Price-Watch’s most active coverage of Antimony price assessment:

- Purity: 99.65%min. FOB Shanghai, China

- Purity: 99.65%min. EX Mumbai, India

- Purity: 99.65%min. FD Rotterdam, Netherlands

- Purity: 99.65%min. Del Baltimore, USA

Antimony Price Trend Q3 2025

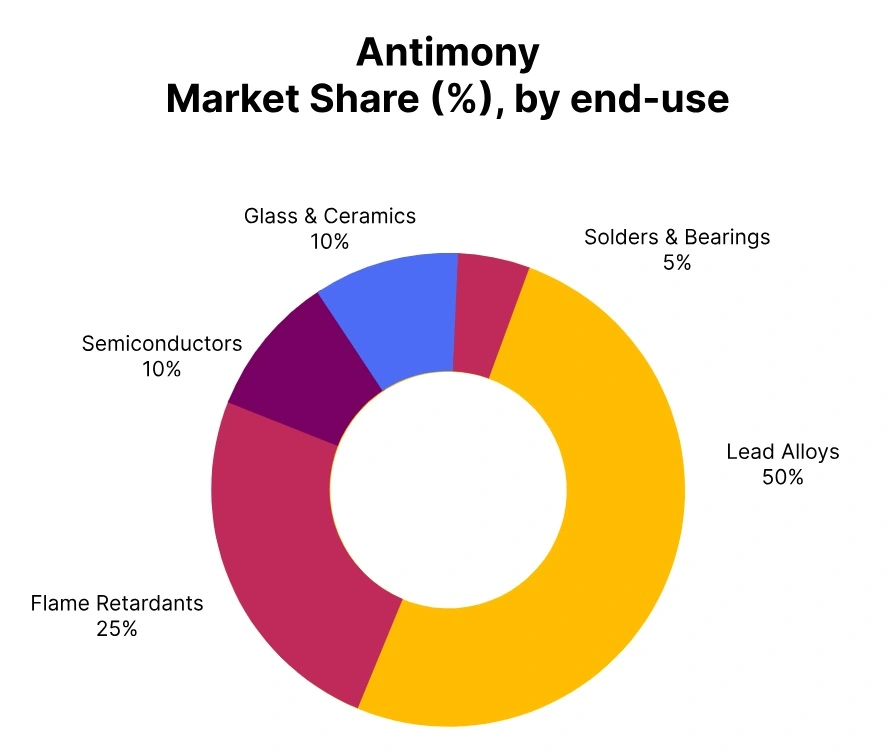

In Q3 2025, the global Antimony Ingot market exhibited a mixed yet mildly bullish trend, with prices inclining by around 2.6% overall. Market sentiment fluctuated across major producing and consuming regions due to shifting industrial demand and varying supply conditions. In China, firmer downstream activity from flame retardant and alloy sectors supported a moderate price rise, while India witnessed stable trading amid steady consumption from battery and glass manufacturers.

The USA and European markets faced intermittent softness owing to sufficient inventories and subdued procurement. Despite regional disparities, tightening supply from certain Chinese smelters and improved export orders helped maintain an upward bias in global prices through the quarter.

China: Antimony ingot Export prices FOB Shanghai, China, Purity: 99.65%min.

In Q3 2025, the antimony price trend in China showed a mild decline of 0.22% compared to the previous quarter, reflecting a marginally weaker global sentiment. The market experienced lessened demand from flame retardant and battery alloy sectors, while export orders softened amid slower downstream activity in Europe and Asia.

Despite steady domestic production levels, persistent oversupply and limited new procurement from overseas buyers exerted slight downward pressure on prices. The decline remained contained as smelters maintained cautious operating rates and raw material availability stayed relatively balanced.

Antimony ingot prices in China increased by 0.1% in September 2025, primarily supported by consistent demand from flame retardant and battery alloy industries alongside constrained smelter output due to maintenance activities. Meanwhile, steady export inquiries and tight raw material availability helped maintain price firmness despite limited domestic consumption growth.

India: Antimony ingot Export prices EX Mumbai, India, Purity: 99.65%min.

According to Price-Watch, in Q3 2025, the antimony price trend in India recorded a notable increase of 3.70% compared to Q2 2025, supported by stronger domestic demand and improved trading sentiment. The rise was primarily driven by restocking activity from alloy and flame-retardant manufacturers ahead of the festive and industrial production cycle.

Import volumes from China remained steady, but higher freight and handling costs added mild upward pressure on landed prices. Furthermore, a minimal depreciation of the Indian Rupee against the U.S. Dollar contributed to firmer import valuations, sustaining the overall bullish tone in the local market.

Antimony ingot prices in India declined by 0.25% in September 2025, mainly due to subdued demand from the flame retardant and alloy manufacturing sectors amid cautious procurement by end users. Additionally, sufficient domestic inventories and competitive imports from China exerted mild downward pressure on prices, keeping overall market sentiment slightly bearish through the month.

USA: Antimony ingot Export prices Del Baltimore, USA, Purity: 99.65%min.

According to Price-Watch AI, in Q3 2025, the antimony price trend in the USA registered a 3.54% increase compared to the previous quarter, mirroring improved demand from the flame-retardant, battery, and alloy manufacturing sectors. The market benefited from steady downstream consumption and limited import availability due to ongoing logistical constraints and higher freight costs.

Traders reported stronger buying interest from industrial consumers seeking to replenish inventories ahead of year-end manufacturing schedules. Additionally, global supply tightness and firmer Chinese export quotations provided upward momentum, supporting the overall price incline in the U.S. market.

Antimony ingot prices in the USA declined by 1.33% in September 2025, primarily driven by weakened demand from the chemical and alloy manufacturing sectors amid slower industrial activity. Simultaneously, stable import supplies and inventory overhang contributed to the downward pressure, resulting in a softening of market prices during the month.

Netherlands: Antimony ingot Export prices FD Rottterdam, Netherlands, Purity: 99.65%min.

In Q3 2025, the antimony price trend in the Netherlands showed a 3.40% increase compared to Q2 2025, driven by rising demand from the European flame-retardant and battery alloy industries. Strengthened procurement activity by downstream manufacturers, coupled with limited immediate availability from global suppliers, supported firmer pricing.

Additionally, logistical constraints and slightly higher import costs from Asian markets contributed to the upward trend. Market sentiment remained cautiously positive as buyers balanced stock replenishment with careful monitoring of global supply fluctuations.

Antimony ingot prices in the Netherlands declined by 1.78% in September 2025, mainly due to sluggish demand from the chemical and metal alloy industries as downstream activity slowed. Ample import availability and comfortable inventory levels weighed on market sentiment, leading to a notable softening of prices during the month.