Price-Watch’s most active coverage of Beta Naphthol price assessment:

- (99% min) Industrial Grade (Powder) FOB Shanghai, China

- (99% min) Industrial Grade (Powder) CIF Santos_China, Brazil

- (99% min) Industrial Grade (Powder) CIF Tokyo_China, Japan

- (99% min) Industrial Grade (Powder) CIF Busan_China, South Korea

- (99% min) Industrial Grade (Powder) CIF Bangkok_China, Thailand

- (99% min) Industrial Grade (Powder) CIF JNPT_China, India

Beta Naphthol Price Trend Q3 2025

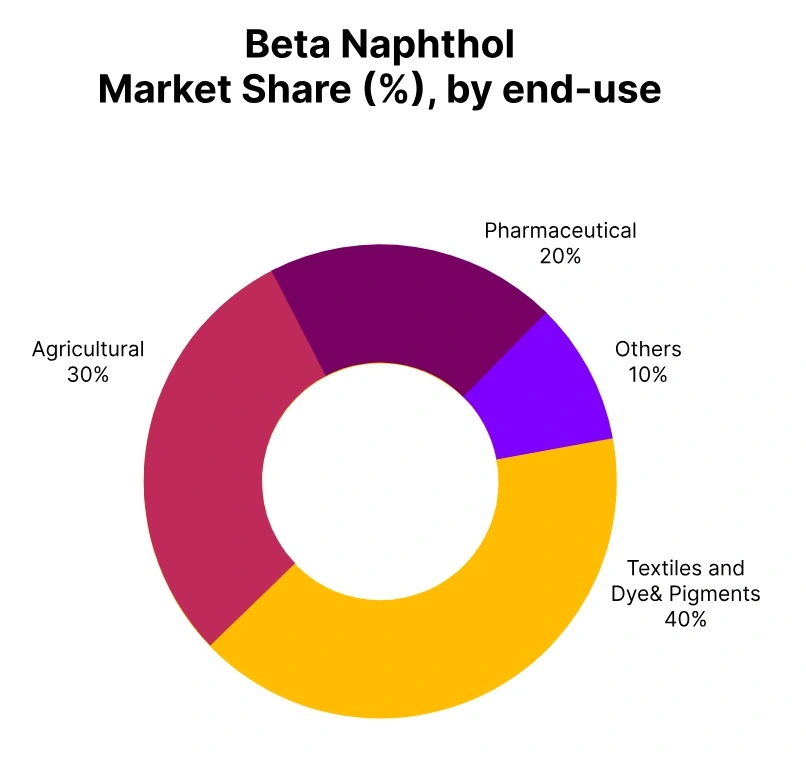

In Q3 2025, prices of Beta Naphthol trended upward in leading nations on the back of consistent demand from textile dye, rubber, drug, and agricultural industries. China witnessed a 2% hike with stabilized supply and tight domestic demand. In Japan, there has been a 5% hike in the face of vigorous procurement before year-end. Prices in South Korea increased by 2% on the back of stable imports and demand.

India registered a 4% increase, indicative of well-balanced supply-demand and tough industrial performance. Thailand registered a 3% gain with solid imports and robust sectoral consumption. The highest spike has been seen by Brazil at 9%, led by active restocking, port backlogs, and robust agricultural demand. September prices have been strong in all countries, indicative of solid raw material costs and Q4 demand expectations.

China: Beta Naphthol Export prices FOB Shanghai, China, Grade- (99% min) Industrial Grade.

According to the PriceWatch, in Q3 2025, the price trend of Beta Naphthol in China witnessed a moderate upward trend from the preceding quarter supported by steady demand from downstream industries like textile dye, rubber, pharmaceutical, and agrochemical industries. The price of Beta Naphthol in China increased by 2%, after a more robust 6% growth seen in Q2 2025. The reduced rate of growth indicated stable market conditions and adequate domestic supply.

Export operations continued to play a role in general market balance, albeit with competition from alternative suppliers in Asia putting margin pressure on a minor level. Agricultural and textile seasonal demand has been unchanged, helping to sustain price levels. Beta Naphthol prices in China in September 2025 remained firm through minimal movement in raw material prices and better logistics than in the last quarter.

Japan: Beta Naphthol Import prices CIF Tokyo, Japan, Grade- (99% min) Industrial Grade.

During Q3 2025, the beta naphthol price trend in Japan has strengthened due to rising procurement by the pharmaceutical and textile dye industries despite economic downturn across the globe. The prices of Beta Naphthol in Japan increased by 5% compared to the last quarter as industries restocked in preparation for year-end production patterns. Imports from China have been steady with Japanese consumers enjoying positive terms of trade.

The agricultural and rubber segments too witnessed firm demand, adding to the overall price support. Sentiment in the market remained modestly bullish driven by optimism over enhanced downstream consumption. In September, Beta Naphthol prices in Japan have been firm as market participants continued forward booking to stay clear of Q4 price uncertainty.

South Korea: Beta Naphthol import prices CIF Busan, South Korea, Grade- (99% min) Industrial Grade.

In Q3 2025, Beta Naphthol price trend in South Korea has been modestly bullish, witnessing a 2% growth over the previous quarter. Consistent imports from China and steady demand from the dyeing and rubber industries kept the supply-demand environment balanced. Domestic consumption from the pharma and agri industries sustained price levels during the quarter.

Although currency fluctuations affected overall import prices, end-use demand was relatively insulated. Traders witnessed guarded optimism from buyers, particularly towards the end of the quarter. In September 2025, Beta Naphthol price in South Korea have slightly improved due to firming industrial output and expected Q4 purchasing.

Brazil: Beta Naphthol import prices CIF Santos, Brazil, Grade- (99% min) Industrial Grade.

Q3 2025 witnessed a significant jump in Beta Naphthol price trend in Brazil, propelled by strong demand from the textile dye, rubber, and pharmaceutical sectors. Beta Naphthol price in Brazil jumped by 9% compared to Q2, the highest among the major importers. Higher activity in the farm segment and lower inventories resulted in active China-led restocking, propelling prices upwards. Apart from this, port congestion and higher freight charges played a role in cost accrual.

Downstream segments have not been affected by these issues, maintaining price support. At the quarter end, Beta Naphthol prices in Brazil in September 2025 have remained elevated with buyers adapting to the price increase trend before the Q4 seasonal demand.

Thailand: Beta Naphthol import prices CIF Bangkok, Thailand, Grade- (99% min) Industrial Grade.

In Q3 2025, Beta Naphthol price trend in Thailand saw moderate upward movement, fuelled by the recovery in demand in the rubber and textile dye industries. Against Q2, Beta Naphthol price in Thailand have increased by 3%, with support from consistent import volumes from China. Though mid-quarter, regional logistics issues temporarily dampened shipments, end-use industries maintained consistent consumption.

Pharma and agro markets had a stable base of demand that supported market pricing. Better raw material availability also helped in stabilizing prices. In September 2025, Beta Naphthol prices in Thailand have been still higher, indicating robust market fundamentals and restrained restocking by buyers in view of Q4 offtake.

India: Beta Naphthol import prices CIF JNPT, India, Grade- (99% min) Industrial Grade.

According to the PriceWatch, in Q3 2025, Beta Naphthol price trend in India indicated consistent growth, backed by steady offtake from the textile dye and pharma industries. Beta Naphthol price in India has been up by 4% compared to the last quarter, indicating strength against moderate global feedstock swings. Imports from China have been steady, leading to robust material availability.

The rubber and agricultural industries also had moderate offtake, which helped stabilize the local market. A minimal uptick in raw material and transportation expenses has been witnessed, yet to the extent that it would interfere with market flow. At the closing of the quarter, Beta Naphthol prices in September 2025 in India held steady as a result of balanced supply-demand equations and continuing industrial activities.