Price-Watch’s most active coverage of Calcium Carbonate (Limestone) price assessment:

- Grounded Calcium Carbonate (GCC) FOB Saigon, Vietnam

- Grounded Calcium Carbonate (GCC) FOB Klang, Malaysia

- Grounded Calcium Carbonate (GCC) FOB Shanghai, China

- Grounded Calcium Carbonate (GCC) FOB Antwerp, Belgium

Calcium Carbonate Price Trend Q3 2025

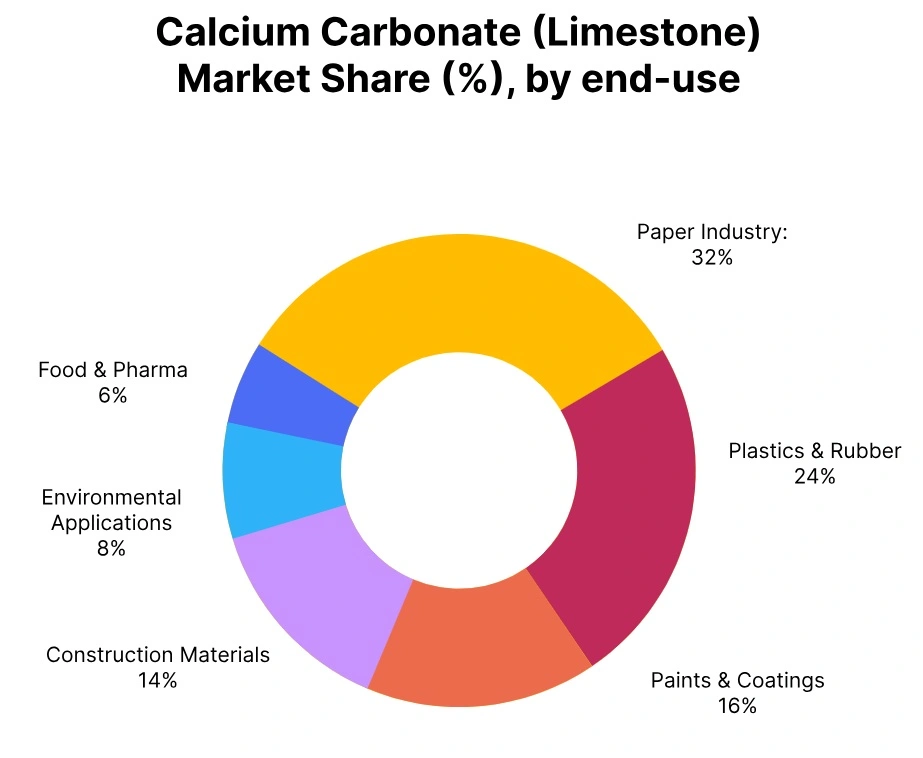

During Q3 2025, the Calcium Carbonate (Limestone) market demonstrated an upward trend, with overall prices increasing by approximately 2.98% during the July-September quarter. The increase has primarily been driven by increased demand from construction, paper, and plastics industry sectors, particularly in Asian markets including Vietnam, Malaysia, and China.

Increased activity in infrastructure and steady output from industrial manufacturing provided momentum for consumption levels. The European markets like Belgium, on the other hand, maintained steady pricing modalities due to supply and demand dynamics balanced with continued export activity.

Supply chain expenses and energy prices fluctuated moderately, however, strong orders received from downstream companies along with sustained industrial manufacturing activity supported positive price movements for the duration of the quarter.

Belgium: Calcium Carbonate Export prices, FOB Antwerp, Belgium, Grade Grounded calcium carbonate (GCC).

In Q3 2025, the calcium carbonate price trend in Belgium inclined by 1.78% compared to the previous quarter, supported by steady demand from the paper, plastics, and construction industries. Moderate growth in downstream consumption, particularly in the coatings and adhesives sectors, contributed to the price increase. Rising energy and transportation costs, along with stable domestic production, helped maintain a balanced supply-demand scenario.

Overall, the market exhibited a cautiously positive sentiment, with producers managing output to sustain price stability while meeting regional demand. Calcium carbonate prices in Belgium increased by 0.49% in September 2025, mainly supported by steady demand from the paper, plastics, and coatings industries amid moderate downstream activity. Stable domestic production alongside rising energy and transportation costs contributed to the mild upward price movement.

Malaysia: Calcium Carbonate Export prices, FOB Klang, Malaysia, Grade- Grounded calcium carbonate (GCC).

In Q3 2025, the calcium carbonate price trend in Malaysia inclined by 3.60% compared to the previous quarter, supported by consistent demand from the plastics, paints, and construction materials sectors. Improved industrial output and stable downstream consumption provided a firm foundation for the price rise.

Additionally, higher logistics and energy costs, along with moderate increases in raw limestone prices, exerted upward pressure on production costs. Export demand from neighbouring Southeast Asian countries also strengthened, helping maintain a steady and optimistic market sentiment throughout the quarter.

Calcium carbonate prices in Malaysia inclined by 1.23% in September 2025, primarily driven by sustained demand from the plastics, paper, and construction industries as downstream activity remained steady. Limited domestic supply and rising logistics costs further supported price firmness, while moderate export inquiries from the ASEAN region added additional momentum.

China: Calcium Carbonate Export prices FOB Shanghai, China, Grade- Grounded calcium carbonate (GCC).

According to PriceWatch, In Q3 2025, the calcium carbonate price trend in China increased by 2.87% as compared to the last quarter, underpinned by consistent demand from the paper, plastics, and construction industries. Modest levels of industrial activity and increased end-use sector consumption of paints and coatings served as positive factors for the upward price trend.

At the same time, rising energy and transportation prices and sustained limestone feedstock prices contributed to overall price cost pressures. The producers operated at plans of moderate capacity utilization levels to match estimated supply with demand in the market, which translated into a stable yet mildly upward price trend over the course of the quarter.

Prices for Calcium Carbonate in China moved upward by 0.99% in September 2025, and underpinned by continuous demand from the paper, plastics, and construction industries. Improved downstream sector activity and steady input costs supported the slight upward price increase witnessed in September and were reflective of stable consumption patterns in the industrial sector, with both sales and prices remaining consistent during the month.

Vietnam: Calcium Carbonate Export prices, FOB Saigon, Vietnam, Grade- Grounded calcium carbonate (GCC).

In Q3 2025, the calcium carbonate price trend in Vietnam increased by 3.69% versus Q2 2025, supported by robust demand from various sectors including paper manufacturing, plastics, and construction. The increase has been further supported by an improvement in downstream consumption to markets in the region, namely China and Malaysia which then subsequently enhanced export activity in Vietnam.

Rising production and logistics costs, especially energy and processed limestone, also contributed to higher pricing. Producers kept a steady output during the quarter to satisfy domestic demand while supplying international markets, fostering a strong and bullish market outlook throughout the quarter.

In September 2025, Calcium Carbonate prices in Vietnam increased by 1.26%, mainly driven by improved demand from the construction, paper and plastics sector, as manufacturing activity remained strong. Limited supply from key domestic suppliers and escalated transportation and energy costs also assisted in the upward price. Additionally demand in the export markets in neighboring Southeast Asia provided local producers additional support.