Price-Watch’s most active coverage of Bleached Eucalyptus Kraft Pulp price assessment:

- Brightness ≥89%, Fiber Lengh-85 FOB Santos, Brazil

- Brightness≥89%, Fiber Length-0.80 mm FOB Coronal, Chile

- Brightness≥89%, Fiber Lengh- 85 CIF Shanghai (Brazil), China

- Brightness ≥89%, Fiber Length 0.80 mm CIF Shanghai (Chile), China

- Brightness ≥89%, Fiber Lengh-85 CIF Rotterdam (Brazil), Netherlands

- Brightness ≥ 89%, Fiber Length 0.80 mm CIF Rotterdam (Chile), Netherlands

- Brightness ≥89%, Fiber Lengh-85 CIF Nhava Sheva (Brazil), India

- Brightness ≥ 89%, Fiber Length 0.80 mm CIF Nhava Sheva (Chile), India

Bleached Eucalyptus Kraft Pulp (BEKP) Price Trend Q3 2025

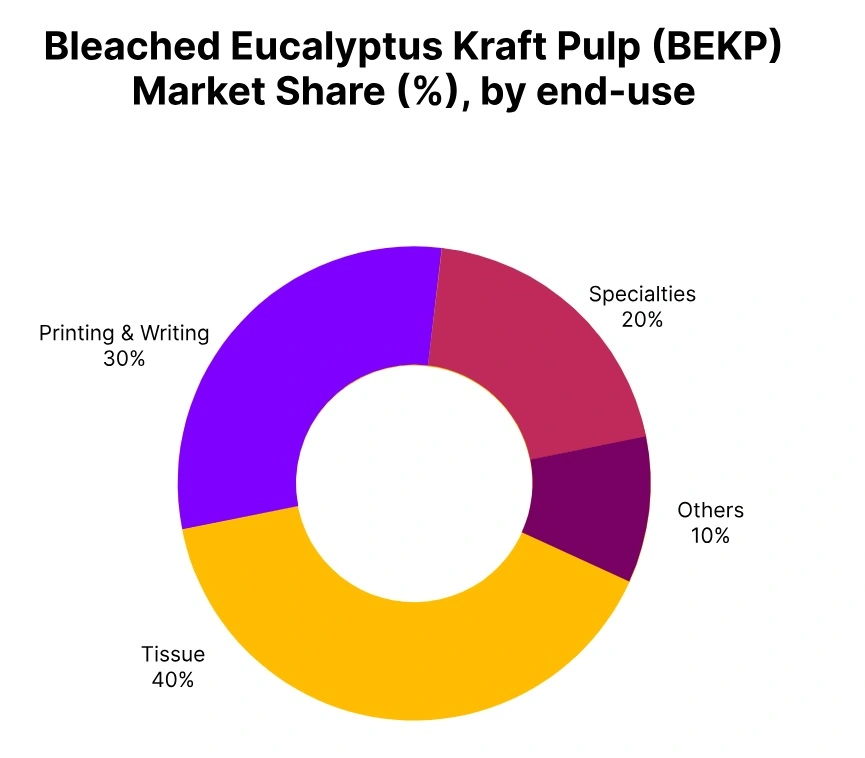

In Q3 2025, the global Bleached Eucalyptus Kraft Pulp (BEKP) market remained largely stable with slight regional fluctuations, reflecting balanced supply and cautious downstream demand from the tissue, packaging, and specialty paper sectors. In South America, Bleached Eucalyptus Kraft Pulp (BEKP) price trend softened modestly as regional exporters maintained consistent shipments amid controlled procurement by paper manufacturers.

Across Asia, market sentiment was generally restrained, with subdued import activity due to cautious purchasing behaviour and adequate inventories, though South Asia maintained steady trading supported by selective sourcing. In Europe, supply-demand dynamics remained balanced with moderate buying volumes, resulting in minimal price movement. Overall, the Bleached Eucalyptus Kraft Pulp (BEKP) market sustained equilibrium through the quarter, with stable trade flows and restrained demand shaping a steady pricing environment heading into Q4 2025.

Brazil: Bleached Eucalyptus Kraft Pulp (BEKP) price in Brazil, Brightness ≥89%, Fiber Length – 85.

In Q3 2025, the Bleached Eucalyptus Kraft Pulp (BEKP) price in Brazil has experienced a slight softening due to moderate demand from tissue and specialty paper manufacturers. FOB Santos prices have declined by –0.6% to a range of USD 530–560 per metric ton. Exporters have continued steady shipments despite downstream buyers maintaining cautious procurement amid balanced inventories. The supply-demand equilibrium has limited significant price movements, with market participants observing a generally stable trading environment throughout the quarter.

The Bleached Eucalyptus Kraft Pulp price trend in Brazil has reflected minimal variation with balanced supply and demand dynamics. In September 2025, BEKP prices in Brazil have remained within the USD 530–560 per metric ton range, showing stable trading activity.

Chile: Bleached Eucalyptus Kraft Pulp (BEKP) price in Chile, Brightness ≥89%, Fiber Length 0.80 mm.

In Q3 2025, the Bleached Eucalyptus Kraft Pulp (BEKP) price in Chile has declined modestly by –0.6%, with FOB Coronel prices ranging between USD 530–550 per metric ton. Demand has remained stable but cautious as paper mills have managed inventories amid moderate downstream consumption. Export availability has stayed comfortable, and buyers have followed a measured purchasing approach.

Market sentiment has been neutral, with minimal price fluctuation observed over the quarter. The Bleached Eucalyptus Kraft Pulp (BEKP) price trend in Chile has shown slight downward pressure but maintained overall stability. In September 2025, Bleached Eucalyptus Kraft Pulp (BEKP) prices in Chile have been steady within the USD 530–550 range, reflecting cautious but consistent demand.

China: Bleached Eucalyptus Kraft Pulp (BEKP) price in China imported from Brazil and Chile, Brightness ≥89%, Fiber Length – 85.

The Bleached Eucalyptus Kraft Pulp (BEKP) import price in China has declined in Q3 2025 due to soft demand from the packaging and tissue sectors. CIF Shanghai prices from Brazil have decreased by –1.9% to trade at USD 560–590 per metric ton, while imports from Chile have fallen by –3.3% within the same price band. Global economic uncertainties and steady supply have pressured prices lower.

Buyers have shown cautious procurement, balancing available inventories with subdued downstream activity. The Bleached Eucalyptus Kraft Pulp (BEKP) price trend in China has reflected a decline influenced by weakening demand and steady imports. In September 2025, Bleached Eucalyptus Kraft Pulp (BEKP) prices in China have stood between USD 560–590 per metric ton, indicating continued market softness.

Netherlands: Bleached Eucalyptus Kraft Pulp (BEKP) price in Netherlands imported from Brazil and Chile, Brightness ≥89%, Fiber Length 0.80 mm.

In Q3 2025, the Bleached Eucalyptus Kraft Pulp (BEKP) import price in the Netherlands has shown mixed trends. CIF Rotterdam prices from Brazil have eased by –0.5% to USD 600–630 per metric ton, while Chilean imports have risen marginally by 0.3%, priced at USD 600–620. Paper producers have maintained moderate buying levels amid cautious demand. Supply has remained balanced, resulting in minimal price volatility throughout the quarter.

The Bleached Eucalyptus Kraft Pulp (BEKP) price trend in the Netherlands has been mixed, with slight decreases from Brazil and marginal increases from Chile. In September 2025, BEKP prices in the Netherlands have remained within USD 600–630 for Brazilian imports and USD 600–620 for Chilean imports.

India: Bleached Eucalyptus Kraft Pulp (BEKP) price in India imported from Brazil and Chile, Brightness ≥89%, Fiber Length – 85.

According to Price-Watch, the Bleached Eucalyptus Kraft Pulp (BEKP) price trend in India has shown divergent trends in Q3 2025. CIF Nhava Sheva prices from Brazil have declined by –2.2% to USD 550–600 per metric ton, while imports from Chile have increased by 2.5%, trading between USD 630–670. Indian tissue and packaging sectors have demonstrated mixed demand, with a slight preference for Chilean pulp due to competitive pricing and quality considerations. Overall market activity has remained steady but restrained.

The Bleached Eucalyptus Kraft Pulp (BEKP) price trend in India during Q3 2025 has shown opposite movements from Brazilian and Chilean sources. In September 2025, BEKP prices in India have ranged from USD 550–600 for Brazil-origin pulp and USD 630–670 for Chile-origin pulp, reflecting the mixed market dynamics.