Price-Watch’s most active coverage of 2-Ethyl Hexanol price assessment:

- (99.5% min) Industrial Grade FOB Klang, Malaysia

- (99.5% min) Industrial Grade CIF Chittagong_Malaysia, Bangladesh

- (99.5% min) Industrial Grade CIF JNPT_Malaysia, India

- (99.5% min) Industrial Grade Ex-Vizag, India

- (99.5% min) Industrial Grade FOB Texas, USA

- (99.5% min) Industrial Grade CIF Santos_USA, Brazil

- (99.5% min) Industrial Grade CIF Montreal_USA, Canada

2-Ethyl hexanol Price Trend Q3 2025

In Q3 2025, 2-Ethylhexanol prices varied globally. Malaysia’s 2-Ethyl Hexanol price trend declined 3%, following a 1% drop in Q2, due to weak demand and oversupply. Bangladesh saw a 2% decrease amid cautious buying and economic uncertainty. The USA price remained flat after a 5% fall in Q2, supported by steady exports. Brazil and Canada each experienced a 1% increase, driven by stable demand and balanced supply. India showed mixed trends: imported prices fell 2%, while domestic 2-Ethyl Hexanol price trend rose 2% due to supply constraints. Overall, subdued demand and cautious procurement shaped market dynamics across these countries during the quarter.

Malaysia: 2-Ethyl hexanol Export prices FOB Klang, Malaysia, Grade- (99.5% min) Industrial Grade.

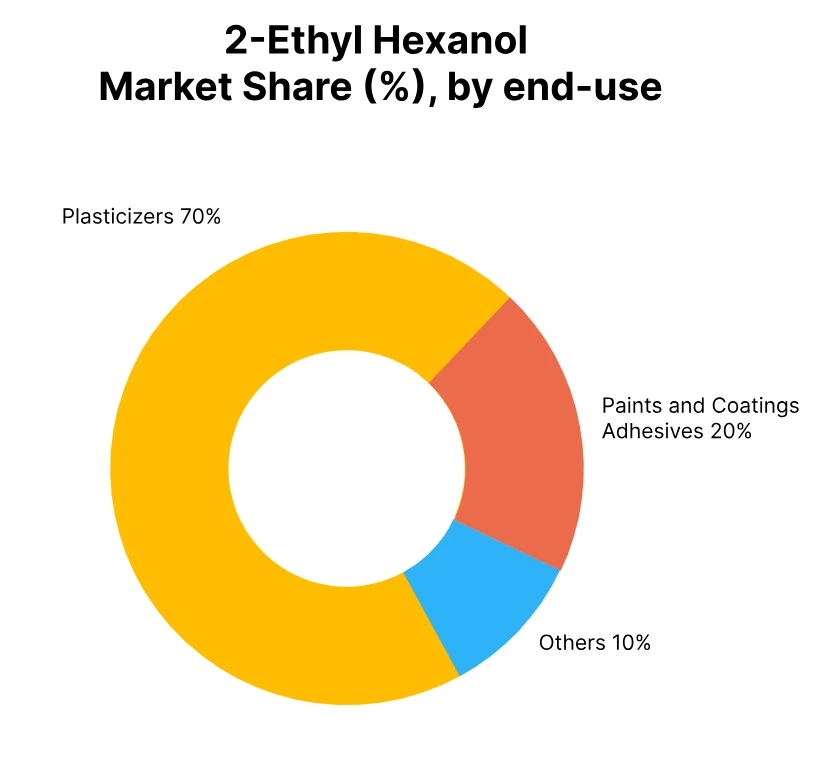

In Q3 2025, 2-Ethylhexanol price in Malaysia declined by 3%, following a marginal 1% drop in Q2. The 2-Ethylhexanol price trend in Malaysia was influenced by soft demand from downstream industries such as plasticizers, paints and coatings, adhesives, and construction. A sluggish recovery in the automotive sector further weighed on buying activity. Regional oversupply and weak economic sentiment caused importers to adopt a cautious purchasing approach.

While market participants reported slight improvements in logistics, overall consumption levels remained limited. 2-Ethylhexanol price trend in September 2025 reflected these bearish conditions, with buyers holding back in anticipation of further price corrections. Market direction in the coming months was expected to depend on improvements in construction activity and automotive output.

USA: 2-Ethyl hexanol Export prices FOB Texas, USA, Grade- (99.5% min) Industrial grade.

In Q3 2025, 2-Ethylhexanol price in USA remained unchanged from Q2, showing a flat performance after a 5% decline in the previous quarter. The 2-Ethylhexanol price trend in USA was supported by consistent export volumes, particularly to Southeast Asia, despite moderate domestic demand. Stable offtake from plasticizers and coatings sectors helped sustain prices, while the adhesives and automotive industries showed gradual recovery.

Supply remained balanced with production running at optimal rates and feedstock availability steady. 2-Ethylhexanol price trend in September 2025 held firm, reflecting stable demand dynamics and limited fluctuations in raw material costs. Export resilience played a key role in price stability, and future trends were expected to be influenced by overseas demand and construction sector performance.

Bangladesh: 2-Ethyl hexanol import prices CIF Chittagong, Bangladesh, Grade- (99.5% min) Industrial grade.

In Q3 2025, 2-Ethylhexanol price in Bangladesh declined by 2% compared to the previous quarter. The 2-Ethylhexanol price trend in Bangladesh was impacted by subdued demand across key end-use industries including plasticizers, paints and coatings, adhesives, construction, and automotive. Imports from Malaysia remained consistent, but weaker domestic consumption and cautious downstream procurement contributed to the bearish market sentiment.

Economic uncertainty and sluggish industrial activity led buyers to delay restocking, while regional supply availability put additional pressure on prices. 2-Ethylhexanol price trend in September 2025 reflected this downward movement, with limited spot trade and slow offtake. Looking ahead, a rebound in construction and automotive manufacturing may influence demand and guide the pricing outlook for the upcoming quarter.

Brazil: 2-Ethyl hexanol import prices CIF Santos, Brazil, Grade- (99.5% min) Industrial Grade.

In Q3 2025, 2-Ethylhexanol price in Brazil increased by 1% compared to the previous quarter. The 2-Ethylhexanol price trend in Brazil was shaped by consistent import volumes from the USA and stable demand from end-use sectors such as plasticizers, paints and coatings, adhesives, construction, and automotive. While local industrial activity showed moderate improvement, inventory levels remained closely managed due to cautious purchasing strategies.

Steady consumption in the coatings and adhesives industries supported the slight upward movement. 2-Ethylhexanol price trend in September 2025 reflected this trend, as buyers faced limited supply-side pressure amid steady freight and logistics conditions. Future pricing in Brazil may depend on shifts in U.S. export dynamics and downstream consumption recovery.

Canada: 2-Ethyl hexanol import prices CIF Montreal, Canada, Grade- (99.5% min) Industrial Grade.

In Q3 2025, 2-Ethylhexanol price in Canada registered a 1% increase over the previous quarter. The 2-Ethylhexanol price trend in Canada was driven by consistent imports from the USA and stable demand from plasticizers, paints and coatings, adhesives, construction, and the recovering automotive sector. Despite no significant supply disruptions, tight availability in the North American market kept sentiment firm.

Buyers maintained procurement levels amid steady project activity in construction and manufacturing. 2-Ethylhexanol price trend in September 2025 remained aligned with this stable trend, supported by balanced supply chains and moderate freight costs. Moving forward, Canadian import demand and U.S. export stability will play a crucial role in determining pricing trajectories.

India: 2-Ethyl hexanol import prices CIF JNPT, India Ex Vizag India, Grade- (99.5% min) Industrial Grade.

According to Price-Watch, In Q3 2025, 2-Ethyl Hexanol price in India displayed mixed movements, with imported material witnessing a slight decline of 2%, while domestic prices from Ex Vizag saw a modest rise of 2% compared to the previous quarter. The overall 2-Ethyl Hexanol price trend in India was shaped by subdued demand from end-use industries such as plasticizers, paints and coatings, adhesives, construction, and automotive.

While import volumes from Malaysia remained steady, competitive regional offers and weak seasonal demand pressured CIF prices. In contrast, the domestic market benefited from improved consumption and regional supply constraints. 2-Ethyl Hexanol price trend in September 2025 reflected this divergence, with domestic prices holding firm amid limited availability, while import prices remained under pressure due to cautious buying sentiment.