Price-Watch’s most active coverage of Benzoic Acid price assessment:

- TG (99% min) Flakes FOB Shanghai, China

- TG (99% min) Flakes CIF Santos_China, Brazil

- TG (99% min) Flakes CIF Haiphong_China, Vietnam

- TG (99% min) Flakes CIF Jakarta_China, Indonesia

- TG (99% min) Flakes CIF Manzanillo_China, Mexico

- TG (99% min) Flakes CIF Manila_China, Philippines

- TG (99% min) Flakes CIF Mersin_China, Turkey

- TG (99% min) Flakes CIF Nhava Sheva_China, India

- TG (99% min) Flakes Ex-Kandla, India

Benzoic Acid Price Trend Q3 2025

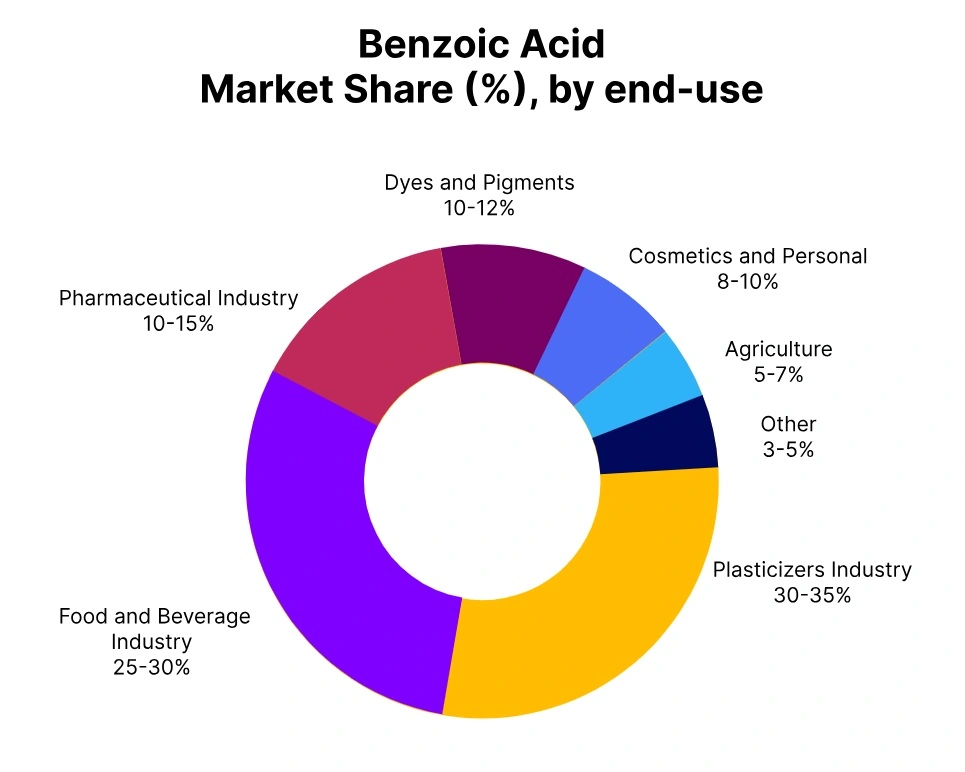

In Q3 2025, the global benzoic acid market experienced a slight decline, with prices decreasing by 2-3% compared to the previous quarter. This trend was largely influenced by lower demand from key downstream industries, including the food and beverage, pharmaceuticals, and plastics sectors, which saw subdued activity during the quarter. Despite stable feedstock costs and minimal fluctuations in energy prices, the market faced challenges from oversupply conditions, particularly from key producers in Asia.

Additionally, the slowdown in industrial production and weaker consumption in end-use applications like plasticizers, preservatives, and flavors contributed to the price decline. As a result, the benzoic acid market entered a phase of adjustment, with reduced purchasing activity and inventory destocking impacting overall price levels. Moving into Q4, a cautious recovery is expected, contingent on improved demand from the automotive and packaging industries, along with potential adjustments in production schedules.

China: (Benzoic Acid export prices FOB Shanghai, China, Grade- Technical Grade (99% min) Flakes).

In Q3 2025, Benzoic Acid prices in China decreased by 6.13% compared to Q2 2025. Benzoic Acid price trend in China was mainly driven by reduced demand from key downstream sectors like automotive and coatings, which faced production slowdowns. Despite stable production levels, oversupply conditions in the domestic market, coupled with higher freight costs, placed further downward pressure on prices.

Benzoic Acid prices in September 2025 in China continued to decline, reflecting weaker demand and global market softness. Moving forward, the market is expected to remain volatile, with prices dependent on the recovery of downstream industries and global supply chain adjustments.

Brazil (CIF from China): (Benzoic Acid Import prices CIF Santos, Brazil, Grade- Technical Grade (99% min) Flakes).

In Q3 2025, Benzoic Acid prices in Brazil increased by 8.15% compared to Q2 2025. Benzoic Acid price trend in Brazil was supported by steady demand from the pharmaceutical and plastic sectors, which maintained production despite macroeconomic challenges. The increase in prices was also influenced by rising freight costs from China and higher feedstock prices.

Benzoic Acid prices in September 2025 in Brazil remained elevated, reflecting a stable domestic market and robust downstream consumption. The outlook for Q4 2025 suggests that prices will remain strong if demand stays consistent and supply chains remain tight.

Vietnam (CIF from China): (Benzoic Acid Import prices CIF Haiphong, Vietnam, Grade- Technical Grade (99% min) Flakes).

In Q3 2025, Benzoic Acid prices in Vietnam decreased by 5.71% compared to Q2 2025. Benzoic Acid price trend in Vietnam was primarily impacted by weaker demand from key sectors, including automotive and coatings, which saw production slowdowns. Oversupply conditions in the market, combined with rising freight costs from China, placed downward pressure on prices.

Benzoic Acid prices in September 2025 in Vietnam continued a downward trajectory, reflecting weaker domestic consumption. The outlook for Q4 2025 remains cautious, with prices expected to remain under pressure unless demand improves in key industries.

Indonesia (CIF from China): (Benzoic Acid Import prices CIF Jakarta, Indonesia, Grade- Technical Grade (99% min) Flakes).

In Q3 2025, Benzoic Acid prices in Indonesia decreased by 7.17% compared to Q2 2025. Benzoic Acid price trend in Indonesia was influenced by reduced demand from the chemical and pharmaceutical industries, which faced production slowdowns. The global oversupply of Benzoic Acid, combined with rising freight costs and weak domestic consumption, further pressured prices.

Benzoic Acid prices in September 2025 in Indonesia remained on a downward trend, influenced by these market conditions. Moving forward, prices are expected to remain volatile, with recovery dependent on downstream demand and supply chain improvements.

Mexico (CIF from China): (Benzoic Acid Import prices CIF Manzanillo, Mexico, Grade- Technical Grade (99% min) Flakes).

In Q3 2025, Benzoic Acid prices in Mexico decreased by 5.88% compared to Q2 2025. Benzoic Acid price trend in Mexico was primarily driven by a decline in demand from the automotive and coatings sectors, which faced production slowdowns. The oversupply conditions, combined with rising freight costs from China, further contributed to the price decrease.

Benzoic Acid prices in September 2025 in Mexico continued to decline, reflecting ongoing market weakness. The outlook for the next quarter suggests that prices will remain under pressure unless there is a recovery in demand from key downstream industries.

Philippines (CIF from China): (Benzoic Acid Import prices CIF Manila, Philippines, Grade- Technical Grade (99% min) Flakes).

In Q3 2025, Benzoic Acid prices in the Philippines decreased by 9.40% compared to Q2 2025. Benzoic Acid price trend in the Philippines was heavily influenced by reduced demand from key sectors, particularly coatings and plastics, which experienced slowdowns in production. Freight costs and supply chain disruptions added additional downward pressure on prices.

Benzoic Acid prices in September 2025 in the Philippines remained lower, reflecting weak domestic consumption and an oversupplied market. The market outlook remains uncertain, with further price decreases expected unless demand from key industries improves in the coming quarter.

Turkey (CIF from China): (Benzoic Acid Import prices CIF Mersin, Turkey, Grade- Technical Grade (99% min) Flakes).

In Q3 2025, Benzoic Acid prices in Turkey decreased by 5.72% compared to Q2 2025. Benzoic Acid price trend in Turkey was driven by lower demand from key sectors, including automotive and packaging, which faced production slowdowns. Despite stable domestic supply, rising freight costs from China and weak consumption further pressured prices.

Benzoic Acid prices in September 2025 in Turkey continued a downward trajectory, influenced by ongoing supply-demand imbalances. The outlook for Q4 2025 remains cautious, with prices likely to remain subdued unless there is a rebound in demand from key industrial sectors.

Ex-Kandla: (Benzoic Acid Ex-Prices Ex-Kandla, India, Grade- Technical Grade (99% min) Flakes).

According to the PriceWatch, In Q3 2025, Benzoic Acid prices at Ex-Kandla increased by 0.77% compared to Q2 2025. Benzoic Acid price trend in India was supported by stable demand from the pharmaceutical and chemical sectors, which continued to perform well despite global market challenges. The increase in prices was also influenced by higher feedstock costs, especially for benzene, and rising transportation costs.

Benzoic Acid prices in September 2025 in Ex-Kandla remained on an upward trajectory, reflecting strong domestic consumption and tightening supply. Moving forward, prices are expected to remain steady if demand stays stable and supply chain conditions improve.