India’s soda ash market stands at a pivotal juncture, experiencing unprecedented transformation as massive capital investments, evolving import dynamics, and global industry consolidation converge to reshape the competitive landscape. The chemical sector, which has long relied on traditional supply chains and pricing models, now faces a period of significant disruption that promises both opportunities and challenges for industry stakeholders.

This article provides a breakdown of how these emerging Soda Ash trends are creating new opportunities and challenges for manufacturers and the broader industry.

GHCL’s Ambitious Expansion Strategy

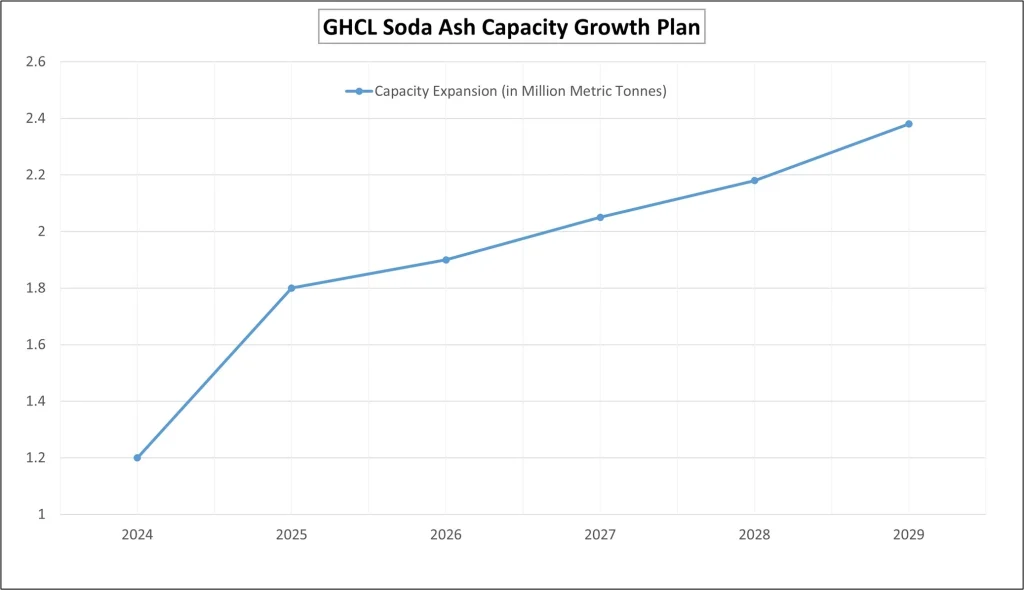

Leading the charge in domestic capacity expansion is GHCL Ltd, which has committed INR 3,500 crore toward establishing a state-of-the-art soda ash facility in Gujarat’s Kutch region. This strategic investment represents one of the largest single commitments to soda ash production in recent Indian industrial history. The facility’s ambitious capacity targets initially 550,000 tonnes annually with planned expansion to 1.1 million tonnes across two phases signal GHCL’s confidence in sustained demand growth and its determination to capture a larger market share.

The company’s expansion strategy is particularly noteworthy given its current production capacity of approximately 1.2 million tonnes. With the new facility operational, GHCL anticipates increasing its market dominance from the current 26% to an impressive 34-35% by the 2028-29 financial year. This aggressive expansion timeline reflects management’s assessment of market fundamentals and their belief in the sector’s long-term growth trajectory.

The timing of this investment coincides with India’s renewable energy revolution, particularly in solar power generation. Solar glass manufacturers, who represent a critical downstream market for soda ash, are scaling their operations dramatically. Current production capacity of 12 GW is expected to surge to 40 GW by 2026, creating incremental demand for approximately 400,000 tonnes of soda ash annually. This demand surge from the clean energy sector provides a solid foundation for GHCL’s capacity expansion justification.

Market Dynamics and Pricing Pressures

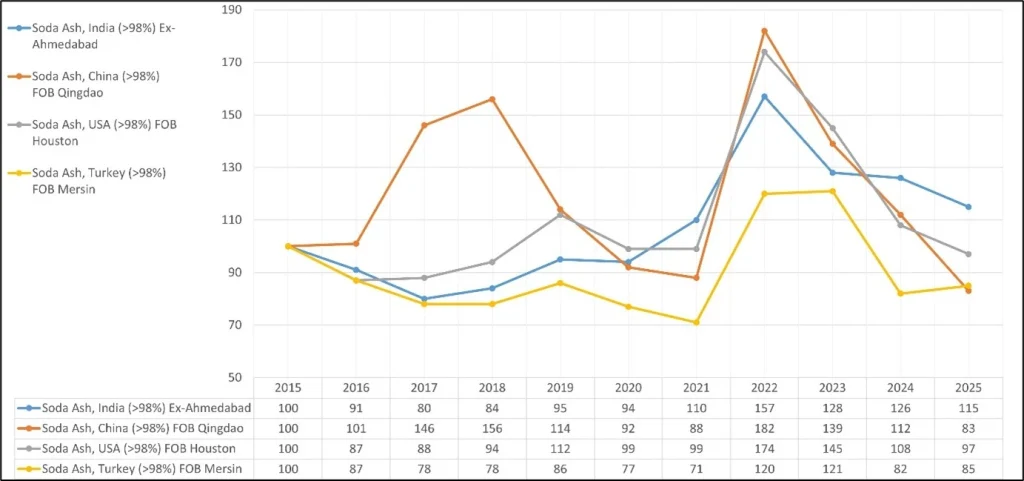

India’s soda ash market is experiencing steady demand growth of approximately 5% annually, driven by diverse industrial applications including glass manufacturing, detergent production, and chemical processing. However, the country’s continued reliance on imports accounting for nearly 25% of total consumption as of 2024 creates vulnerability to international price volatility and supply chain disruptions.

The introduction of substantial new domestic capacity has the potential to fundamentally alter market dynamics. As local production increases and import dependence decreases, pricing pressures may shift toward domestic competition among major producers. Established players like Tata Chemicals and DCW Chemicals will face intensified competition from GHCL’s expanded operations, potentially leading to more competitive pricing for end users.

This transition from import-dependent to domestically focused supply chains could provide greater price stability and reduce exposure to international market fluctuations. However, the adjustment period may witness increased price volatility as market participants adapt to new competitive realities and production capacities come online.

Global Consolidation Reshapes Industry Landscape

The international soda ash industry has undergone significant consolidation with WE Soda’s acquisition of Genesis Alkali, creating the world’s largest soda ash producer with combined annual capacity exceeding 9.5 million tonnes. This strategic acquisition provides WE Soda with enhanced access to natural soda ash sources, particularly the high-quality trona deposits in the United States, which offer cost advantages over synthetic production methods.

The consolidation trend in global soda ash production creates both opportunities and challenges for Indian market participants. On one hand, larger, more efficient international producers may exert downward pressure on global pricing, potentially benefiting Indian importers and downstream consumers. Conversely, increased market concentration could lead to greater pricing power among international suppliers, potentially affecting import costs and domestic pricing benchmarks.

The efficiency gains achieved through consolidated operations, combined with access to lower-cost natural soda ash sources, may influence global pricing trends that ultimately impact Indian market dynamics. These international developments underscore the importance of domestic capacity expansion as a hedge against global supply chain risks and pricing volatility.

Infrastructure Improvements Enhance Competitiveness

India’s port infrastructure improvements are contributing to enhanced supply chain efficiency and cost competitiveness. The recent achievement at Kattupalli Port, which successfully handled a record 35,000 tonnes of soda ash in a single shipment, demonstrates the country’s evolving logistics capabilities. Such improvements in handling capacity and operational efficiency translate directly to reduced turnaround times and lower logistics costs for importers and downstream users.

These infrastructure enhancements are particularly beneficial for southern Indian markets, where improved port efficiency can significantly impact delivered costs for soda ash consumers. Reduced logistics expenses contribute to overall cost competitiveness and may help offset some of the premium associated with international sourcing compared to domestic production.

The continued investment in port infrastructure and logistics networks supports India’s broader strategy of becoming more competitive in chemical manufacturing and reducing dependence on imports across various industrial sectors.

Sustainability Initiatives Shape Future Costs

Environmental considerations are increasingly influencing operational strategies and cost structures across the soda ash industry. GHCL’s commitment to achieving a 30% annual reduction in emissions while targeting carbon neutrality by 2047 exemplifies the industry’s response to growing environmental awareness and regulatory pressure.

The company’s strategy involves increased utilization of biofuels and other sustainable energy sources, which may initially increase operational costs but could provide long-term advantages through improved operational efficiency and potential regulatory incentives. Additionally, sustainability initiatives may create opportunities for premium pricing among environmentally conscious customers.

As environmental regulations become more stringent and customer preferences shift toward sustainably produced materials, investments in cleaner production technologies may become competitive necessities rather than optional initiatives. These trends could influence long-term pricing structures and create differentiation opportunities for producers who successfully implement comprehensive sustainability programs.

Market Outlook and Strategic Implications

The convergence of domestic capacity expansion, global industry consolidation, and sustainability imperatives creates a complex but promising outlook for India’s soda ash market. The substantial investments being made suggest industry confidence in long-term demand growth, particularly from emerging sectors like solar glass manufacturing.

For market participants, the evolving landscape presents opportunities to reduce import dependence, achieve greater price stability, and capture growing domestic demand. However, success will require careful navigation of increased domestic competition, changing global supply dynamics, and evolving customer expectations regarding environmental performance.

The next few years will likely witness continued volatility as new production capacity comes online, and market dynamics adjust. However, the foundation for a more robust, domestically focused soda ash market appears to be solidifying, supported by strategic investments, infrastructure improvements, and growing end-market demand across diverse industrial applications.