Price-Watch’s most active coverage of Busheling Scrap price assessment:

- Del Alabama, USA

- FD Rotterdam, Netherlands

Bushelling Scrap Price Trend Q3 2025

According to PriceWatch, in Q3 2025, global busheling scrap prices showed a negative trend, driven by weak steel demand, particularly in Asia and Europe, as well as increased competition from cheaper billet imports. Market participants remained cautious, with mills negotiating lower scrap purchase prices amid subdued construction and manufacturing activity.

Seaborne scrap trade volumes contracted, and in key markets like Turkey and Russia, prices declined month over month. The U.S. market also saw downward pressure on busheling scrap, reflecting limited buying interest and sluggish downstream demand, solidifying a bearish outlook for the quarter.

Netherlands: Bushelling Scrap Export prices FD Rotterdam, Netherlands Grade 1.

According to PriceWatch, in Q3 2025, the bushelling scrap price trend in the Netherlands showed a 4.12% decline compared to Q2, reflecting a moderate market correction driven by softer demand from steel mills, increased scrap availability, and cautious buyer sentiment amid broader industrial slowdown. This downward movement aligns with wider trends in the European ferrous scrap market, where oversupply and limited downstream activity have applied pressure on prices.

While the market may find short term support from export opportunities or supply constraints, the overall outlook remains cautious heading into Q4, with further weakness possible unless industrial demand recovers.

The 2.97% decrease in bushelling scrap prices in the Netherlands during September 2025 can be attributed to reduced demand from the automotive and manufacturing sectors amid slowing economic activity. Additionally, increased availability of scrap metal from domestic and neighbouring markets may have contributed to downward pricing pressure.

USA: Bushelling Scrap Domestic prices, Del Alabama, United States Grade 1.

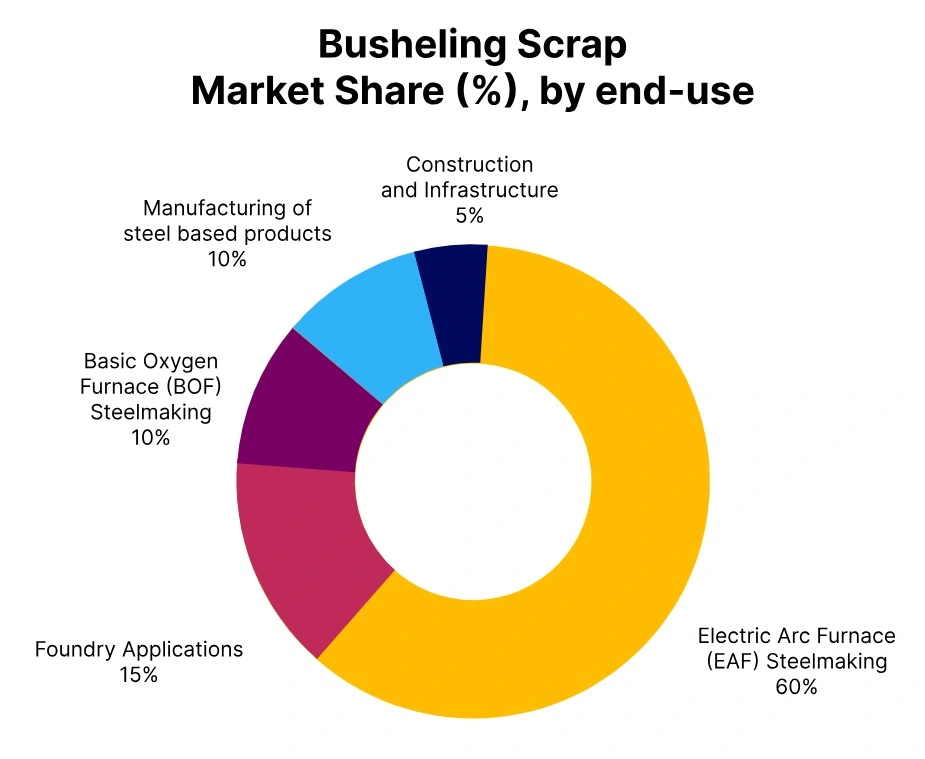

According to PriceWatch, in Q3 2025, the bushelling scrap price trend in the U.S. showed a 4.71% decrease from Q2, driven by softening demand from electric arc furnace (EAF) mills, elevated inventory levels, and weakening downstream steel consumption. Prime scrap grades of busheling saw average spot prices dip down in the previous quarter. The decline also reflects narrowing price spreads between prime and obsolete grades, as well as muted export activity and regional oversupply.

Market sentiment remains cautious, with suppliers under margin pressure and mills exerting more pricing leverage in monthly negotiations. The 4.66% decrease in busheling scrap prices in the USA during September 2025 can be attributed to weakened demand from steel mills amid slower manufacturing activity. Additionally, increased supply from industrial scrap sources may have exerted downward pressure on prices.