The aerospace and automotive sectors are located at a critical moment in time between materials science and strategic competitive advantage. High-performance metals (HPMs) such as titanium alloys, Inconel superalloys, advanced high-strength steel, aluminum and others have moved from being merely an engineering problem to a major source of economic and competitive advantage for the core industries. This transition demonstrates a broader trend whereby innovation in materials correlates with competitive advantage and operational efficiency.

The Strategic Imperative of High-Performance Metals

High-performance metals (HPMs) are highly engineered alloys designed to withstand extreme conditions, such as high temperatures, high pressure, and corrosive environments. High-performance metal (HPM) materials exhibit advanced strength-to-weight ratios, higher corrosion resistance, and longer durability, compared to conventional metals. In markets where the performance margins can convert into economic value, the careful selection and application of HPM materials have become a key factor driving success.

The aerospace industry sharply illustrates this dynamic. Every kilogram of weight saving in commercial aircraft leads to meaningful savings over the operational life of the aircraft. The same is true in automotive manufacturing, where electrification represents a transition to materials that alleviate weight while maintaining the structural integrity and safety of the vehicle.

Nickel: The Critical Element Driving Industry Dependency

Nickel has become the foundational element in high-performance metallurgy, being the basis for some of the most important alloys in aerospace and automotive. Nickel’s properties exceptionally good resistance to high temperatures, corrosion and oxidation mean it is required in superalloys and stainless-steel formulations. That dependency creates a strategic risk.

The dependence of the aerospace industry on Inconel, a nickel-chromium superalloy essential for making turbine blades, shows how superiority of materials can produce supply risk. As geopolitical tensions and resource nationalism continue to affect nickel markets, producers will have to deal with the risk of maintaining access to this essential component while also navigating cost volatility.

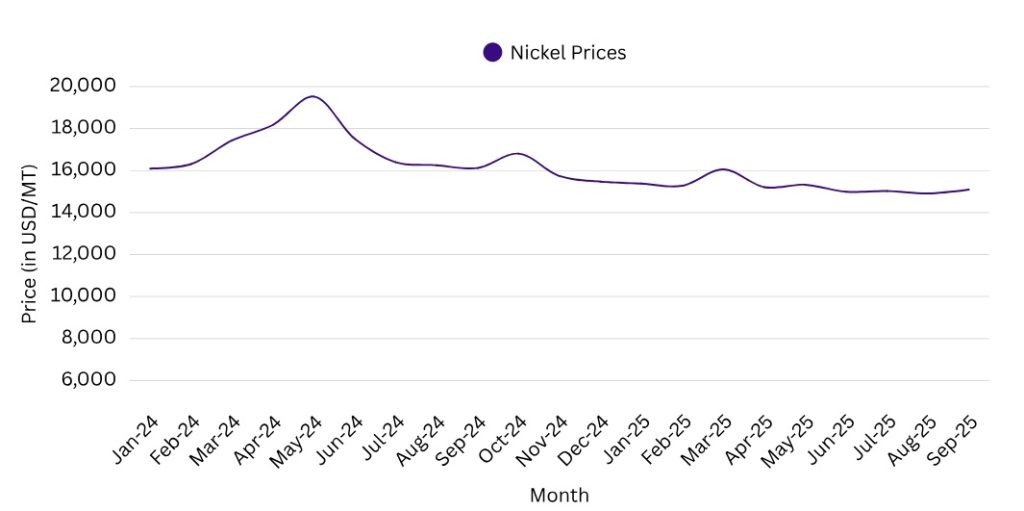

Nickel prices decreased significantly from highs above USD 18,000 per metric ton in Q2 2024, to roughly USD 15,000-16,000 per metric ton for the first two quarters of 2025. This price decrease resulted from rising supply, particularly from Indonesia, leading to market surplus, as demand was also weaker due to slower build out of the EV market and the strong dollar script. Nickel prices were volatile but remained under pressure overall due to oversupply and trade uncertainty.

Precision Engineering Meets Economic Imperative in Aerospace industry

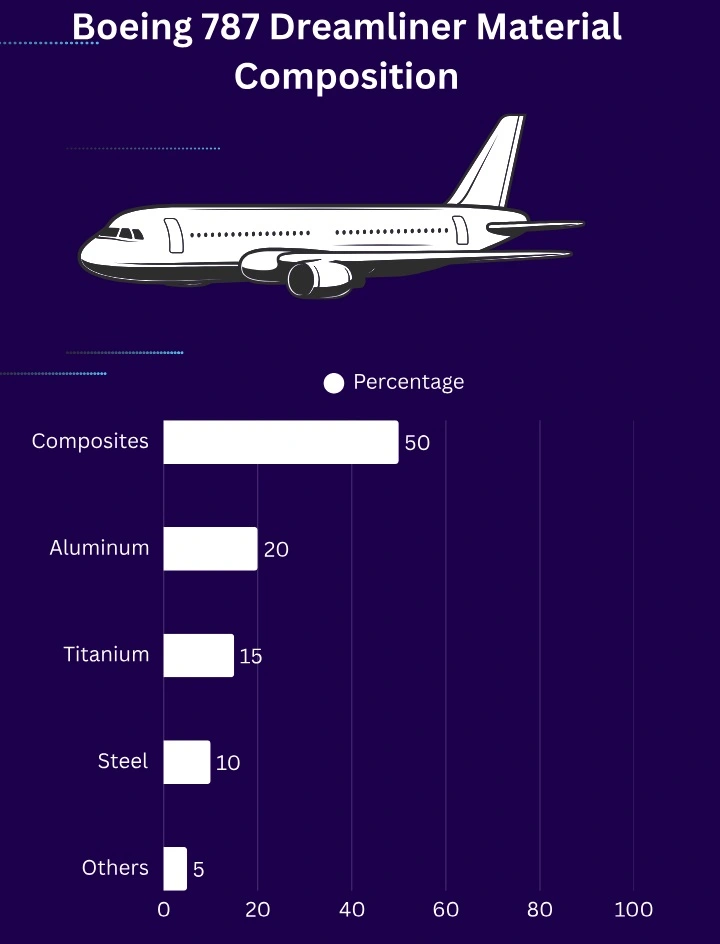

The aerospace sector’s implementation of high-performance metals shows the direct link between materials development and efficiency of operation. Titanium alloys have become central to contemporary aircraft designs, providing the ideal balance of low weight, high-temperature performance, and strength. The extensive application of titanium in fuselage and engine components by Boeing 787 Dreamliner is a prime example of this strategic initiative, providing both weight savings and improved fuel efficiency.

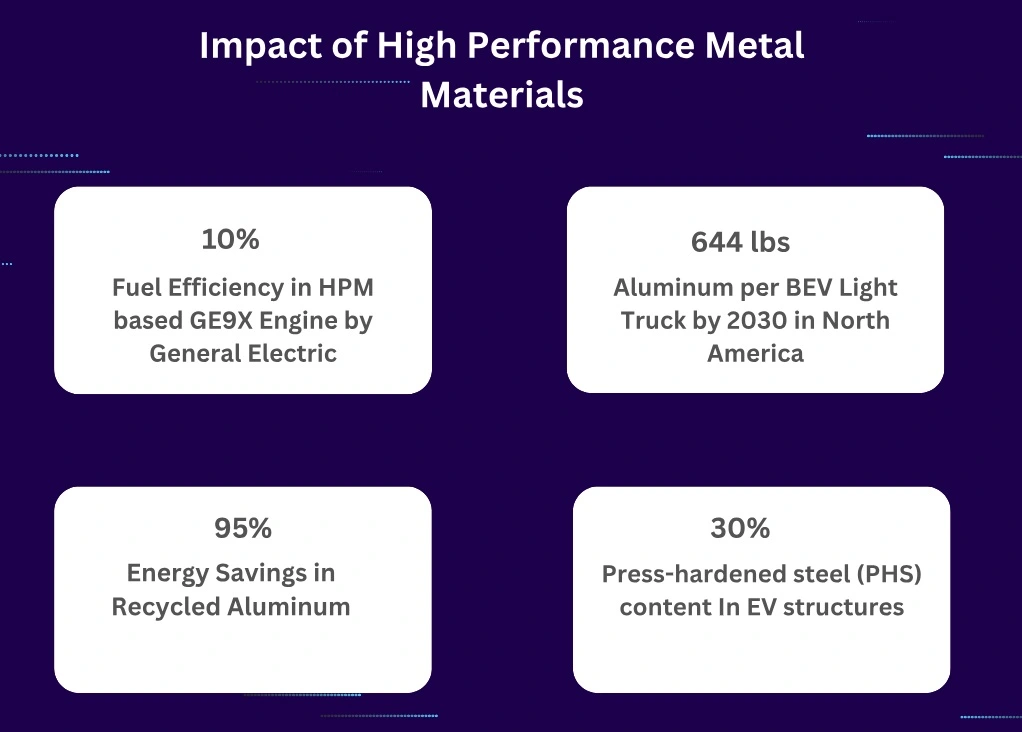

The use of Inconel in jet engines is another significant advancement. This nickel-chromium alloy sustains its structural integrity during the extreme combustion chamber temperatures, allowing a higher operating temperature range, resulting in improved fuel efficiency. The GE9X engine achieved around a 10% improvement in fuel efficiency compared to its predecessor in part because of the titanium-aluminum additive manufactured blades. This is illustrative of how innovations in materials benefit operations for airlines with millions in fuel savings annually per aircraft.

Advanced superalloys also help advance these capabilities with a high level of stability in high-temperature extremes while maintaining important mechanical properties. With growing emphasis on sustainability, these types and classes of materials allow manufacturers to coax higher performance from the engine while reducing fuel consumption and emissions.

Light weighting Meets Electrification in Automotive transformation

The material strategy of the automotive sector embodies both the simultaneous pressures of electrification and efficiency. Market indications are that, by the year 2030, North American vehicles will contain approximately an additional 100 pounds of aluminum per vehicle than in 2020, with battery-electric light trucks projected to exhibit an average of 644 pounds of aluminum by 2030. This transport of weight serves as more than just a value reduction; it is a fundamental rethinking of the economics of manufacturing.

Aluminum’ strategic value is not simply in its lightweight properties. In fact, recycled aluminum requires roughly 95% less energy in production than primary aluminum, creating cost structure benefits for manufacturers with established recycling facilities. For example, several manufacturers, such as Novelis, are reporting 63% recycled content average across rolled products, showing that sustainability metrics will instead become correlating measures of efficiency and cost competitiveness in operations.

In parallel, press-hardened steel (PHS) and advanced high-strength steel (AHSS) have emerged as key safety materials for electric vehicles. New grades of PHS demonstrate excellent strength-to-weight ratio for crash structures in electric vehicles, with some models approaching 30% PHS content in body-in-white construction. This development demonstrates a very sophisticated approach for the industry to optimize the use of materials that perform well, using high-performance metals only where they have the highest impact.

Manufacturing Innovation and Materials Science

Innovations in manufacturing and materials Science advancements in high-performance metals will continue to rely on technological innovation in manufacturing processes. Additive manufacturing and 3D printing are transforming the way complex components are produced with metal materials, allowing attributes not previously possible, or cost-prohibitive complex geometries. For example, 3D printing of lightweight and high-performance components in aerospace applications generates efficient options that use material intelligently. It was once inefficient and wasteful to produce complex and inexpensive designs.

Nanotechnology is a new frontier in improving materials, allowing for manipulation at the atomic/molecular level for improvements in the strength, flexibility, and corrosion resistance of metals. Such advances will help make viable alloys that will perform even better as they are subjected to increasingly extreme conditions.

The advent of machine learning and algorithmic design represents a significant transformative force in the development of alloys. High-entropy alloys (HEAs) multi-principal element mixtures which are designed using computational chemistry represent immense potential to design custom materials that target specific performance attributes. This ability to design materials shifts materials science from the realm of purchasing commodities to the land of competitive differentiation.

Market Challenges and Strategic Implications

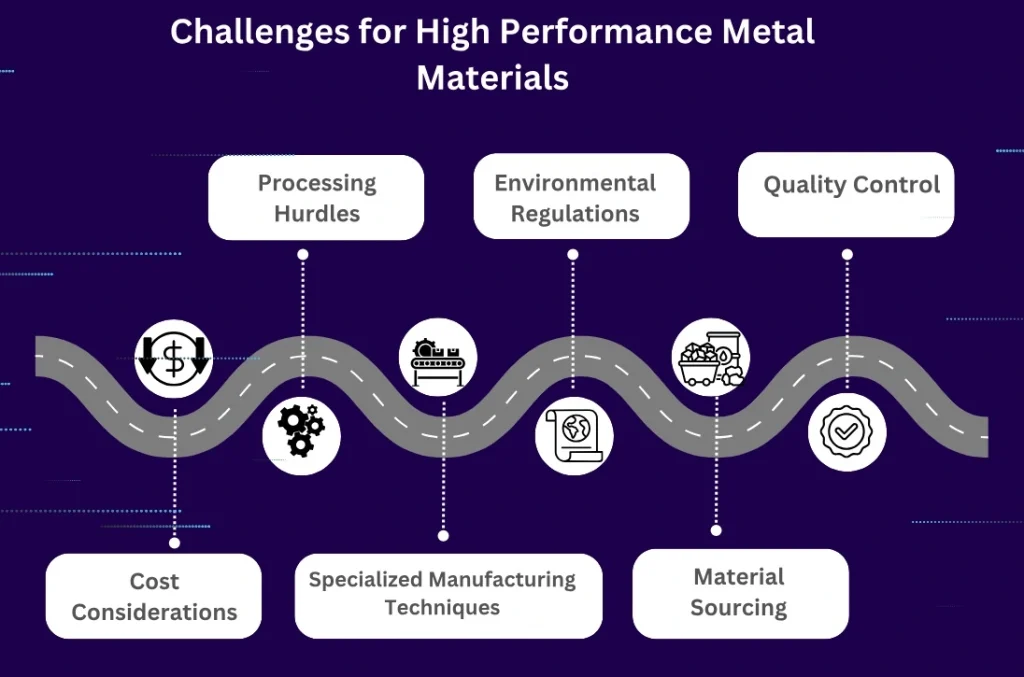

The high-performance metals sector faces several critical challenges that shape competitive dynamics. Cost considerations remain paramount, as materials like titanium and nickel alloys command premium prices that can significantly impact manufacturing economics. Processing complexity presents additional hurdles, requiring specialized manufacturing techniques and equipment that create natural barriers to entry.

The high-performance metals industry is confronted by some major challenges related to competitive dynamics. Cost is always a consideration, particularly since materials like titanium and nickel alloys sell at a premium price that can shift the economics of manufacturing. Manufacturing and processing complexity is also an additional hurdle, as it requires specialized manufacturing processes and equipment that creates a natural barrier to entry.

Sourcing materials involves another strategic consideration, as supply chains can shift with global market swings and geopolitical realities. Companies must weigh performance requirements on the one hand with supply security needs on the other, while managing cost volatility and availability limits.

Environmental regulations are also beginning to shape how manufacturing firms’ source and select materials, as their need to comply with additional emission standards has heightened demand for metals that support environmentally sustainable manufacturing practices. Such an environment rewards firms with innovative recycling processes and environmentally efficient production schemes.

Outlook and Strategic Positioning

The upcoming 24 months will be a critical time for the high-performance metals sector. Aerospace titanium demand could fluctuate impacting production rates, placing further pressure on supply chains and necessitating alternative sourcing capabilities. The automotive industry will have an increased call for bifurcation of materials, with specific strategies for structures, crashworthiness (safety), and powertrain components.

Additive manufacturing and repair processes will expand from specialized applications into mainstream maintenance repair and overhaul (MRO), holistically changing vehicle lifecycle dynamics and fleet management strategies.

High-performance metals have progressed beyond being excellent material options, to being integral elements of competitive advantage in the aerospace and automotive space. Companies that recognize the complex interactions of materials science, manufacturing technology, and supply chain strategy, will do more than develop better products; they will create sustainable competitive positions within increasingly demanding markets.

The strategic imperative is clear. Organizations will need sophisticated materials selection, processing optimization, and supply chain management capabilities, to truly master the transformational potential of high-performance metals. Success in this domain will determine market leadership in the next generation of aerospace and automotive innovation.

Sources and further readings: –

https://www.geaerospace.com/news/articles/5-things-know-about-cfm-rise-program

Aluminum Transportation Group- ATG

https://www.aluminum.org/news/new-survey-automakers-confirms-aluminum-use-expected-grow-new-electric-vehicles

https://investors.novelis.com/news-events/press-releases/detail/1390/novelis-opens-ulsan-aluminum-recycling-center

https://www.worldautosteel.org/press-hardened-steels-help-shape-the-future-of-automotive-safety/

https://www.voestalpine.com/highperformancemetals/en/

Aerospace Materials Characteristics

https://www.osti.gov/servlets/purl/1845310

https://www.industry.gov.au/news/advanced-manufacturing-high-performance-alloys