moderate regional supply are expected to maintain balanced pricing in the Indian market.

Turkey: Butanediol import prices CIF Izmir, Turkey, Grade Industrial Grade(99.7% purity min).

In Q3 2025, 1,4-Butanediol (BDO) prices in CIF Turkey saw declining prices, primarily influenced by the declining price trend in the FOB China market. The downward movement in Chinese BDO prices, driven by weaker feedstock acetylene costs and subdued downstream consumption, exerted a softening effect on Turkish import values. Stable freight rates and consistent shipment arrivals maintained adequate supply across Turkish ports.

Despite regular inventory levels, subdued import sentiment persisted as buyers adopted a cautious approach amid expectations of further price corrections. As a result, CIF Turkey BDO prices reflected a marginal decline during Q3 2025, with regional import parity closely tracking the bearish trend in China. Looking ahead, stable freight conditions and steady Chinese production are anticipated to support limited price movements in the next quarter.

Vietnam: Butanediol import prices CIF Haiphong, Vietnam, Grade Industrial Grade (99.5% purity min).

In Q3 2025, 1,4-Butanediol (BDO) prices in CIF Vietnam displayed a downward movement, mainly influenced by the declining price trend in the FOB Taiwan market. The fall in Taiwanese BDO prices was primarily attributed to lower feedstock acetylene and formaldehyde costs, alongside stable plant operations and sufficient regional supply. Freight conditions between Taiwan and Vietnam remained consistent, ensuring steady import arrivals throughout the quarter.

Despite adequate stock levels, the soft price sentiment from Taiwan exerted downward pressure on Vietnamese import valuations. As a result, CIF Vietnam BDO prices declined slightly during Q3 2025, tracking the bearish momentum of the Taiwanese market. In the upcoming quarter, steady feedstock trends and balanced regional supply are expected to maintain a stable pricing outlook.

Brazil: Butanediol import prices CIF Santos, Brazil, Grade Industrial Grade(99.7% purity min).

In Q3 2025, 1,4-Butanediol (BDO) prices in CIF Brazil recorded a downward trajectory, primarily influenced by the declining price trends in FOB Taiwan and FOB China markets. The bearish sentiment from these exporting regions stemmed from lower feedstock acetylene and formaldehyde costs, along with steady operating rates and sufficient product availability.

Imports from China were observed in the range of USD 1100–1200/MT, while imports from Taiwan stood higher at USD 1600–1800/MT, reflecting quality variations and freight differentials. Stable shipping routes and regular inflows ensured consistent supply across Brazilian ports, though the soft pricing from Asia exerted pressure on overall import valuations.

Consequently, CIF Brazil 1,4 Butanediol prices declined modestly during Q3 2025, mirroring the bearish tone in key Asian markets. Looking ahead, balanced supply and steady freight rates are expected to keep prices stable in the coming quarter.

USA: Butanediol import prices CIF Houston, USA; Grade- Industrial Grade(99.7% purity min)

According to PriceWatch, in Q3 2025, 1,4-Butanediol (BDO) prices in CIF USA showed a slight downward movement, primarily influenced by the declining price trend in the FOB China market. The fall in Chinese BDO prices was mainly driven by weaker feedstock acetylene and formaldehyde costs, along with steady plant operations and sufficient export availability.

Regular freight schedules and steady shipment flow from China ensured smooth imports into the U.S. market. However, the bearish sentiment from Chinese suppliers weighed on U.S. import valuations, keeping procurement activities cautious.

As a result, CIF USA 1,4 Butanediol prices were recorded in the range of USD 1100–1200/MT, reflecting the softer market tone. Looking forward, steady feedstock dynamics and balanced import volumes are expected to help maintain stable price movements in the upcoming quarter.