Price-Watch’s most active coverage of Bleached Hardwood Kraft Pulp (BHKP) price assessment:

- (Brightness ≥ 88%) Ex-Shandong, China

- (Brightness ≥ 88%) DEL East Coast, USA

- Mixwood (Brightness ≥ 88%) FD Hamburg, Germany

Bleached Hardwood Kraft Pulp (BHKP) Price Trend Q3 2025

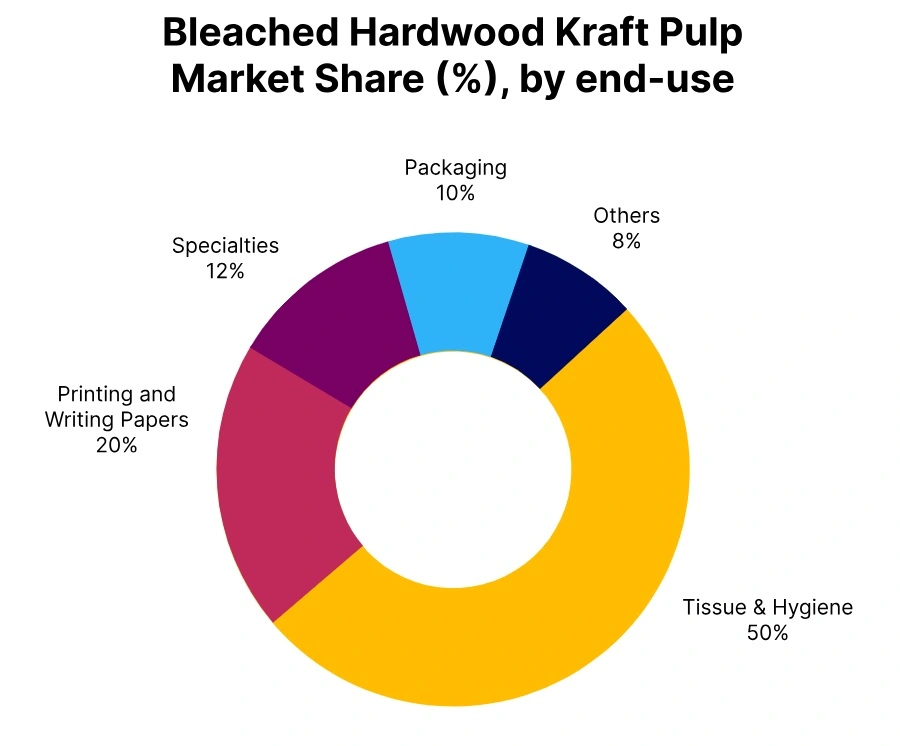

In Q3 2025, the global Bleached Hardwood Kraft (BHK) market trended downward, driven by subdued demand and sufficient supply across major regions. In Europe, prices declined notably as weak consumption from tissue and printing paper segments, combined with elevated inventory levels, continued to exert pressure despite efforts to adjust production.

North America followed a similar pattern, with moderate reductions reflecting cautious procurement behavior and stable supply conditions amid muted demand from tissue and packaging applications. Across the Asia-Pacific region, pricing softened slightly as consistent production and competitive availability maintained balanced trading dynamics.

Overall, the global BHK market remained under pressure through the quarter, shaped by sluggish downstream activity, ample supply, and restrained purchasing sentiment, resulting in a generally subdued pricing environment heading into Q4 2025.

Germany: Bleached Hardwood Kraft price in Germany, Grade: Mixwood (Brightness ≥ 88%).

In Q3 2025, the Bleached Hardwood Kraft (BHK) price in Germany has declined sharply, pressured by slow demand from tissue and printing paper manufacturers and ample domestic supplies. FD Hamburg prices have fallen by 10.9% quarter on quarter, trading between USD 1000–1200 per metric ton. Buyers have scaled back procurement amid excess inventories and a cautious outlook for downstream consumption.

Producers have responded by moderating output, but price recovery has been limited due to abundant availability and subdued new orders. Market sentiment has remained soft across both export and domestic segments.

The Bleached Hardwood Kraft price trend in Germany has reflected a pronounced downward movement with limited recovery signs. In September 2025, Bleached Hardwood Kraft prices in Germany have remained within the USD 1000–1200 per metric ton range, maintaining weak market fundamentals.

United States: Bleached Hardwood Kraft price in the USA, Grade: (Brightness ≥ 88%).

According to PriceWatch, in Q3 2025, the Bleached Hardwood Kraft (BHK) price in the USA has decreased moderately as tissue and specialty packaging sectors have continued to manage stocks conservatively. DEL East Coast prices have slipped by 5.2% from the previous quarter to USD 730–770 per metric ton.

Suppliers have maintained steady delivery flows, but buyers have been selective with orders amid weak demand and balanced inventory levels. Price adjustments have reflected the broader slowdown in North American hardwood pulp consumption.

The Bleached Hardwood Kraft price trend in the USA has indicated steady downward pressure. In September 2025, Bleached Hardwood Kraft prices in the USA have stayed between USD 730–770 per metric ton, showing continued moderation.

China: Bleached Hardwood Kraft price in China, Grade: (Brightness ≥ 88%).

According to PriceWatch, in Q3 2025, the Bleached Hardwood Kraft (BHK) price in China has softened slightly, impacted by muted demand from paper mills and competitive supplies. Ex-Shandong prices have fallen by 1.2%, ranging between USD 510–540 per metric ton. Producers have kept operations steady, but downstream buyers have adopted a cautious stance, limiting order sizes as inventories have stayed sufficient.

The market has remained steady, with minimal volatility observed throughout the quarter. The Bleached Hardwood Kraft price trend in China has reflected slight weakness under stable supply conditions. In September 2025, Bleached Hardwood Kraft prices in China have remained within the USD 510–540 per metric ton range, showing consistent stability.