Price-Watch’s most active coverage of Aluminium Ingot price assessment:

- Purity:99.7% FOB Shanghai, China

- Purity:99.5%(IC20) Ex-Mumbai, India

- Purity:99.7% FD-Willich, Germany

- Purity:99.7%(P1020A) Del Alabama, USA

- Purity:99.5%(IC20) Ex-West India, India

- Purity:99.7%(P1020) Ex-Faridabad, India

- Purity:99.7%(P1020) Ex-North India, India

- Purity:99.7%(P1020) Ex-Chennai, India

- Purity:99.7%(P1020) Ex-South India, India

- Purity:99.7%(P1020) Ex-Korba, India

- Purity:99.7%(P1020) Ex-Central India, India

- Purity:99.5%(IC20) Ex-Bhubaneswar, India

- Purity:99.5%(IC20) Ex-East India, India

Aluminum Ingot Price Trend Q3 2025

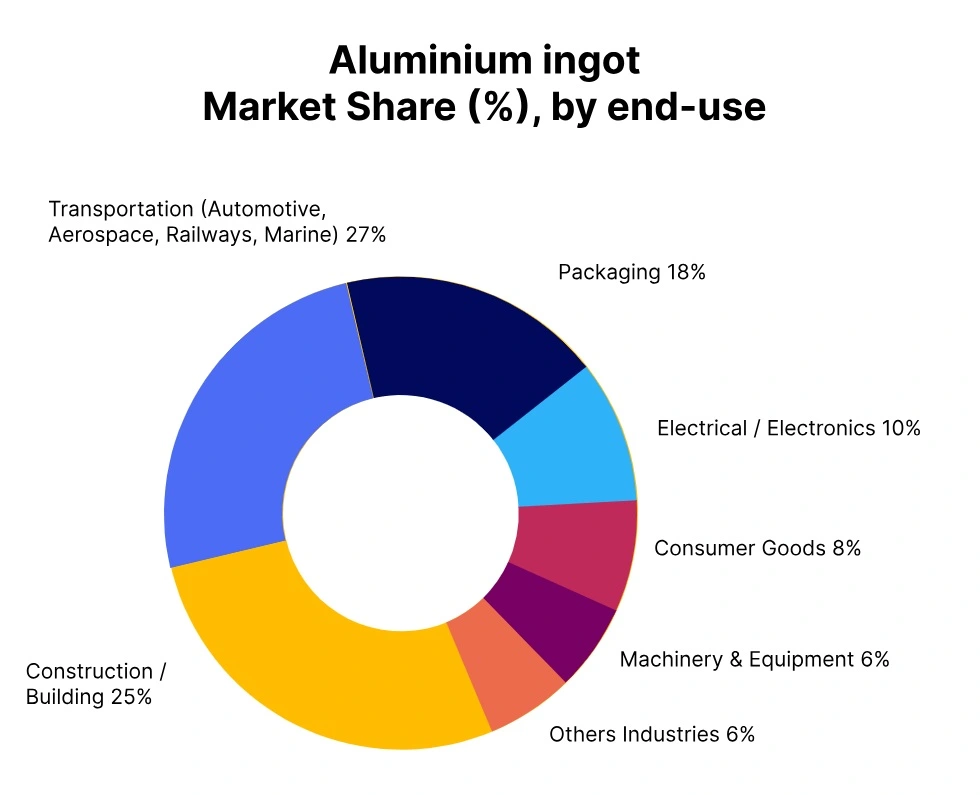

During Q3 2025, the global aluminum ingot market witnessed a mild price hike of 1-3% over Q2 2025, an outcome of a mix of recovering demand and constricting supply conditions. This has been propelled by sustained industrial demand in major industries like automotive, construction, and packaging, most noticeably in Asia and North America.

Also, supply disruptions caused by energy shortages and environmental measures in significant producer nations, such as China, restricted output and fueled the price rise. Market sentiment has also been driven by optimistic caution about global economic expansion, although there have still been uncertainties over interest rates and geopolitical tensions.

India: Aluminum Ingot Domestic prices EX-Mumbai, India, Grade- Purity:99.5%(IC20).

During Q3 2025, the Aluminum ingot price trend in India during Q3 2025 registered a significant upsurge, with a total 8% hike from Q2 2025. This increase has mainly been influenced by continuous automotive, construction, and electrical industries’ demand alongside tight domestic availability and strong international aluminum prices.

Aluminum ingot prices in India have also influenced by this bullish momentum, going up by 2.50% in September 2025, driven by greater input prices and sustained downstream demand. Reduced inventories and constrained imports by market players have also been cited amid higher global premiums, further underpinning the domestic price rally.

Higher energy prices and freight levels also added to the cost push, leading producers to raise prices. The Indian market continued to be sensitive to foreign developments, particularly from China and the Middle East, whose supply restrictions narrowed world supplies.

China: Aluminum Ingot Export prices FOB-Shanghai, China, Grade- Purity:99.7%.

The aluminum ingot price trend in China in Q3 2025 has experienced upward momentum with a minute rise of 0.10% over Q2 2025. This modest increase has mainly been fueled by consistent downstream demand and constrained supply conditions against the backdrop of continued production controls in some provinces.

Aluminum ingot prices in China also rose modestly, a 0.06% rise being noted at the start of September 2025, as a result of steady consumption from the automotive and building sectors. While macroeconomic uncertainty and volatile input prices put pressure, the market has generally been stable during the quarter. Purchasers had been cautiously optimistic, which helped inventory levels to remain in balance and trading activity to be moderate.

USA: Aluminum Ingot Domestic prices Del-Alabama, USA, Grade- Purity:99.7%(P1020A).

According to PriceWatch, During Q3 2025, the Aluminum ingot price trend in the USA has moved moderately upward, registering a 2% advance from Q2 2025. The movement has mostly been fueled by sustained demand from the automotive and construction industries, coupled with more constricted global supply owing to production restrictions in major exporting nations.

In September 2025, Aluminum ingot prices in the US rose by nearly 1%, reflecting consistent bullish sentiment in the market. The US domestic supply chain has also been subjected to pressure from increased energy expenses and logistical restrictions, adding to price levels at a high level.

Also, inventory withdrawals from large warehouses and a weaker dollar contributed to the price rise. Market players continued to be optimistic but wary, hoping that the prevailing supply-demand situation would continue to support aluminum prices through to the next quarter.

Germany: Aluminum Ingot Domestic prices FD-Willich, Germany, Grade- Purity:99.7%.

The aluminum ingot price trend in Germany for Q3 2025 registered a small upward trend, registering on average around a 0.5% increase over Q2 2025. This slow growth has mainly been fueled by robust demand from the automotive and construction industries, alongside minor supply constraints arising from upkeep shutdowns at some European smelters.

However, in September 2025, Aluminum ingot prices in Germany fell by nearly 1% due to softer market sentiment and a modest moderation of downstream demand. Better import flows and energy cost stabilization also helped in moderating price pressures at the end of the quarter. Long-term recovery signals in industrial activity underpinned overall quarterly price direction that was otherwise positive.