The n-butanol market in 2025 stands at a pivotal juncture marked by steady industrial demand, evolving supply chain dynamics, and progressive advances in bio-based production methods. Despite global economic uncertainties, the market demonstrates resilience supported by enduring demand in paints, coatings, and adhesives the core consumption segments alongside diversified trade flows and nascent bio-based alternatives. A closer examination of price drivers, demand growth, supply factors, and the framework for bio-based n-butanol development reveals a nuanced landscape characterized by equilibrium and cautious optimism.

Trade, Price Drivers, Demand Trends and Industrial Production

Industrial production trends remain a critical determinant of n-butanol pricing in major regions. In the European Union, industrial production contracted by 1.0 percent month-on-month in August 2025 yet maintained a 1.1 percent year-on-year growth, reflecting a stable but cautious manufacturing sector. Buyers in coatings and chemical industries are cautious in restocking amid uncertain macroeconomic signals, resulting in firm market prices that hold steady absent external shocks such as feedstock scarcity or logistics interruptions.

In the United States, production in the paint, coating, and adhesive sectors remains flat through mid-2025, reflecting stable consumption but limited growth. This steadiness supports n-butanol prices that carry a modest premium over European levels due to regional transportation and energy costs rather than robust demand growth. Trade competitiveness significantly influences pricing pressure, particularly in Europe.

The European Chemical Industry Council reports a 17 percent decrease in the EU chemical trade surplus in H1 2025, driven by weaker internal demand and increased imports at competitive prices. European manufacturers face structural cost disadvantages stemming from high energy tariffs and stringent EU Emission Trading System regulations, compressing profitability, and enabling cheaper global feedstock alternatives to gain market share.

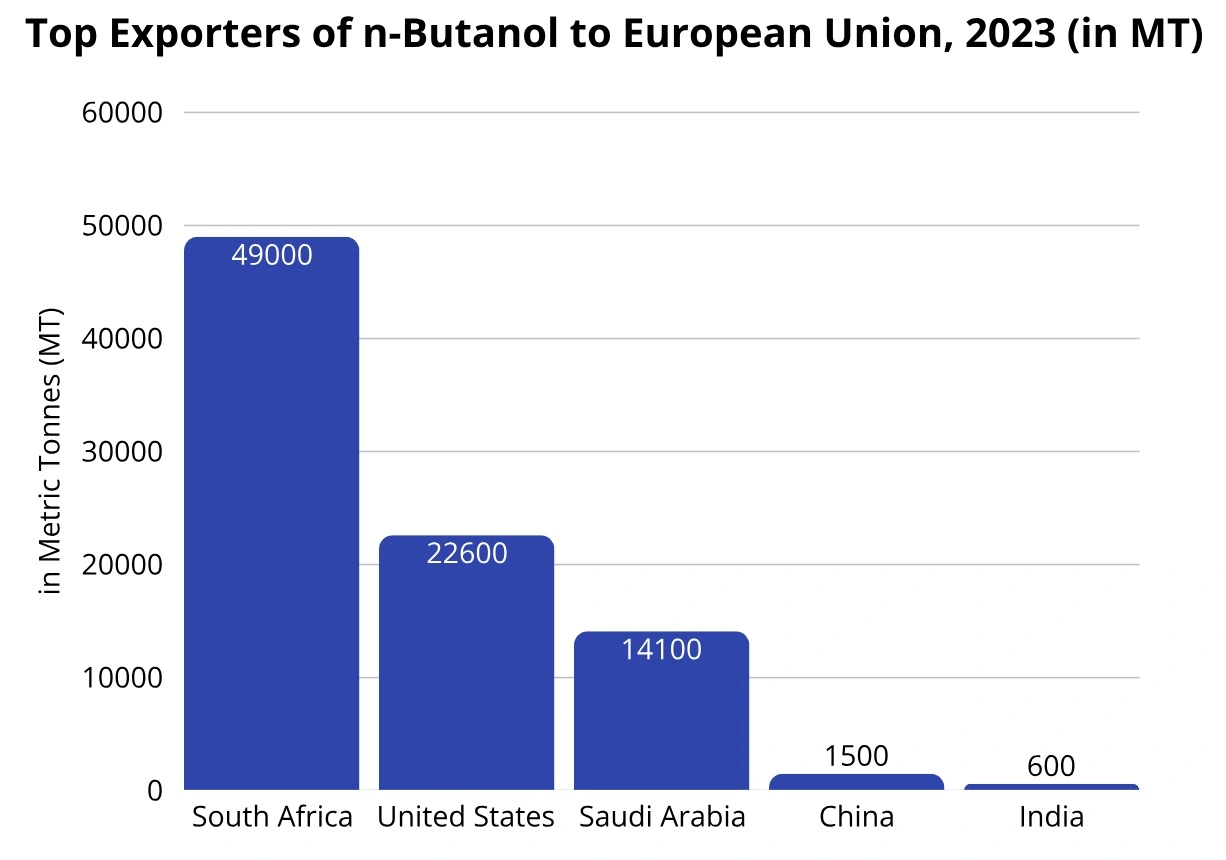

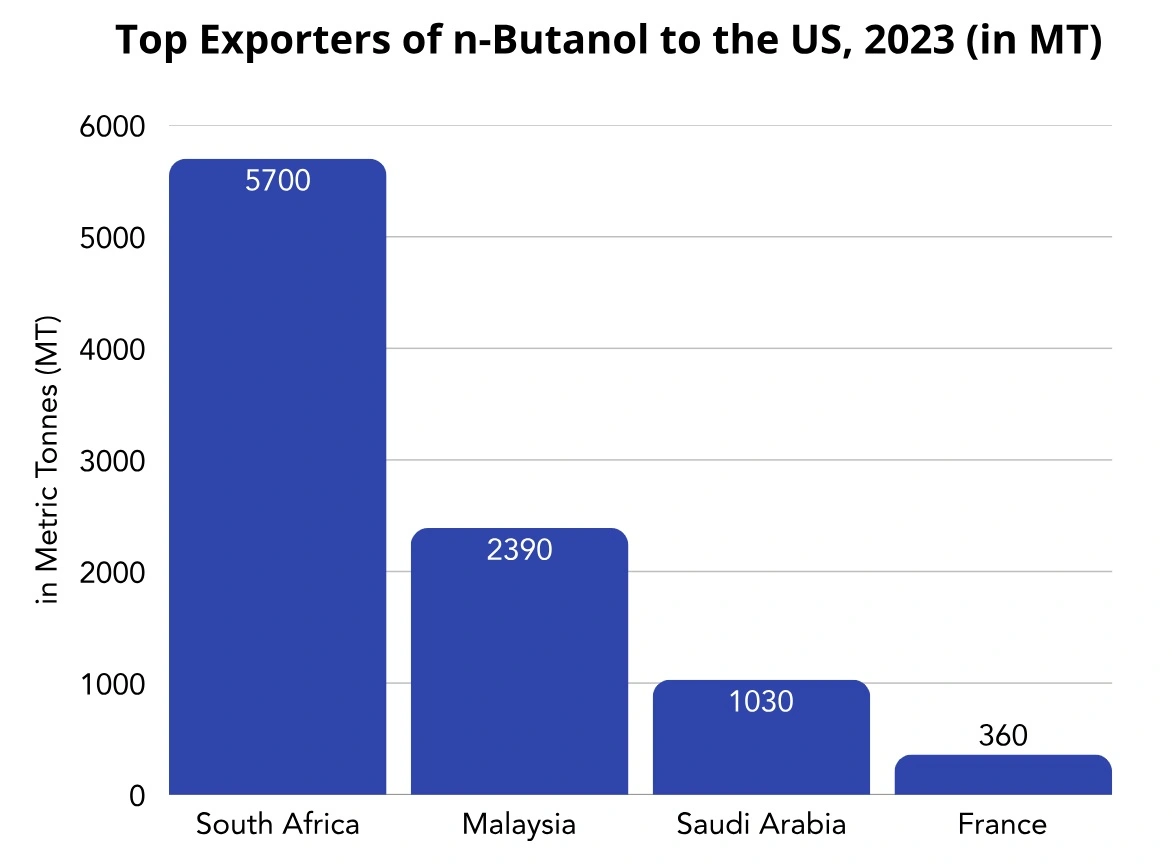

Europe’s n-butanol imports predominantly come from South Africa, the United States, and Saudi Arabia, while the US relies mostly on South Africa and Malaysia. This diversified import base fosters market resilience, buffering against supply disruptions by enabling swift sourcing shifts among alternative suppliers.

Demand Growth

The global demand for n-butanol is largely anchored by the paints, coatings, and adhesives industry, where n-butanol serves primarily as a solvent. Important downstream derivatives like butyl acetate and butyl acrylate also underpin applications in flexible packaging, films, construction materials, and automotive parts. Secondary demand stems from its use in plasticizers, textiles, and resin production; industries tied to broader construction and consumer durable cycles. Consequently, n-butanol demand acts as an industrial economic barometer.

Effective demand monitoring relies on sector-specific governmental data such as the U.S. Census Bureau’s Manufacturers’ Value of Shipments report for paint and coatings, complemented by broader industrial production indexes like Eurostat’s Monthly Manufacturing Production Index in Europe. These data sources provide leading indicators of n-butanol consumption trends with typical 2–3-month lags.

Industry benchmarks, such as the American Coatings Association’s $31.6 billion shipment value and 313,000-employee footprint in 2022, confirm a mature yet resilient coatings sector underpinning n-butanol consumption. Both the EU and US markets in 2025 reflect steady yet cautious demand, supported by seasonal repainting for industrial maintenance and measured construction activities. Price levels during this period average around $1.10 per kg in Europe and $1.35 per kg in the US, consistent with a balanced, zero-growth consumption scenario.

Supply Trends & Trade Flows

Europe’s n-butanol import profile highlights a stable and diversified supply chain, vital for maintaining steady availability. In 2023, key exporters to the EU-27 included South Africa (~49.0 kt), the United States (~22.6 kt), and Saudi Arabia (~14.1 kt), supplemented by smaller volumes from China and India. This concentration among a few reliable exporters enhances flexibility to accommodate maintenance or export constraints without prolonged shortages.

In contrast, the US import structure in 2023 showed South Africa (~5.72 kt) as the primary supplier, followed by Malaysia, Saudi Arabia, and France. US importers closely monitor South African shipments, especially regarding availability on the Gulf and East Coasts, where logistical bottlenecks or outages can induce regional price fluctuations. Saudi Arabia’s role as a swing supplier plays a stabilizing function globally, leveraging integrated petrochemical complexes and competitive feedstock pricing to adjust volumes dynamically in response to regional shortfalls. This global interconnectedness reduces price volatility risks and reinforces supply continuity.

Market intelligence suggests that supply chain agility is paramount. Employing multi-origin sourcing and flexible port logistics enabling use of North Sea and Mediterranean terminals in Europe or Gulf and East Coast ports in the US mitigates regional supply chain risks and avoids premium costs during constrained market events. Such strategies ensure downstream production continuity amid dynamic sourcing shifts.

Bio-Based Actually Progress and Implications

While the traditional oxo process dominates n-butanol production, bio-based alternatives are gaining traction due to increased research funding and sustainability imperatives. Public-private partnerships, including initiatives by the US Department of Energy (DOE), National Renewable Energy Laboratory (NREL), and IEA Bioenergy, drive innovation toward renewable routes.

Technological challenges persist, notably energy-intensive separation steps that account for 45-55 percent of biorefinery process energy, impeding commercial-scale fermentation. Issues such as low microbial yield and product toxicity raise purification costs, with separation technologies representing a major commercialization bottleneck. DOE’s recent programs focus on continuous biobutanol fermentation integrated with membrane solvent extraction to reduce energy consumption and production costs, with promising pilot-scale results at industrial sites.

IEA Bioenergy underscores the importance of co-product valorization and integrated energy recovery systems for economic viability at scale, reinforcing ongoing global collaboration. Previous DOE demonstrations validated membrane-assisted solvent extraction feasibility using lignocellulosic feedstocks, and current projects expand upon these foundations to optimize yield and process integration, aiming to close the cost and efficiency gap with conventional oxo-derived n-butanol.

For buyers in 2025, bio-n-butanol availability remains limited, primarily in early commercialization. Its key value proposition lies in providing a carbon footprint reduction equivalent to conventional fossil-based products, spurring interest from sustainability-conscious industries such as coatings, automotive, and packaging. Procurement diligence must include transparent life-cycle assessments, process documentation, and certification parity. Standards established by NREL and IEA Bioenergy assist buyers in verifying bio-based claims, supporting informed contract decisions.

Sustainable and Strategic n-Butanol Market

The n-butanol market in 2025 is characterized by steady demand rooted in resilient industrial consumption, a diversified and flexible supply chain, and the emergence of bio-based alternatives gradually bridging gaps with petrochemical production. Despite structural cost pressures from energy and regulatory compliance in Europe, global supply diversification and Saudi Arabia’s swing supplier role maintain market stability. Demand growth remains cautious but stable, reflecting a mature coatings industry sustaining solvent consumption amid macroeconomic uncertainties.

Technological advances in biobutanol production signal a cautious transition toward hybrid sourcing models integrating renewable and traditional supply streams, aligning with broader sustainability trends. Stakeholders equipped with real-time market intelligence and flexible procurement strategies are best positioned to navigate this evolving landscape while leveraging emerging opportunities in green chemical evolution.