Price-Watch’s most active coverage of Butyric Acid price assessment:

- 99.5% min Industrial Grade FOB Shanghai, China

- 99.5% min Industrial Grade CIF_Singapore China, Singapore

- 99.5% min Industrial Grade CIF_Callao China, Peru

- 99.5% min Industrial Grade CIF_JNPT China, India

- 99% min Industrial Grade FOB Houston, USA

- 99.5% min Industrial Grade FOB Gothenburg, Sweden

Butyric Acid Price Trend Q3 2025

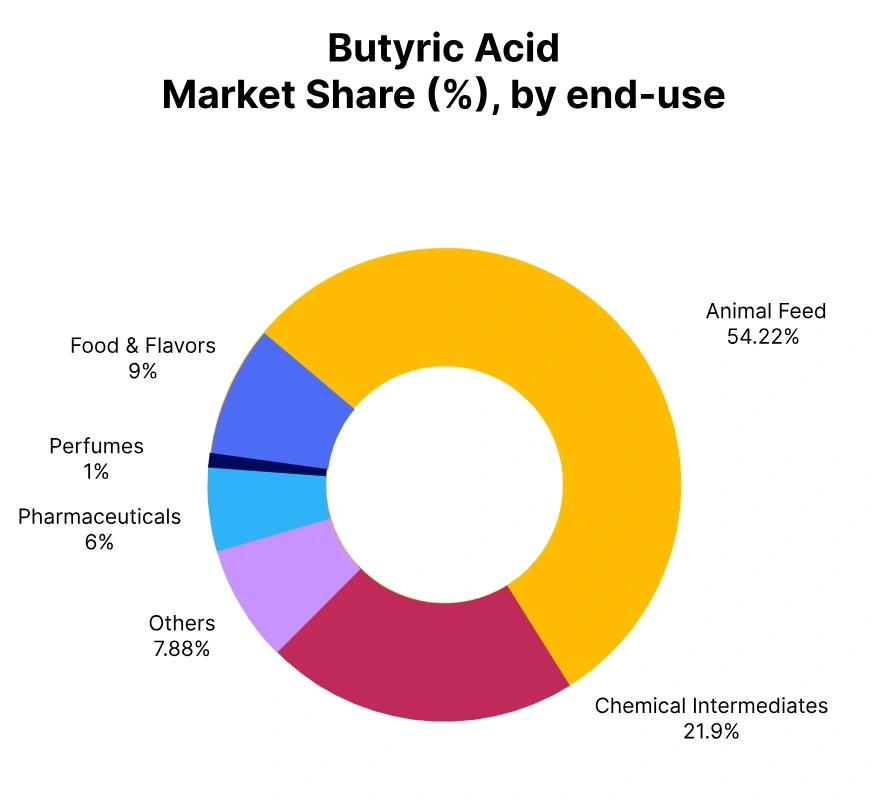

In the third quarter of 2025, Butyric Acid prices saw a mixed trend among the main markets. China, the USA, Sweden, Singapore, and Peru experienced price reductions owing to deteriorating demand from food and beverages, pharmaceuticals, and skincare and cosmetics, combined with logistics issues and an oversupplied market.

Conversely, Indian prices increased slightly due to mild recovery in food and pharmaceutical sectors. Besides mixed pricing, logistical delays and production slowdowns led the trend of Butyric Acid pricing to be volatile.

USA: Butyric Acid Export prices FOB Houston, USA, Grade 99.5 min Industrial Grade.

In Q3 2025, Butyric Acid prices in the USA decreased by 3.19%, following a more modest 0.42% drop in Q2. The Butyric Acid price trend in the USA was heavily influenced by reduced demand from the food and industrial sectors, both of which faced slow production cycles. A temporary shutdown in a major production facility also contributed to supply disruptions, leading to a tightening of available stocks.

The slowdown in consumer demand and the rising cost of imports from China further pressured prices. Butyric Acid prices in September 2025 reflected a notable decline from the previous levels in the US. Butyric acid prices are expected to remain under pressure unless there is a significant rebound in demand during Q4.

Sweden: Butyric Acid Export prices FOB Gothenburg, Sweden, Grade 99.5 min Industrial Grade.

According to PriceWatch, In Q3 2025, Butyric Acid prices in Sweden experienced a sharp decline of 4.92%, reversing the 4.72% increase seen in Q2. The Butyric Acid price trend in Sweden has been influenced by several factors, including a drop in demand from the pharmaceutical and cosmetics industries, which saw seasonal slowdowns. Additionally, supply disruptions due to a temporary shutdown of a key production plant further tightened supply.

The increased cost of raw materials and logistical challenges in Europe also contributed to the price drop. In Sweden, Butyric Acid prices in September 2025 have been lower compared to the previous month, reflecting the overall market downturn in Sweden. The market may remain volatile in the coming months, with the potential for further fluctuations depending on supply and demand conditions.

China: Butyric Acid Export prices FOB Shanghai, China, Grade 99.5 min Industrial Grade.

In the third quarter of 2025, butyric acid prices in China dropped slightly by 1.22%, following a decrease of 1.74% in the second quarter of 2025. The price trend of butyric acid in China has been heavily influenced by soft demand from both the domestic and international markets. Lower food and beverage consumption as well as softness in the fragrance sector resulted in lower-than-expected demand from final consumption customers.

Production issues and delays added to bearish sentiment. Despite challenges, though, import volumes remained constant, although excess stock availability kept prices rangebound. In September 2025, Butyric prices in China decreased by 0.55% in comparison to the previous month.

Singapore: Butyric Acid import prices CIF Singapore, Singapore, Grade- 99.5 min Industrial Grade.

Butyric acid prices in Singapore fell by 1.38% in Q3 2025, following a 2.39% decline in Q2. The decrease in Butyric acid price trend in Singapore has mainly been driven by sluggish demand from key end-use industries, such as food processing and pharmaceuticals, both of which have been affected by slow production cycles. Moreover, supply chain disruptions and increasing import costs, particularly from China, led to further downward pressure on prices.

Although imports remained consistent, oversupply conditions in the domestic market continued to limit any potential price recovery, and butyric acid prices in September 2025 remained lower than the previous month in Singapore.

Peru: Butyric Acid import prices CIF Callao, Peru, Grade- 99.5 min Industrial Grade.

In Q3 2025, Butyric Acid prices in Peru decreased by 1.45%, continuing the modest increase of 0.91% in Q2. In Peru, the butyric acid price trend has been influenced by less than expected demand in the food and beverage sector, as economic issues facing the region affected industrial activity. While imports from China have been stable, transport delays and rising raw material prices had a holding effect on pricing.

The Butyric acid market as a whole has been constrained by oversupply, which supported the price drop. Lastly, the Butyric Acid prices in September 2025 have been lower than the previous month’s prices in Peru. For Q4 2025, prospects for the Butyric Acid market will depend on the recovery of industrial demand and supply chain concerns.

India: Butyric Acid import prices CIF Nhava Sheva, India, Grade- 99.5 min Industrial Grade.

Butyric Acid prices in India increased by 0.73% in Q3 2025 after dropping by 3.48% in Q2. The price trend of Butyric Acid in India has been supported by a moderate recovery in demand from food and pharma activity in India. Nevertheless, subdued demand from other industries such as automotive and cosmetics limited the overall price increase for Butyric Acid in Q3 2025.

Although transportation costs remained elevated and logistics challenges persisted, imports from China flowed steadily and sufficed to limit the price fluctuations. In India, Butyric Acid prices in September 2025 have been slightly higher than August 2025 however pricing remained relatively stable overall and have been subject to moderate upwards pressure.