Price-Watch’s most active coverage of Aluminium Alloy Ingot price assessment:

- Purity:81% (ADC12) FOB Shanghai, China

- Purity:88% (IA80) Ex-Mumbai, India

- Purity:81% FD-Willich, Germany

- Purity:81% Del Alabama, USA

- Purity:81%(ADC12) CIF Osaka (Malaysia), Japan

- Purity:81%(ADC12) FOB Klang, Malaysia

Aluminum Alloy Ingot Price Trend Q3 2025

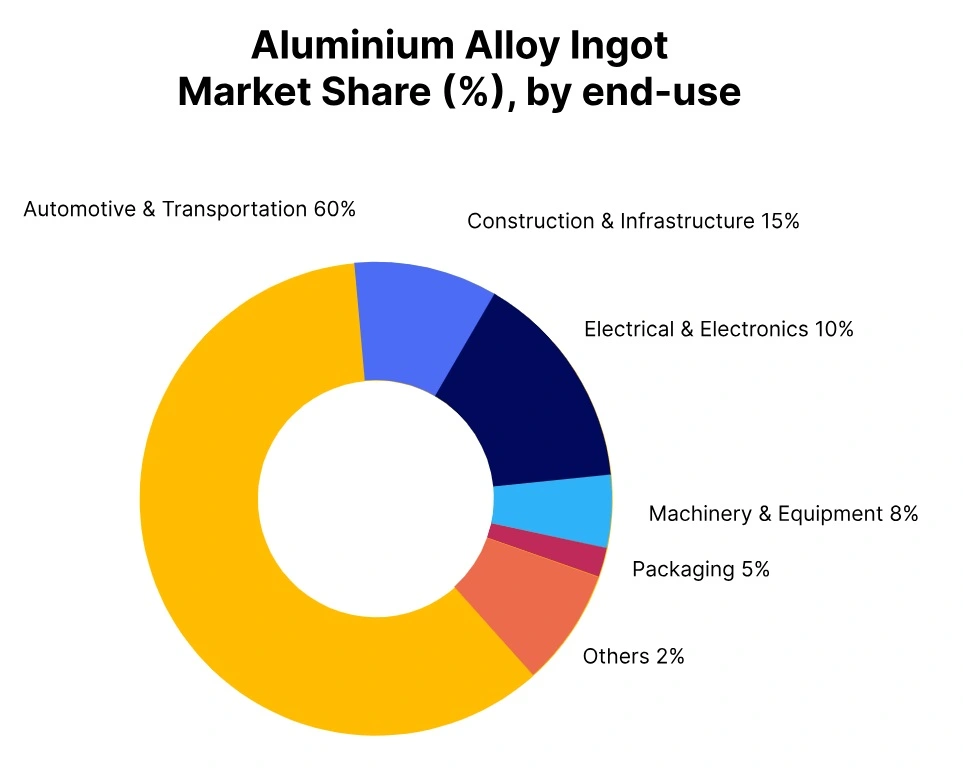

In Q3 2025, the global aluminum alloy ingot market recorded a moderate price increase of around 1.5–3% compared to Q2 2025. The upward movement was supported by steady demand recovery from the automotive and aerospace sectors, particularly in North America and Europe, where production activities gained momentum.

Supply constraints arising from maintenance shutdowns at several smelters and alloy producers, alongside higher logistics costs, also contributed to tighter market conditions. In contrast, demand growth in Asia remained stable but subdued due to slower construction activity in China. Additionally, a mild rebound in aluminum prices and increased costs of alloying materials, such as magnesium and silicon, added to overall price firmness.

China: Aluminium Alloy Ingot Export prices FOB-Shanghai, China, Grade- Purity:81%(ADC12).

According to PriceWatch, the aluminum alloy ingot price trend in China during Q3 2025 reflected a modest upward momentum, with an increase of around 0.50% compared to Q2 2025. This growth was primarily driven by stable downstream demand from the automotive and construction sectors, along with slightly tighter domestic supply due to environmental production controls in key manufacturing hubs. Prices were supported by a marginal rise in raw material costs and energy tariffs.

Aluminum alloy ingot prices in July and August showed gradual appreciation, underpinned by positive market sentiment and restocking activity. However, in September 2025, Aluminium alloy ingot prices declined by 0.12%, attributed to weakening demand toward the quarter’s end and increased inventory levels in some regions. Despite the minor dip in September, the quarterly price movement remained on an upward trajectory, indicating a carefully optimistic outlook among traders and manufacturers for the near term.

USA: Aluminium Alloy Ingot Domestic prices Del-Alabama, USA, Grade- Purity: Purity:81%.

According to PriceWatch, the aluminum alloy ingot price trend in the USA during Q3 2025 showed a modest upward movement, marking a 1.47% increase in comparison to Q2 2025. This growth was primarily driven by consistent demand from the automotive and construction sectors, coupled with tightened supply due to ongoing global logistics disruptions and rising energy costs affecting smelting operations.

Aluminum alloy ingot prices experienced consistent support throughout July and August, with market participants anticipating continued recovery in downstream industries. Although, in September 2025, Aluminum alloy ingot prices declined by 1%, attributed to easing raw material costs and increased inventory levels in some regional markets. Regardless of this minor dip, overall quarterly prices maintained a firm trajectory, reflecting the alloy’s strategic demand and constrained production outlook.

India: Aluminium Ingot Domestic prices EX-Mumbai, India, Grade- Purity: Purity:88%(IA80).

According to PriceWatch, aluminum alloy ingot prices in India showed an upward trend in Q3 2025, registering an overall increase of 8.39% compared to Q2 2025. This stable price trend of the product was primarily driven by robust demand from the automotive and construction sectors, paired with a surge in raw material costs and limited scrap availability in the domestic market.

In September 2025, Aluminum alloy ingot prices further escalated by 2.84%, reflecting sustained buying activity and tightened supply dynamics. Furthermore, the global uptick in aluminum prices, due to energy cost pressures and production curbs in major producing regions, added to the bullish sentiment in the Indian market. Import restrictions and a depreciating rupee also contributed to higher landed costs, causing domestic producers to revise prices upward.

Germany: Aluminium Ingot Domestic prices FD-Willich, Germany, Grade- Purity:81%.

According to PriceWatch, the aluminum alloy ingot price trend in Germany during Q3 2025 showed a slight upward movement, recording a 0.32% increase in comparison to Q2 2025. This growth was primarily driven by steady demand from the automotive and construction sectors, coupled with moderate supply chain constraints and increased energy costs impacting production margins.

However, in September 2025, Aluminum alloy ingot prices decreased by 0.91%, reflecting a temporary dip in demand and improved import availability, which slightly eased supply-side pressures. Over the quarter, the market remained cautiously optimistic, with prices fluctuating within a narrow band. Market participants noted that while the price support continued due to long-term infrastructure projects, short-term consumption remained sensitive to macroeconomic uncertainties.