Price-Watch’s most active coverage of Benzaldehyde price assessment:

- Industrial Grade(99.9% min purity) FOB Shanghai, China

- Industrial Grade(99.9% min purity) CIF Manila (China), Philippines

- Industrial Grade(99.9% min purity) CIF Jakarta (China), Indonesia

- Industrial Grade(99.9% min purity) CIF Houston (China), USA

- Industrial Grade(99.9% min purity) CIF Djibouti (China), Djibouti

- Industrial Grade(99.9% min purity) CIF JNPT (China), India

- Industrial Grade(99.5% min purity) Ex-Dahej, India

- Industrial Grade(99.5% min purity) Ex-West India, India

- FCC Grade(99.5% min purity) FOB Rotterdam, Netherlands

Benzaldehyde Price Trend Q3 2025

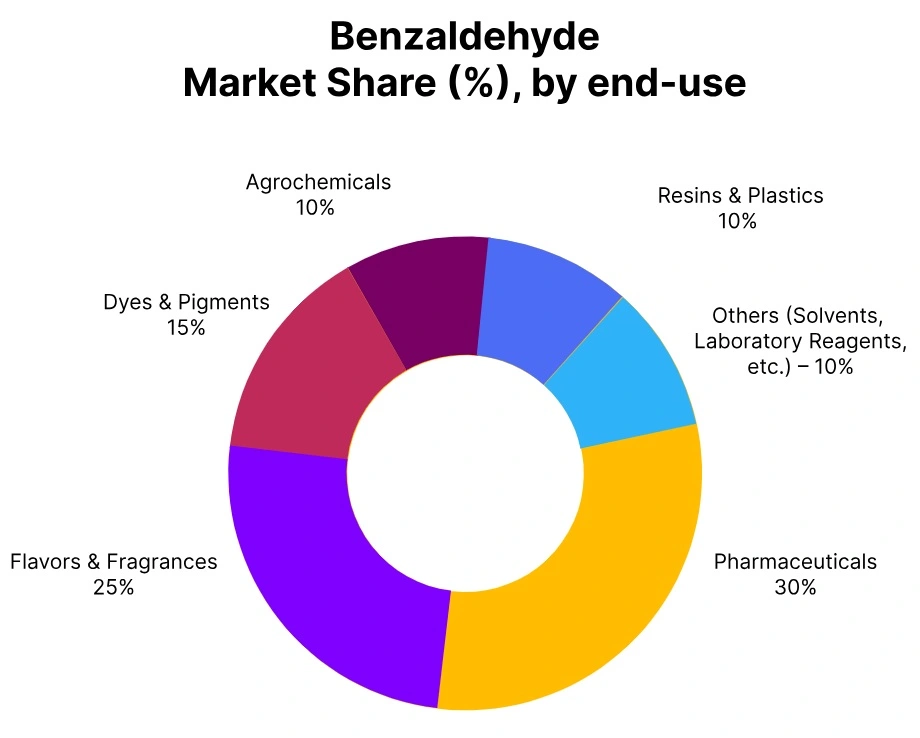

In Q3 2025, the global Benzaldehyde market witnessed a noticeable downward trend, with Benzaldehyde prices declining by around 5–10%. This decline in the Benzaldehyde price trend was primarily driven by weak demand from downstream sectors such as fragrances, pharmaceuticals, and agrochemicals, coupled with steady production rates across key manufacturing regions.

Lower feedstock toluene costs and sufficient raw material availability further contributed to the softening of market prices. Additionally, sluggish export activity and cautious procurement behavior among end-users added to the bearish sentiment. Looking ahead, stable feedstock trends and a gradual rebound in end-use industries are expected to bring moderate decline to the Benzaldehyde price trend in September and the upcoming quarter.

China: Benzaldehyde Export prices FOB Shanghai, China, Grade- Industrial Grade (99.9% min purity).

In Q3 2025, the Benzaldehyde price in China followed a clear downward trajectory, with the Benzaldehyde price trend in China declining by around 8–12% during the quarter. Benzaldehyde prices in September 2025 ranged between USD 1400–1550/MT on an FOB basis. The decline in the Benzaldehyde price trend was primarily due to softer demand from downstream sectors such as fragrances, pharmaceuticals, and agrochemicals. Lower feedstock toluene costs and sufficient raw material availability further contributed to the bearish movement.

Despite steady plant operations, increased inventories and limited export inquiries kept market sentiment subdued. Toward the end of the quarter, stable energy costs and moderate restocking activities provided slight support, though overall market conditions remained weak. Looking ahead, balanced supply fundamentals and gradual recovery in end-use sectors are expected to offer mild price decline in the Benzaldehyde price trend in September and the upcoming quarter.

Netherlands: Benzaldehyde Export prices FOB, Grade- FCC Grade (99.5% min purity).

In Q3 2025, the Benzaldehyde price in the Netherlands showed a slight downward movement, with Benzaldehyde prices in September 2025 ranging between USD 1600–1700/MT on an FOB basis. The Benzaldehyde price trend in the Netherlands declined modestly by around 1–3%, primarily influenced by steady but slightly lower demand from downstream fragrance and pharmaceutical sectors.

Feedstock toluene costs remained largely stable, while consistent production activity across European facilities ensured adequate market supply. Despite minor fluctuations in export activity, balanced inventories and stable energy costs prevented sharper declines. As the fourth quarter approaches, steady feedstock availability and gradual improvement in end-use demand are expected to support moderate price decline in the Benzaldehyde price trend in September and the overall Benzaldehyde market.

Philippines: Benzaldehyde import prices CIF Manila, Philippines, Grade- Industrial Grade (99.9% min purity).

In Q3 2025, Benzaldehyde prices in the Philippines witnessed a slight downward trajectory, with Benzaldehyde prices in September 2025 assessed in the range of USD 1500–1600/MT on a CIF Philippines basis. The Benzaldehyde price trend in the Philippines was influenced by the declining momentum in FOB China Benzaldehyde prices, where subdued buying interest and lower feedstock toluene values exerted mild pressure on export offers.

Additionally, steady import arrivals and sufficient domestic inventories kept trading activity moderate throughout the quarter. Toward the end of the period, stable freight rates and balanced regional demand provided slight support to the Benzaldehyde price trend in September, though overall market sentiment remained cautious.

Indonesia: Benzaldehyde import prices CIF Jakarta, Indonesia, Grade- Industrial Grade (99.9% min purity).

In Q3 2025, Benzaldehyde prices in Indonesia recorded a mild downward movement, with Benzaldehyde prices in September 2025 ranging between USD 1480–1600/MT on a CIF Indonesia basis. The Benzaldehyde price trend in Indonesia closely followed the weakening pattern in the FOB China Benzaldehyde market, where lower feedstock toluene costs and moderate export demand led to softer price sentiment.

Consistent import arrivals and comfortable stock availability within the domestic market further contributed to the subdued pricing environment. Consistent import arrivals and comfortable stock availability within the domestic market further contributed to the subdued pricing environment.

USA: Benzaldehyde Import prices CIF Houston, USA, Grade- Industrial Grade (99.9% min purity).

In Q3 2025, Benzaldehyde prices in the USA showed a slight downward movement, with Benzaldehyde prices in September 2025 ranging between USD 1550–1700/MT on a CIF USA basis. The Benzaldehyde price trend in the USA mirrored the weakening pattern observed in the FOB China Benzaldehyde market, where lower feedstock toluene costs and subdued export demand exerted mild downward pressure on global offers.

Consistent import arrivals, steady freight conditions, and balanced domestic inventories further contributed to the soft pricing environment, keeping market sentiment moderate throughout the quarter. Toward the end of the period, stable trade activity and adequate supply levels offered slight support to the Benzaldehyde price trend in September, though overall outlook remained declining.

Djibouti: Benzaldehyde Import prices CIF Dijbouti, Dijbouti, Grade- Industrial Grade (99.9% min purity).

In Q3 2025, Benzaldehyde prices in Djibouti exhibited a slight downward movement, with Benzaldehyde prices in September 2025 assessed in the range of USD 1650–1800/MT on a CIF Djibouti basis. The Benzaldehyde price trend in Djibouti was largely influenced by the softening momentum in the FOB China Benzaldehyde market, where weaker feedstock toluene prices and reduced export activity pressured overall price levels. Stable import arrivals and adequate stock availability in the domestic market further limited upward price movement, resulting in a steady-to-soft market tone throughout the quarter.

India: Benzaldehyde Import prices CIF JNPT, India, Grade- Industrial Grade (99.9% min purity).

According to PriceWatch, In Q3 2025, Benzaldehyde prices in India experienced a moderate downward trajectory, with Benzaldehyde prices in September 2025 assessed in the range of USD 1500–1600/MT on a CIF India basis. The Benzaldehyde price trend in India was shaped by weaker cues from the FOB China Benzaldehyde market, where declining feedstock toluene values and sluggish export activity exerted pressure on international offers.

Consistent import volumes and comfortable inventory positions among domestic distributors for further limited price improvement. On the local front, Benzaldehyde prices in India declined by about 4–7% during Q3 2025, mirroring the global bearish sentiment. As the quarter closed, stable freight rates and mild restocking activity lent slight support to the Benzaldehyde price trend in September, although overall market tone remained cautious.