Price-Watch’s most active coverage of Aluminium Wire price assessment:

- 8011-10mm FOB Shanghai, China

- 8011-10mm CIF Busan (China), South Korea

- 8011-10mm CFR Hai Phong (China), Vietnam

Aluminum Wire Price Trend Q3 2025

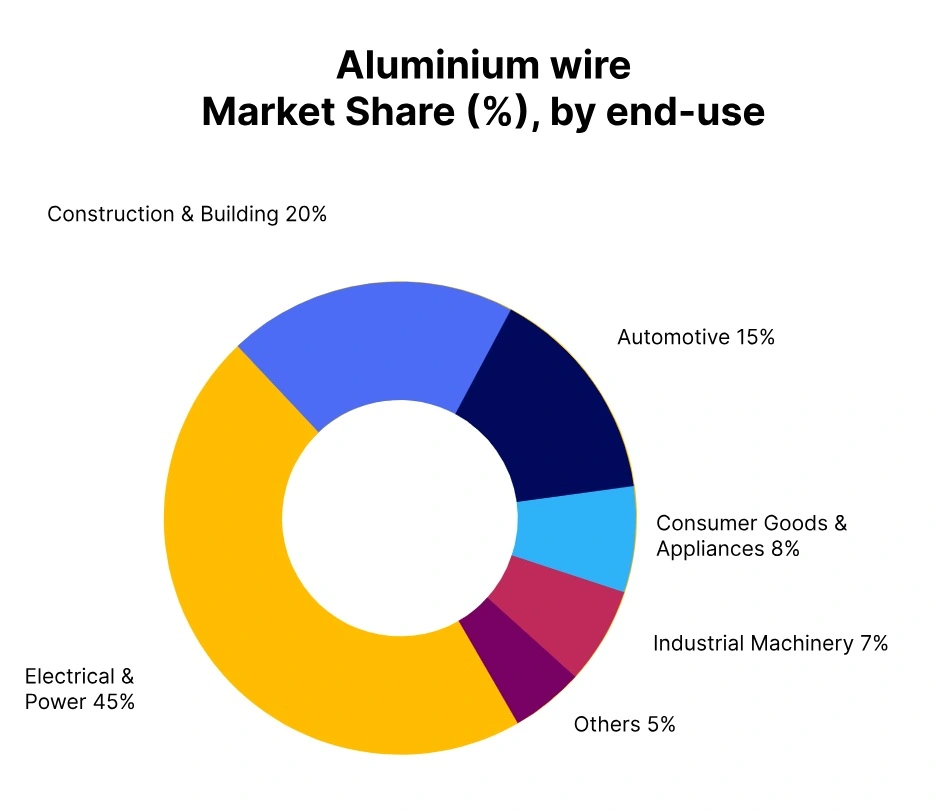

In Q3 2025, the global aluminum wire market experienced a modest price increase of approximately 1% compared to Q2 2025. This uptick was primarily driven by steady demand from key end-use sectors such as construction, power transmission, and automotive manufacturing, particularly in Asia-Pacific and North America.

While overall market sentiment remained cautious due to macroeconomic uncertainties, the resilience of infrastructure projects and sustained investment in renewable energy contributed to stable consumption levels.

On the supply side, production remained largely consistent, though some regions faced minor logistical constraints and higher input costs, which also supported the upward price movement. Additionally, fluctuations in global aluminum ingot prices influenced wire costs, albeit moderately.

China: Aluminum Wire Export prices FOB Shanghai, China, Grade- 8011-10mm.

The aluminum wire price trend in China during Q3 2025 showed a marginal decline, registering a decrease of 0.53% compared to Q2 2025. This slight downturn can be attributed to softened downstream demand, particularly from the construction and electrical sectors, alongside improved production output from domestic smelters. Additionally, stable raw material costs and adequate inventory levels kept pricing pressures subdued throughout the quarter.

However, despite the overall quarterly dip, September 2025 saw a shift in market sentiment. Aluminum wire prices experienced a modest increase of 0.13%, reflecting a rebound in demand from the automotive and packaging industries and signaling a potential stabilization in the aluminum market. This slight recovery in wire prices may also suggest a cautious optimism among buyers heading into the final quarter of the year.

South Korea: Aluminum Wire import prices CIF Busan (China), SK, Grade- 8011-10mm.

According to PriceWatch, The aluminum wire price trend in South Korea during Q3 2025 showed a marginal downward movement, with an overall decrease of approximately 1% compared to Q2 2025. This decline was primarily driven by softened demand from the construction and automotive sectors, coupled with stable supply levels and lower input costs in the global aluminum market. Manufacturers maintained cautious procurement strategies amid economic uncertainties, which further pressured prices.

However, in September 2025, the price of Aluminum wire slightly increased by 0.50% month-on-month, attributed to a modest rebound in industrial activity and restocking efforts ahead of anticipated year-end demand. Despite this uptick, the overall quarterly trend remained bearish. Additionally, international market fluctuations and a stronger Korean won also contributed to the subdued pricing.

Vietnam: Aluminum Wire import prices CIF Hai Phong (China), Vietnam, Grade- 8011-10mm.

The aluminum wire price trend in Vietnam during Q3 2025 showed a slight overall decline of approximately 1% compared to Q2 2025, reflecting subdued demand from the construction and electrical sectors amid ongoing economic uncertainties. While the quarter generally experienced downward price pressure due to lower raw material costs and sufficient inventory levels, September 2025 marked a minor shift in momentum.

In that month, the price of Aluminum wire slightly increased by 0.50%, primarily driven by a modest pickup in downstream demand and marginal supply tightening from regional producers. Despite this late-quarter uptick, it was not sufficient to offset the earlier declines observed in July and August. Export activity also remained relatively flat, contributing little support to pricing.