Price-Watch’s most active coverage of Aluminium Sheet price assessment:

- 5251 H22-2mm FOB Shanghai, China

- 1200,H12-2mm Ex-Mumbai, India

- 1100-H14-2mm Del Alabama, USA

- AW-1050A-2mm FD-Willich, Germany

Aluminium Sheet Price Trend Q3 2025

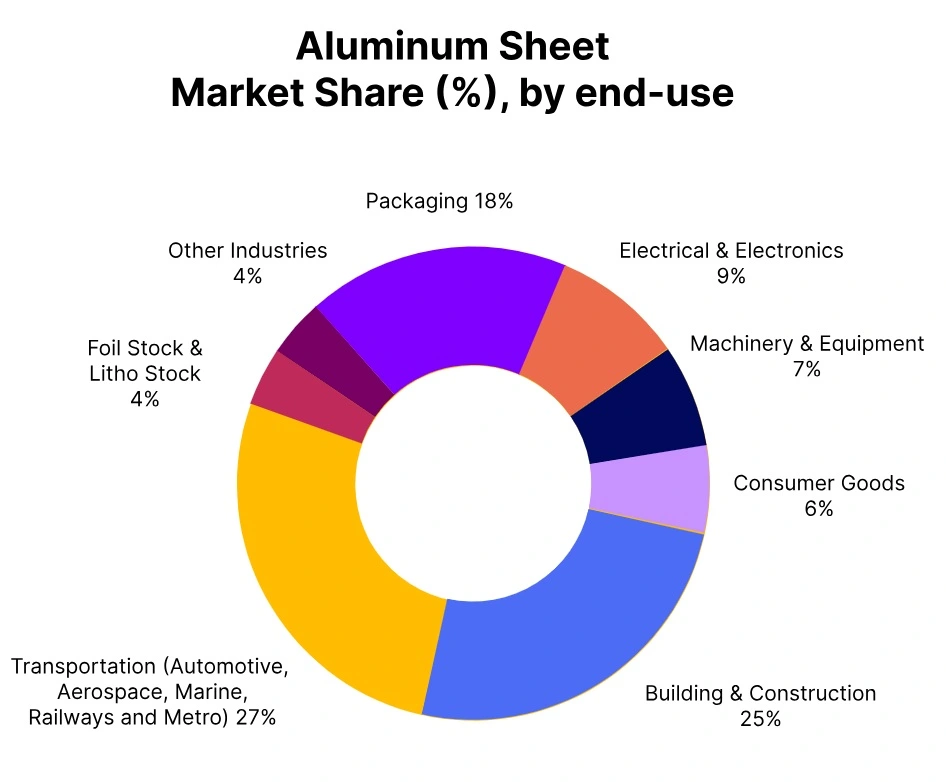

During July-September 2025, the aluminium sheet market followed a mixed trend in Q3 2025, with prices varying 1-2%. This fluctuation was prompted by an interplay of various factors affecting demand and supply in different regions.

While on one side some markets saw prices rise due to increasing raw material costs and growing demand from sectors like automotive and construction, On the contrary, some areas experienced price falls due to oversupply concerns and low market sentiment, a sign of risk-averse buying activity. These divergence factors were the cause of the overall moderate volatility of aluminium sheet prices during the quarter.

China: Aluminium Sheet Export prices FOB Shanghai, China, Grade- 5251 H22-2mm.

During Q3 2025, Aluminium sheet price trend in China recorded a marginal fall of about 0.10% against Q2 2025, thus showing a relatively stable market in general. The minor drop was largely fueled by prudent demand due to fear of reduced industrial output and inventory realignments by large consumers.

In spite of the modest decline, supply held steady, balancing the market and stopping substantial falls in prices. Nevertheless, in September 2025, aluminium sheet prices experienced a marginal rise, with prices rising by approximately 0.10%. This increase was due to reviving demand from the automotive and packaging industries and a slight rise in the cost of raw materials.

USA: Aluminium Sheet Domestic Prices Del Alabama, USA, Grade- 1100-H14-2mm.

The trend of price of the Aluminium sheet in the U.S. market in Q3 2025 reflected a modest upward movement with a 3% uptick from Q2 2025. This increase has been largely fueled by increased demand across the automotive and construction industries, along with the tighter supply conditions as a result of continuing maintenance at various domestic mills and import supply disruptions.

Prices of Aluminium sheets have been steady in July and August underpinned by robust order volumes and buoyant input costs, notably energy and raw materials. Aluminium sheet prices in the US dropped, however, in September 2025 by 0.2% as US Aluminium sheet prices followed a moderate weakening in demand and strengthened supply availability. Market players also observed a short dip in LME aluminium prices, which helped ease the September slowdown.

India: Aluminium Sheet Domestic Prices EX- Mumbai, India, Grade- 1200, H12-2mm.

According to PriceWatch, Aluminium sheet price trend in India recorded strong upward movement during Q3 2025, posting a net hike of 8% over Q2 2025. This increase was prompted by robust demand from major industries like automotive, packaging, and construction, as well as tight supply owing to raw material shortages globally and increasing energy prices.

Indian aluminium sheet prices went up by 2% in September 2025, further adding to the bullish mood of the market. Producers dealt with higher input costs, such as alumina and power, that added to the increase in prices. Moreover, exports demand continued to be strong, tightening local availability and helping fuel the price rise.

Germany: Aluminium Sheet Domestic Prices FD-Willich, Germany, Grade- 1200, H12-2mm.

The price trend of the Aluminium sheet in the German market for Q3 2025 had a gradual increase, up by a total of 2% from Q2 2025. The rise was underpinned by a modest rebound in European manufacturing activity, especially within automotive and packaging segments, combined with ongoing supply-side tensions as a result of energy cost pressures and lower output of major producers.

Market sentiment was robust during July and August, with purchasers locking in material in expectation of further price increases. Aluminium sheet prices in Germany came under a little pressure at the end of the quarter following that. US Aluminium sheet prices dropped 1% during September 2025, led by weaker industrial orders and softer raw material prices, such as a fall in primary aluminium prices on the LME.