Price-Watch’s most active coverage of Butyl Acetate price assessment:

- IG (99.7% min) FOB Shanghai, China

- IG (99.7% min) CIF Nhava Sheva (China), India

- IG (99.7% min) CIF Jebel Ali (China), UAE

- IG (99.7% min) CIF Rotterdam (China), Netherlands

- IG (99.7% min) CIF Haiphong (China), Vietnam

- IG (99.5% min) FOB Klang, Malaysia

- IG (99.5% min) CIF Bangkok (Malaysia), Thailand

- IG (99.5% min) CIF Jakarta (Malaysia), Indonesia

- IG (99.5% min) CIF Nhava Sheva (Malaysia), India

- IG (99.5% min) FOB Jurong, Singapore

- IG (99.5% min) CIF Jakarta (Singapore), Indonesia

- IG (99.5% min) CIF Bangkok (Singapore), Thailand

- IG (99.5% min) CIF Busan (Singapore), South Korea

- IG (99.5% min) Ex-Mumbai (Bulk), India

- IG (99.5% min) Ex-Kandla (Bulk), India

Butyl Acetate Price Trend Q3 2025

In Q3 2025, the global butyl acetate market exhibited moderate stability with regional variations, as prices fluctuated within a 0-4% range during the July-September quarter. This trend was shaped by stable feedstock costs, energy prices, and regional supply chain factors. Upstream, key feedstocks including butanol and acetic acid experienced some volatility due to fluctuations in oil prices and chemical manufacturing dynamics but remained relatively stable overall.

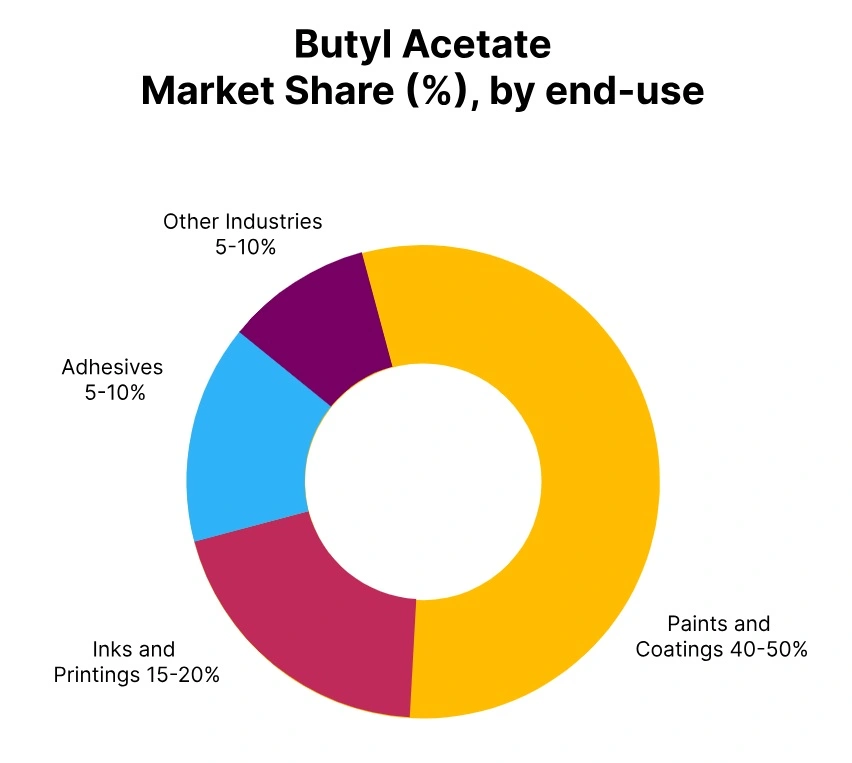

Intense demand from downstream sectors, particularly the automotive, paints, coatings, and adhesives industries, assisted in maintaining price resilience. As a result, despite some upstream volatility, the market showed stability, with continued expansions in production capacity and supply chain adjustments expected to further support stable prices in the coming quarter.

China: (Butyl Acetate export prices FOB Shanghai, China, Grade- Industrial Grade (99.7% min).

According to PriceWatch, in Q3 2025, Butyl Acetate prices in China decreased by 2.52% compared to Q2 2025. Butyl Acetate price trend in China was mainly impacted by less demand in the automotive and coatings sectors, which faced production slowdowns and lower consumption. Despite stable production levels, oversupply conditions contributed to the decline in prices. The reduction in demand from key downstream industries, paired with rising freight costs, placed further downward pressure on the market.

Butyl Acetate prices in September 2025 in prices remained on a downward trend, influenced by lower demand and weaker market conditions. Moving forward, prices are expected to remain volatile, dependent on the recovery in downstream industries and adjustments in global supply chains.

Malaysia: (Butyl Acetate export prices FOB Klang, Malaysia, Grade- Industrial Grade (99.5% min).

Butyl Acetate prices in Malaysia experienced a decrease of 3.34% in Q3 2025 compared to Q2 2025. Butyl Acetate price trend in Malaysia was driven by subdued demand from key sectors such as coatings, automotive, and pharmaceuticals. A combination of lower domestic consumption and global oversupply led to a reduction in prices. Furthermore, fluctuations in feedstock costs and the general softness in the regional market added to the price decline.

The drop in demand from key industries was exacerbated by increasing logistical challenges and rising transportation costs. Butyl Acetate prices in September 2025 in Malaysia continued to reflect the sluggish market conditions. The outlook remains cautious, with potential for further price adjustments based on demand recovery.

Singapore: (Butyl Acetate export prices FOB Singapore, Singapore, Grade- Industrial Grade (99.5% min).

Butyl Acetate prices in Singapore saw a downward trend of 3.38% in Q3 2025 compared to Q2 2025. Butyl Acetate price trend in Singapore was influenced by weakened demand from the automotive, coatings, and paint sectors. Despite stable logistics and production, lower orders from major industries placed pressure on prices. In addition, the regional oversupply conditions and fluctuating feedstock costs resulted to the price drop.

The price decrease in Singapore was further amplified by a stronger competitive market, with other regions offering more cost-effective options. Butyl Acetate prices in September 2025 in remained subdued, continuing the downward trend. Looking foward, market conditions are expected to stabilize only if there is a recovery in demand from key sectors, particularly automotive and coatings.

UAE (CIF from China): (Butyl Acetate Import prices CIF Jebel Ali, UAE, Grade- Industrial Grade (99.7% min).

According to PriceWatch, in Q3 2025, Butyl Acetate prices in the UAE decreased by 1.81% compared to Q2 2025. Butyl Acetate price trend in the UAE was influenced by weaker demand in the construction and paints sectors, which are critical consumers of Butyl Acetate. Despite a stable supply chain, the decline in demand from these industries led to an overall reduction in prices. Additionally, fluctuations in the exchange rate and rising freight costs further contributed to the downward price movement.

Butyl Acetate prices in September 2025 in prices in the UAE were significantly lower, continuing the trend observed throughout the quarter. The outlook for the coming quarter remains uncertain, with prices expected to stabilize if demand from key sectors shows signs of recovery.

Netherlands (CIF from China): (Butyl Acetate Import prices CIF Rotterdam, Netherlands, Grade- Industrial Grade (99.7% min).

In Q3 2025, Butyl Acetate prices in the Netherlands went up by 0.57% compared to Q2 2025. Butyl Acetate price trend in the Netherlands was driven by moderate demand growth in the automotive and chemical industries, which led to stable consumption levels. This uptick in demand helped offset the broader market challenges, including supply chain disruptions and fluctuating raw material costs.

However, despite the modest price increase, oversupply conditions from neighbouring regions kept the market relatively stable. Butyl Acetate prices in September 2025 in the Netherlands continued to show a small rise, signalling a steady recovery in demand. The market is expected to maintain stability, with moderate price adjustments likely to continue through the next quarter.

Vietnam (CIF from China): (Butyl Acetate Import prices CIF Haiphong, Vietnam, Grade- Industrial Grade (99.7% min).

Butyl Acetate prices in Vietnam experienced a decrease of 2.31% in Q3 2025 compared to Q2 2025. Butyl Acetate price trend in Vietnam was influenced by less industrial demand, particularly from the automotive and coatings sectors, which saw production slowdowns. The general oversupply in the market, coupled with supply chain disruptions, contributed to the downward pressure on prices.

Although logistical issues were partly resolved by September 2025, the market faced challenges from lessened export volumes and a slowdown in domestic consumption. Prices in Vietnam continued to reflect this softer demand environment. Looking ahead, the market remains uncertain, with further price movements dependent on the recovery of key industries and regional demand shifts.

Thailand (CIF from Malaysia): (Butyl Acetate Import prices CIF Laem Chabang, Thailand, Grade- Industrial Grade (99.5% min).

In Q3 2025, Butyl Acetate prices in Thailand went down by 3.20% compared to Q2 2025. Butyl Acetate price trend in Thailand was driven by reduced demand from the automotive and textile sectors which saw slower production cycles. While production remained steady, the reduced consumption from key industries and an oversupplied market led to a decline in prices.

The logistics sector also faced challenges, with increased freight costs impacting price stability. Butyl Acetate prices in September 2025 in Thailand continued to show a downward trend, influenced by global market conditions. The outlook for the next quarter suggests that price recovery is unlikely unless demand from major sectors increases significantly.

Indonesia (CIF from Malaysia): (Butyl Acetate Import prices CIF Jakarta, Indonesia, Grade- Industrial Grade (99.5% min).

Butyl Acetate prices in Indonesia decreased by 3.12% in Q3 2025 compared to Q2 2025. Butyl Acetate price trend in Indonesia was influenced by lower demand from the chemical and paint sectors, which faced challenges from reduced production rates. Additionally, the market was impacted by global oversupply conditions and rising feedstock costs, which pressured local prices.

Regardless of stable domestic production levels, the price decline in Indonesia was exacerbated by logistical issues and increasing transportation costs. Butyl Acetate prices in September 2025 in Indonesia remained subdued. The outlook for Q4 2025 suggests potential for further price declines unless there is a recovery in demand from key industries such as automotive and coatings.

South Korea (CIF from Singapore): (Butyl Acetate Import prices CIF Busan, South Korea, Grade- Industrial Grade (99.5% min).

In Q3 2025, Butyl Acetate prices in South Korea decreased by 3.33% compared to Q2 2025. Butyl Acetate price trend in South Korea was influenced by weaker demand from the automotive and textile industries, which faced operational slowdowns. Despite consistent demand from the chemical sector, oversupply conditions and increasing feedstock costs contributed to the price decline.

The decrease in South Korea was further driven by rising freight charges and a reduction in exports. Butyl Acetate prices in September 2025 in South Korea continued to decrease, following the broader trend in the region. The outlook for the next quarter depends on improvements in downstream demand, specifically in the automotive and textile sectors.

Ex-Mumbai: (Butyl Acetate Ex-Prices Ex-Mumbai, India, Grade- Industrial Grade (99.5% min).

Butyl Acetate prices in Ex-Mumbai experienced a minor decrease of 0.26% in Q3 2025 compared to Q2 2025. Butyl Acetate price trend in India reflected consistent demand from pharmaceutical and automotive sectors, which helped maintain price stability. Although, slight fluctuations in import costs and regional supply chain challenges led to a small price dip.

Butyl Acetate prices in September 2025 in Ex-Mumbai were continuing on a downward trend, albeit marginally. The market remains steady, with added price adjustments expected depending on global supply conditions and domestic demand recovery. The outlook for the next quarter remains cautiously optimistic, with prices likely to stabilize if demand from key sectors increases.