Price-Watch’s most active coverage of Calcium Chloride price assessment:

- IG Prills 94% Purity FOB Nhava Sheva, India

- IG Prills 94% Purity CIF Laem Chabang_ Nhava Sheva, Thailand

- IG Prills 94% Purity CIF APAPA_ Nhava Sheva, Nigeria

- IG Prills 94% Purity CIF Houston_ Nhava Sheva, USA

- IG Prills 94% Purity CIF Sydney_Nhava Sheva, Australia

Calcium Chloride Price Trend Q3 2025

In Q3 2025, the global Calcium Chloride market showed moderate stability with regional variations. The Calcium Chloride price trend fluctuated sharply during the July-September 2025 quarter, driven by consistent feedstock costs, energy prices, and regional supply chain dynamics.

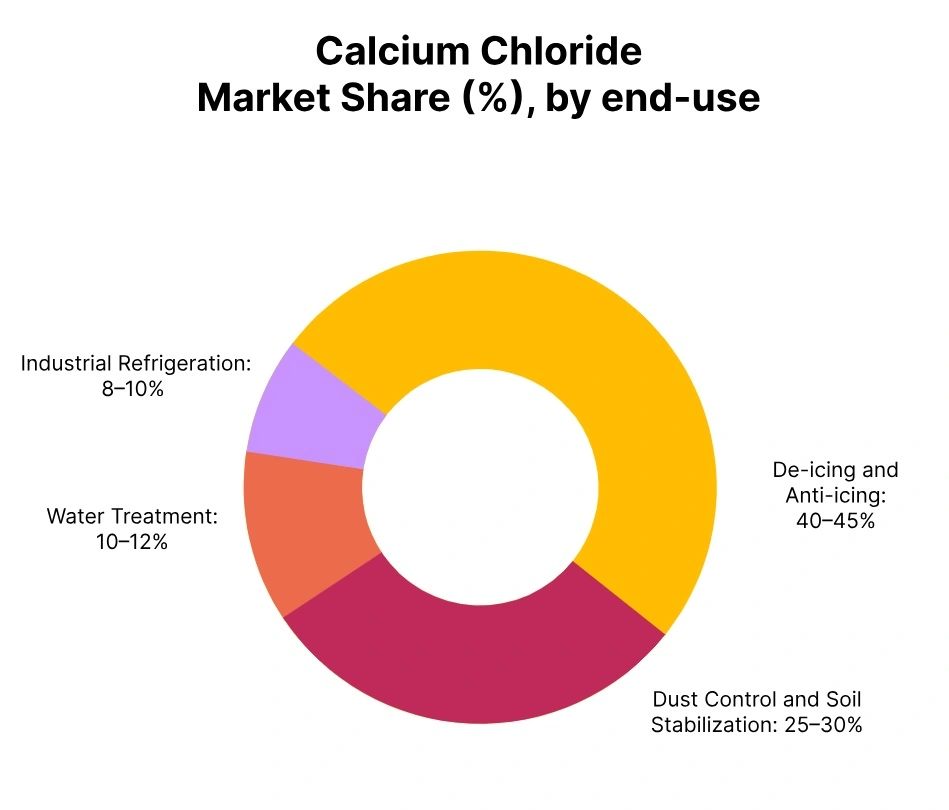

Despite some fluctuations in upstream factors, robust demand from industries such as construction and road de-icing helped maintain price stability. Ongoing expansions in production capacity and adjustments in supply chains are expected to keep prices stable in the coming quarter.

USA: Calcium Chloride Import prices CIF Houston, USA, Grade: Industrial Grade 94% purity.

In September 2025 ending quarter, Calcium Chloride price in the USA increased by approximately 2.39%, largely driven by rising import costs from key supply sources. The Calcium Chloride price trend in the USA mirrored the global market’s price hike, influenced by supply constraints, steady demand from industries such as construction, de-icing, and water treatment, and elevated logistics costs. This upward price momentum in the US has been transmitted to the US market, where buyers faced higher landed costs due to both increased export prices and rising freight charges.

Additionally, stable demand in the USA, combined with limited availability from alternative sources, helped support the price increase. The marginal depreciation of the US dollar also contributed to raising the effective import cost when priced in local currency. Looking ahead, while supply conditions may stabilize and freight rates ease, strong seasonal demand could continue to keep Calcium Chloride Prills prices in the USA elevated in the short term.

Australia: Calcium Chloride Import prices CIF Sydney, Australia, Grade: Industrial Grade 94% purity.

In Q3 2025, Australia experienced an increase in the cost of Calcium Chloride Prills of approximately 12.20%, as import prices from key supply sources had increased. The Calcium Chloride price trend in Australia nominally reflected a notable global price increase as associated with Northeast markets, driven by supply constraints, demand from industries, such as construction, de-icing and water treatment, spelt high costs of logistics and the cost of supply. These same trends have been evident in the Australian market, where buyers saw higher landed costs, since export prices had additionally increased, as had freight charges.

Given that established markets around the globe may revert to normal supply conditions and pressure on freight rates may ease, seasonality and lack of alternatives to Calcium Chloride Prills may still support higher prices in Australia in the coming quarter. Similarly, in line with that increase, the Calcium Chloride price in Australia, in September of 2025 ramped up by the higher amount of 16.91%.

India: Calcium Chloride Export prices FOB Nhava Sheva, India, Grade: Industrial Grade 94% purity.

According to Price-Watch, in the third quarter of 2025, the Calcium Chloride price trend in India rose by about 3.05%, indicating moderate stability in pricing in a relatively stable market. Factors that contributed to the stable Calcium Chloride price trend in India included steady and consistent feedstock costs as well as stable energy prices. The stability of different supply chains in the region and continued stable demand from key end-use sectors such as construction, de-icing, and oilfield chemicals, helped support stable pricing.

Fluctuations with some upstream raw material pricing have taken place, yet continued improvements in production capacity and logistical enhancements helped stabilize pricing. Overall, all indications suggest that Calcium Chloride price stability in India will remain for the fourth quarter of 2025. In September 2025, the Calcium Chloride price trend in India rose by 6.96%, reflecting a notable uptick, likely driven by seasonal demand and supply adjustments in response to heightened requirements during peak use periods.

Thailand: Calcium Chloride Import prices CIF Laem Chabang, Thailand, Grade: Industrial Grade 94% purity.

In the third quarter of 2025, the Calcium Chloride Prills price in Thailand went up by about 0.78%, primarily due to increased landed costs from its main supply regions. The Calcium Chloride price trend in Thailand is symptomatic of the increase in pricing across the global market, which has been largely driven by supply deficiencies, demand from construction, de-icing, water treatment and related industries in addition to upward pressure on logistics from significant export manufacturers.

This pricing pressure translated into Thailand with increases in both landed costs as a result of increased export pricing pressure and increases in freight costs. There has also been stable end-user demand within Thailand and limited substitutions available from other regional suppliers which provided additional support for commodity prices. The slight depreciation of the Thai Baht also increased the effective cost of importing the product as measured in Thai Baht.

Looking ahead, while supply conditions may recover to reflect the existing availability and freight costs may stabilize, seasonal demand could very well lead to elevated calcium chloride price trends in the Thai marketplace temporarily. In September 2025, Calcium Chloride prices in Thailand increased by 5.74%, reflecting a sharp increase in price due to tightened supply and late demand surge in that quarter.

Nigeria: Calcium Chloride Import prices CIF Apapa, Nigeria, Grade: Industrial Grade 94% purity.

In Q3 2025, Calcium Chloride Prills price in Nigeria decreased by approximately 2.09%, largely influenced by lower import costs from key supply sources. The Calcium Chloride price trends in Nigeria mirrored the global market’s price decline, driven by easing supply constraints, stable demand from industries such as construction, de-icing, and water treatment, and more manageable logistics costs.

This decrease in price has been passed onto the Nigerian market, where buyers benefitted from lower landed costs due to reduced export prices and more favorable freight rates. Additionally, stable demand in Nigeria and increased availability from alternative sources contributed to the price decrease. The appreciation of the Nigerian naira also helped mitigate the impact of import costs when priced in local currency.

Looking ahead, if global supply conditions remain stable and freight rates continue to ease, Calcium Chloride Prills prices in Nigeria may stabilize, although short-term demand fluctuations could still influence pricing. In September 2025, the Calcium Chloride price trend in Nigeria rose by 3.31%, reflecting a slight rebound, likely driven by temporary demand increases or supply chain adjustments following the earlier price dip.