Price-Watch’s most active coverage of Butyl Glycol price assessment:

- Industrial grade(99%) FOB Jeddah, Saudi Arabia

- Industrial grade(99%) CIF Santos (Saudi Arabia), Brazil

- Industrial grade(99%) CIF Shanghai (Saudi Arabia), China

- Industrial grade(99%) FOB Marseille-Fos, France

- Industrial grade(99%) FD Genoa, Italy

- Industrial grade(99%) CIF Nhava Sheva (Saudi Arabia), India

- Industrial grade(99%) Ex-Mumbai, India

- Industrial grade(99%) CIF Mersin (Saudi Arabia), Turkey

Butyl Glycol Price Trend Q3 2025

In Q3 2025, Butyl Glycol prices decreased across key markets, including Saudi Arabia, France, Italy, Brazil, China, Turkey, and India, driven by lower demand from sectors like automotive, construction, and coatings. Rising feedstock and import costs, and logistical challenges, pressured prices. The depreciation of local currencies, particularly the Brazilian Real and Indian Rupee, exacerbated the price decline.

The outlook for Q4 2025 remains cautious, with potential for further price fluctuations depending on demand recovery in key sectors such as automotive, construction, and coatings. The market remains uncertain, with recovery contingent on global industrial demand.

Saudi Arabia: Butyl Glycol Export prices FOB Jeddah, Saudi Arabia, Grade- Industrial Grade (99%).

In Q3 2025, Butyl Glycol prices in Saudi Arabia went down by 6.87%, after a 3.03% increase in Q2. The Butyl Glycol price trend in Saudi Arabia was mainly driven by reduced demand from key industries, including construction and textiles, which experienced slowdowns due to economic challenges. Supply chain disruptions and rising feedstock costs contributed to the price decline.

Despite stable production levels, higher import costs and logistical challenges increased the overall cost of Butyl Glycol. Butyl Glycol prices in September 2025 were significantly lower compared to Q2. The outlook for Q4 2025 depends on the recovery of demand from key sectors and the resolution of supply chain issues.

France: Butyl Glycol Export prices FOB Marseille, France, Grade- Industrial Grade (99%).

According to PriceWatch, In Q3 2025, Butyl Glycol prices in France decreased by 13.09%, following a 4.23% increase in Q2. The Butyl Glycol price trend in France was heavily impacted by a significant decline in demand from the automotive and coatings sectors, which experienced production slowdowns and reduced consumption.

Furthermore, rising raw material costs and logistical challenges due to disruptions in European supply chains contributed to the price drop. Despite stable imports, the overall demand contraction led to weaker prices. Butyl Glycol prices in September 2025 were significantly lower than in Q2. The market outlook remains uncertain, with potential price fluctuations depending on demand recovery in the automotive and coatings industries.

Italy: Butyl Glycol Export prices FD Genoa, Italy, Grade- Industrial Grade (99%).

In Q3 2025, Butyl Glycol prices in FD Italy decreased by 11.61%, following a 3.67% increase in Q2. The Butyl Glycol price trend in FD Italy was mainly influenced by weaker demand from the automotive and construction industries, which faced production slowdowns and economic uncertainty.

Additionally, higher import costs from Saudi Arabia and rising freight and feedstock prices, added downward pressure on prices. Butyl Glycol prices in September 2025 were lower compared to Q2. The outlook for the next quarter remains cautious, with potential for further declines unless demand from key sectors including automotive and construction recovers.

Brazil: Butyl Glycol Import prices CIF Santos, Brazil, Grade- Industrial Grade (99%).

In Q3 2025, Butyl Glycol prices in Brazil decreased by 4.98%, following a smaller decline of 2.07% in Q2. The Butyl Glycol price trend in Brazil was swayed by a slowdown in demand from the automotive and coatings industries, which faced reduced production and consumption. The depreciation of the Brazilian Real increased the cost of imports from Saudi Arabia, further adding to the price pressure.

Despite steady imports, logistics challenges and rising freight rates exacerbated price declines. Butyl Glycol prices in September 2025 were lower than in Q2. The outlook for Q4 2025 remains cautious, with price trends dependent on a recovery in the automotive and coatings sectors.

China: Butyl Glycol Import prices CIF Shanghai, China, Grade- Industrial Grade (99%).

In Q3 2025, Butyl Glycol prices in China decreased by 7.15%, following a 2.99% increase in Q2. The Butyl Glycol price trend in China was primarily driven by weak demand from the automotive and construction sectors, which faced production slowdowns. Rising raw material costs and logistical disruptions, especially from Saudi Arabia, also contributed to the price drop.

Despite stable domestic production, the weakened Chinese Yuan made imports more expensive, further pressing prices downward. Butyl Glycol prices in September 2025 were lower compared to Q2. The market outlook remains uncertain, with potential for further price declines depending on if demand from key industrial sectors recovers.

Turkey: Butyl Glycol Import prices CIF Mersin, Turkey, Grade- Industrial Grade (99%).

In Q3 2025, Butyl Glycol prices in Turkey went down by 6.55%, following a 2.56% increase in Q2. The Butyl Glycol price trend in Turkey was largely impacted by weak demand from the construction and chemical industries, which experienced slowdowns in production. Additionally, rising feedstock and import costs from Saudi Arabia, paired with currency fluctuations, added further downward pressure on prices.

Butyl Glycol prices in September 2025 were noticeably lower compared to Q2. The market outlook for the next quarter remains uncertain, with potential price fluctuations depending on the recovery of demand from key industrial sectors like construction and chemicals.

India: Butyl Glycol Import prices CIF Nhava Sheva, India, Grade- Industrial Grade (99%).

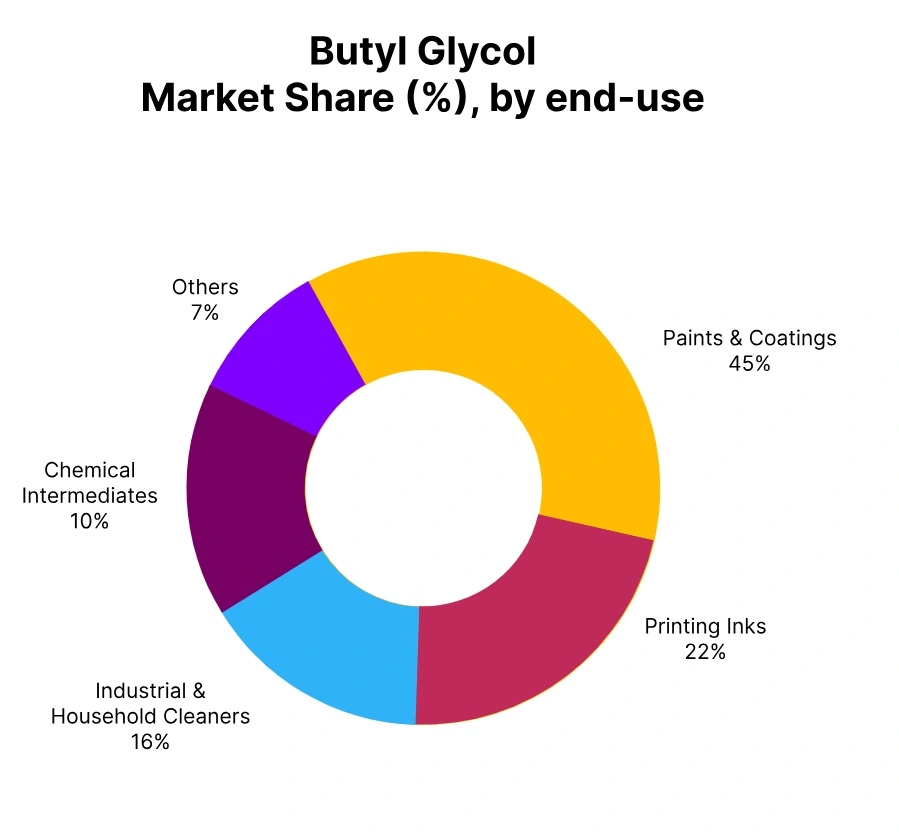

In Q3 2025, Butyl Glycol prices in India decreased by 6.67%, following a positive increase of 3.12% in Q2. The Butyl Glycol price trend in India was swayed by a slowdown in demand from key sectors such as paints and coatings, as production slowed. Despite steady imports from Saudi Arabia, logistical disruptions and rising feedstock costs placed downward pressure on prices.

The weakening of the Indian Rupee also increased import costs, contributing to the price decline. Ex-Mumbai Butyl Glycol prices showed a slight decline of 0.14%, following a slight drop of -0.37% in Q2. Butyl Glycol prices in September 2025 were lower compared to the previous quarter. The outlook for Q4 2025 remains cautious, with potential for price fluctuations depending on demand recovery in the manufacturing and coatings sectors.