Price-Watch’s most active coverage of Aniline price assessment:

- Technical Grade (>99%) India-Ex Bharuch, India

- Technical Grade (>99%) India-Ex Mumbai, India

- Technical Grade (>99%) CIF Nhava Sheva (China), India

- Technical Grade (>99%) FOB Qingdao, China

- Technical Grade (>99%) CIF Busan (China), South Korea

- Technical Grade (>99%) FD Antwerp, Belgium

- Technical Grade (>99%) FD Hamburg, Germany

- Technical Grade (>99%) CIF Houston (China), USA

- Technical Grade (>99%) CIF Houston (Belgium), USA

Aniline Price Trend Q3 2025

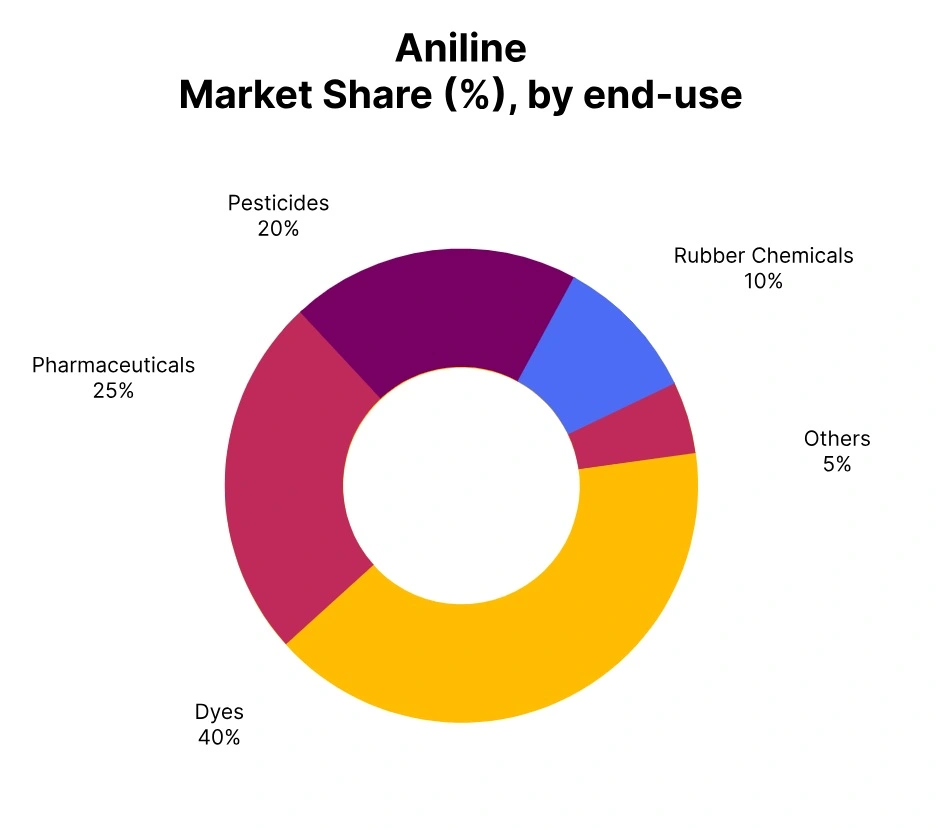

In Q3 2025, the global Aniline market experienced a moderate price fluctuation of 5–8% across different regions. The market remained under pressure in key geographies such as Europe, India, and the U.S., due to sluggish downstream demand from dyes, MDI, and rubber chemicals industries. Declines in Benzene feedstock costs further contributed to the bearish sentiment.

However, some Asian markets, particularly China and South Korea, saw marginal increases supported by steady operational rates and modest export demand. Market participants navigated volatile freight costs and regional inventory build-ups, which added complexity to trade flows during the quarter.

Belgium: Domestically Traded Aniline price in Belgium, Technical Grade (>99%).

In Q3 2025, the European Aniline price trend remained weak, with Belgium Aniline prices falling by 8.47% to USD 1320–1480/MT. The decline has been led by sluggish downstream demand from MDI and dyes sectors, particularly in Western Europe. An ongoing inventory overhang and reduced industrial output in Germany and France further dampened sentiment.

Energy and raw material costs eased slightly, but not enough to spur fresh buying. Market participants reported limited spot activity, with many contracts being deferred or renegotiated. The Aniline price trend in Belgium indicated a subdued outlook as slow demand recovery and weak downstream consumption kept market sentiment under pressure. Without a rebound in end-use sectors, sustained improvement in market conditions appeared unlikely in the near term.

In September 2025, the Aniline prices in Belgium remained subdued as weakening global trade and sluggish downstream demand limited buying activity. Fragile sentiment persisted throughout the period, with slow recovery prospects keeping market participants cautious and pricing stability restrained.

Germany: Domestically Traded Aniline price in Germany, Technical Grade (>99%).

In Q3 2025, Aniline price trend in Germany dropped by 8.32% to USD 1380–1520/MT. Weak performance in the downstream coatings and specialty chemicals industries weighed on demand. As production costs fell due to lower benzene input prices, sellers had limited leverage to maintain previous pricing levels.

Inventory levels remained high, discouraging fresh procurement by major buyers. Market sentiment remained subdued, with cautious trading across both contract and spot markets. The Aniline price trend in Germany reflected weak market sentiment as limited industrial activity, particularly in automotive and construction-related chemicals, constrained recovery prospects.

Without a notable rebound in these sectors, overall market conditions remained subdued and lacked upward momentum. In Q3 September 2025, the Aniline prices in Germany exhibited a subdued tone as weak global trade and limited industrial activity, particularly in automotive and construction sectors, restrained demand. Risk-averse buying and cautious sentiment kept overall market conditions muted throughout the period.

USA: Aniline Import Price in USA from China, Technical Grade (>99%).

The Aniline price trend in the USA showed a downward movement as reduced demand from polyurethane and agricultural chemical sectors dampened market activity in the third quarter of 2025. In Q3 2025, freight rates decreased for Aniline imports into the USA from China (CIF Houston), while Aniline prices in the US have declined by 3.11%, averaging between USD 1150–1210/MT.

Although Chinese suppliers maintained stable availability, U.S. buyers remained cautious, limiting forward purchases due to ongoing economic uncertainty and elevated inventory levels. Logistics have been favorable, with no significant port congestion or freight disruptions. The market tone stayed subdued, with participants closely tracking global benzene pricing trends and domestic chemical production levels.

In Q3 September 2025, the Aniline price in the USA displayed mixed sentiment as improved logistics and lower freight costs offered brief support, but weak demand from polyurethane and agricultural chemical sectors limited overall momentum, keeping sellers cautious throughout the period.

India: Domestically Traded Aniline price in Mumbai, Technical Grade (>99%).

According to Price-Watch, in Q3 2025, Aniline (Intact) prices in India declined by 7.68% to USD 1540–1650/MT. Despite stable operations at manufacturing facilities, subdued demand from downstream MDI and pharmaceutical intermediates sectors weighed heavily on market sentiment.

Overall, the price trend of Aniline in India mirrored the bearish trend of the bulk segment, albeit with slightly stronger price realization due to packaging and handling costs. Regional supply remained sufficient, but limited export interest added to domestic buildup.

Falling Benzene prices also led buyers to renegotiate contracts at lower levels. Logistics from western India remained unaffected, keeping distribution channels open, but buyer hesitation over macroeconomic concerns further delayed purchases.

In Q3 September 2025, the Aniline prices in India witnessed mixed sentiment as early weakness from constrained supply has been followed by a mild recovery driven by cautious buying. Shifting demand patterns and feedstock fluctuations kept overall pricing stability fragile throughout the period.

China: Aniline Export price from China, Technical Grade (>99%).

According to Price-Watch, in Q3 2025, Aniline prices in China, assessed on FOB Qingdao, remained largely stable, with prices inching up by marginal 0.31% to USD 1000–1020/MT. Domestic producers maintained stable operating rates, and export interest from South Asia and Southeast Asia provided a moderate buffer against weakening local consumption.

The price trend of Aniline in China remains cautiously optimistic as Chinese production stays robust, although buyers remain price-sensitive considering broader economic concerns. Benzene feedstock costs remained relatively steady, limiting any major price swings. Despite muted global demand, Chinese suppliers benefited from consistent export contracts and regional arbitrage opportunities.

In September 2025, the Aniline prices in China maintained a firm tone as restricted supply and limited availability supported steady sentiment. Sellers adopted a cautious approach, and consistent demand ensured stable momentum through the month despite persistent market tightness.

South Korea: Aniline Import Price in South Korea from China, Technical Grade (>99%).

In Q3 2025, The Aniline price trend in South Korea reflected a stable premium position as consistent quality and reliable delivery supported buyer confidence. Freight rates remained stable for Aniline exports prices from China to South Korea (CIF Busan), while prices saw a marginal increase of 0.25%, ranging between USD 1030–1060/MT.

The slight price gain reflected steady production levels in South Korea and consistent demand from Chinese buyers, particularly within the rubber chemicals sector. Operating rates have been unaffected by external disruptions, and stable shipping routes contributed to a balanced supply flow. Although alternative suppliers introduced slight downward pressure, Korean-origin material sustained its advantage amid steady regional demand.

In Q3 September 2025, the Aniline prices in South Korea held a steady premium as improved logistics and reduced freight supported stable sentiment. Reliable quality and delivery consistency sustained buyer preference, while competition from alternative sources applied mild downward pressure.