Price-Watch’s most active coverage of Acetonitrile price assessment:

- (99.9% min) FOB Shanghai, China

- (99.9% min) FOB Kaohsiung, Taiwan

- (99.9% min) CIF Santos (China), Brazil

- (99.9% min) CIF Manzanillo (China), Mexico

- (99.9% min) CIF JNPT (China), India

- (99.9% min) CIF Houston (China), USA

- (99.9% min) CIF JNPT (Taiwan), India

Acetonitrile Price Trend Q3 2025

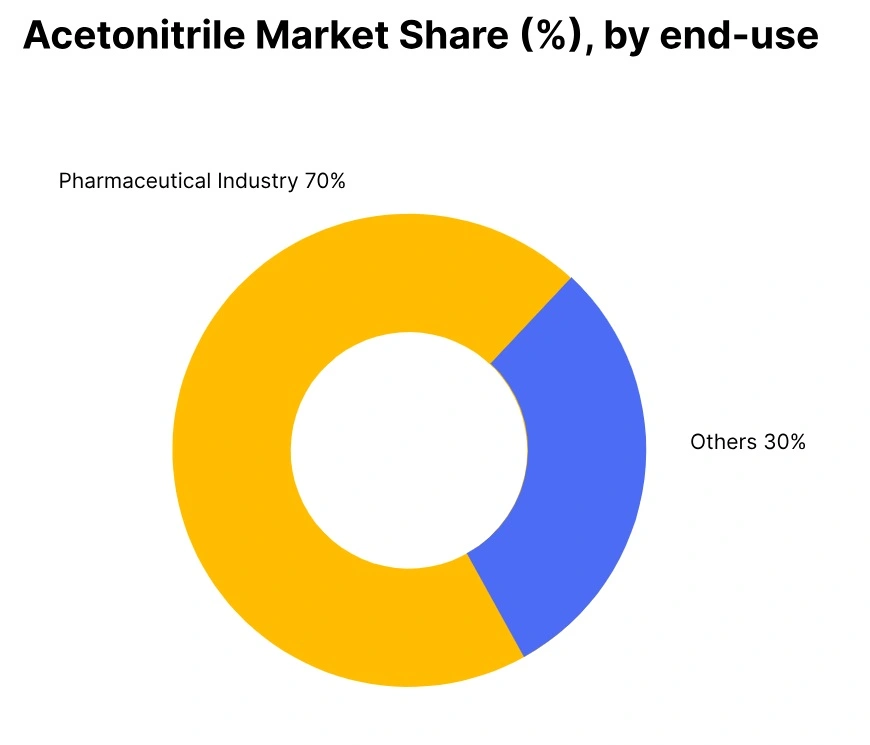

In Q3 2025, the global Acetonitrile market witnessed a broad price decline due to weak demand across major end-use sectors like pharmaceuticals, chemicals, electronics, and petrochemicals. China saw a 10% price drop amid reduced domestic and export demand. The USA recorded the steepest decline at 11.1%, driven by excess inventories and sluggish consumption. Mexico followed with a 9.9% decrease due to weaker imports and low trade activity.

In India, prices declined as Chinese imports fell by 8%, while Taiwanese imports dipped just 0.5%. Taiwan’s market softened slightly by 1.8%, with stable pharma and petrochemical demand. Brazil’s prices remained stable, supported by balanced supply and steady demand. Overall, the market faced bearish pressure in September 2025, with oversupply and subdued demand keeping prices under downward pressure globally.

China: Acetonitrile Export prices FOB Shanghai, China, Grade- (99.9% min).

In Q3 2025, Acetonitrile price in China declined by 10% compared to the previous quarter. The acetonitrile price trend in China reflected weak demand fundamentals, especially from the pharmaceutical and chemical industries, which scaled back procurement amid sluggish domestic activity. Exports also faced pressure due to global oversupply and softer downstream requirements in international markets.

While feedstock availability remained stable, market sentiment was affected by lower offtake from the electronics and petrochemical sectors. The Acetonitrile price in September 2025 showed no signs of recovery as end-use industries continued to operate below capacity. With supply outpacing demand and limited production curtailments, prices remained under bearish pressure throughout the quarter.

Taiwan: Acetonitrile Export prices FOB Kaohsiung, Taiwan, Grade- (99.9% min).

In Q3 2025, Acetonitrile price in Taiwan witnessed a marginal decline of 1.8% from the previous quarter. The acetonitrile price trend in Taiwan was shaped by relatively stable demand from the pharmaceutical and petrochemical sectors, although the electronics and chemical industries showed slight reductions in consumption. Supply-side fundamentals were largely balanced, with no major production disruptions reported.

However, limited international buying interest kept export volumes modest. The Acetonitrile price in September 2025 reflected this overall cautious market environment, with minor price softening due to steady but unspectacular downstream activity. The market outlook remained neutral, with players closely watching inventory levels and export demand in the coming months.

Brazil: Acetonitrile imports prices CIF Santos, Brazil, Grade- (99.9% min).

In Q3 2025, Acetonitrile price in Brazil remained largely stable, showing no significant change compared to the previous quarter. The acetonitrile price trend in Brazil was shaped by steady demand from the pharmaceutical and chemical industries, which maintained consistent consumption levels despite minor fluctuations in import volumes from China. The electronic and petrochemical sectors also supported overall market stability.

Supply availability remained adequate, and feedstock costs did not witness major changes, helping balance the market. As a result, Acetonitrile price in September 2025 reflected no notable variation. Overall, limited downstream pressure and stable Chinese export offers led to a balanced market, with no percentage movement recorded for the quarter.

USA: Acetonitrile imports prices CIF Houston, USA, Grade- (99.9% min).

In Q3 2025, Acetonitrile price in USA declined by 11.1% compared to the previous quarter. The acetonitrile price trend in USA was influenced by weak downstream demand from the pharmaceutical and electronic industries, along with excess inventories from earlier Chinese shipments. Slower consumption from the chemical and petrochemical sectors also contributed to the bearish pricing environment.

Market participants noted reduced buying interest, while stable supply from China further pressured prices. The lack of production issues and lower domestic consumption weighed heavily on market sentiment. As a result, Acetonitrile price in September 2025 showed a clear downward movement. The overall trend reflected weakened fundamentals, and declining spot offers throughout the quarter.

Mexico: Acetonitrile imports prices CIF Manzanillo, Mexico, Grade- (99.9% min).

According to PriceWatch, during Q3 2025, Acetonitrile price in Mexico witnessed a decline of 9.9% compared to Q2. The acetonitrile price trend in Mexico was largely bearish, attributed to reduced demand from the chemical and pharmaceutical industries, along with slowing import activities from China. The petrochemical and electronic sectors showed limited procurement interest, which further weakened market sentiment.

Competitive pricing from Chinese exporters and higher inventories contributed to softening prices. Market sources reported subdued trade activity and fewer spot transactions, reinforcing the downward trajectory. Consequently, Acetonitrile price in September 2025 reflected this negative pressure. The quarter ended with weaker fundamentals across the board, signalling a need for market correction in the near term.

India: Acetonitrile imports prices CIF JNPT, India, Grade- (99.9% min).

In Q3 2025, Acetonitrile price in India experienced an overall downward trend, driven by weak demand across key end-use sectors such as the pharmaceutical, electronic, chemical, and petrochemical industries. Imports from China recorded a sharper decline of over 8% compared to the previous quarter, as the acetonitrile price trend in India was impacted by sluggish buying activity, elevated inventories, and lower regional export demand.

In contrast, imports from Taiwan showed more resilience, with only a marginal drop of around 0.5%, supported by stable logistics and limited supply. The Acetonitrile price in September 2025 continued to reflect market softness, particularly for Chinese-origin cargoes. While Taiwanese imports offered some price stability, overall sentiment remained bearish amid uncertain global fundamentals and cautious downstream consumption.