Price-Watch’s most active coverage of Calcium Formate price assessment:

- Industrial Grade(98% min purity) FOB Shanghai, China

- Industrial Grade(98% min purity) CIF JNPT_China, India

- Industrial Grade(98% min purity) CIF Santos_China, Brazil

- Industrial Grade(98% min purity) CIF Jakarta_China, Indonesia

- Industrial Grade(98% min purity) CIF Manila_China, Philippines

- Industrial Grade(98% min purity) CIF Mersin_China, Turkey

- Industrial Grade(98% min purity) CIF Haiphong_China, Vietnam

- Industrial Grade(98% min purity) CIF Buenos Aires_China, Argentina

- Industrial Grade(98% min purity) CIF Houston_China, USA

Calcium Formate Price Trend Q3 2025

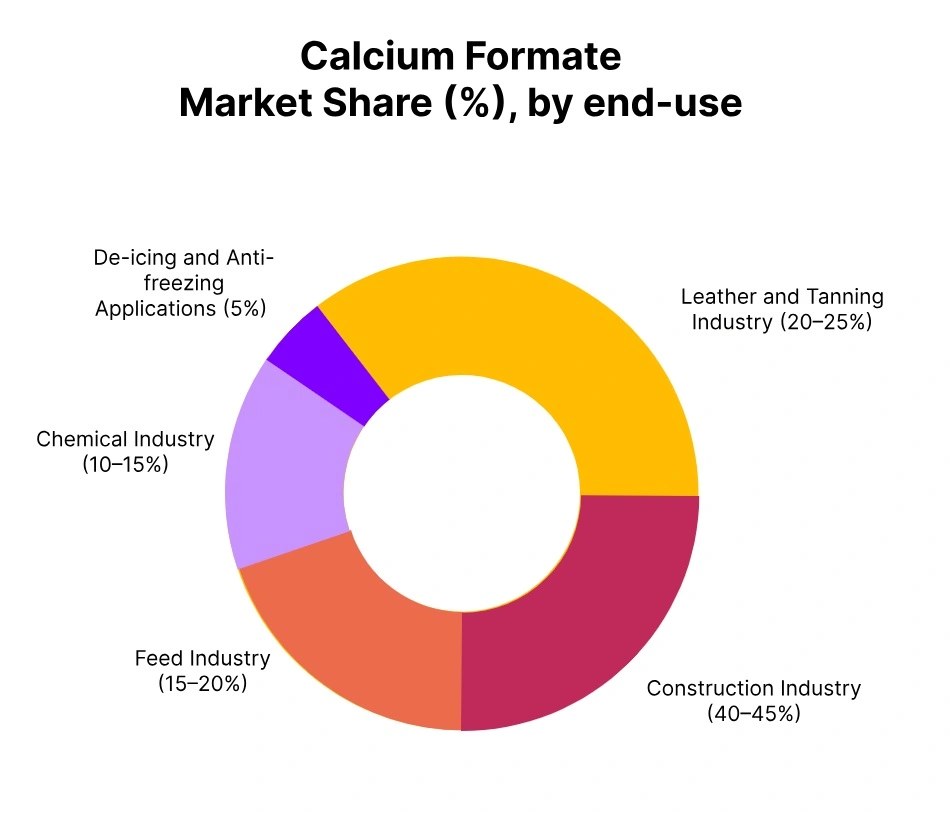

The global Calcium Formate market saw an indication of decline in Q3 2025, with prices declining around 8–12%. Calcium Formate price decline was attributed largely to weaker demand from major end-use sectors such as construction, dry-mixed mortars, and animal feed, as well as favorable supply conditions from key producing regions such as China.

While production levels remained unchanged, high inventory levels in several markets and a lack of urgency in purchasing distributors and end-users put further downward pressure on pricing. A slow recovery in downstream consumption and a balanced supply-demand environment should help stabilize the market in the coming months.

China: Calcium Formate Export prices FOB Shanghai, China, Grade- Industrial Grade (98% min purity).

According to Price-Watch, in Q3 2025, Calcium Formate FOB prices in China were on a clear downward trajectory, with pricing in the month of September 2025 sitting between USD 400-500/MT. Calcium Formate price trend across the quarter was driven by healthy production levels occurring in major manufacturing regions in China, alongside subdued demand from downstream customer sectors like construction, dry-mixed mortars, and animal feed.

Despite slight shifts in feedstock costs for formic acid and lime, this had a minimal impact on pricing, as significant inventory levels in key markets dampened sentiment. Overall, pricing for Calcium Formate in China followed this trend, with prudent buying from domestic and international buying participants contributing to price reductions. A stable feedstock conditions combined with moderate linear demand recovery downstream supports some mild stabilization of Calcium Formate pricing in China entering Q4.

India: Calcium Formate import prices CIF JNPT, India, Grade- Industrial Grade (98% min purity).

According to Price-Watch, in the third quarter of 2025, India’s market for Calcium Formate CIF imports exhibited soft market patterns, largely driven by the overall decline in Calcium Formate prices originating from China. The decline in Calcium Formate price trend was attributed to ongoing production at major Chinese production hubs and weaker demand from downstream sectors, namely construction, dry-mixed mortars, and animal feeds.

Trading range prices for Calcium Formate CIF imports were USD 470–550/MT in September 2025, and freight movements and available inventories had some moderate upward effects on price moderation. Overall, it was clear that caution underpinned the Calcium Formate price trend across India on account of cautious buying and sufficient levels of availability, with continued steady supply from China and balanced downstream demand expected to bring mild stability over the next couple of months.

Brazil: Calcium Formate import prices CIF Santos, Brazil, Grade- Industrial Grade (98% min purity).

Calcium Formate CIF imports into Brazil showed soft market sentiment in Q3 2025, due to the falling FOB price trend from China. Calcium Formate price movement was impacted by steady production levels from major Chinese production hubs along with weaker offtake from end-use markets, including construction, dry-mixed mortars, and animal feed.

Import price levels for Calcium Formate ranged from USD 550–650/MT in September 2025, with freight, inventory, and shipping schedules impacting the overall price moderation. Domestic market levels in Brazil followed suit with soft conditions as demand remained muted and distributors were staying well stocked.

Indonesia: Calcium Formate import prices CIF Jakarta, Indonesia, Grade- Industrial Grade (98% min purity).

In the third quarter of 2025, the Calcium Formate CIF import price for Indonesia witnessed a softer set of market circumstances, which was largely driven by the overall downward trends in CIF price originating from China.

Calcium Formate price trend back toward China were influenced by steady production in the prominent Chinese manufacturing regions alongside lagging demand coming from construction, dry-mixed mortars, and animal feed markets.

CIF import price ranges for Calcium Formate as of September 2025 were in the range of USD 450–550/MT, with freight rates, inventory levels, and shipping times coinciding with moderate price rounding. Domestic market conditions in Indonesia were similar in their softness, with buyers cautious of purchasing products, and distributors featuring sustainable inventories.

Philippines: Calcium Formate import prices CIF Manila, Philippines, Grade- Industrial Grade (98% min purity).

In Q3 2025, imports of Calcium Formate on a CIF basis to the Philippines were indicative of a soft market by there being a lack of price support from the declining FOB price trend stemming from China. Calcium Formate price trend was driven by the steady production from numerous Chinese manufacturing facilities and recessed demand from key areas such as Construction, Dry-Mixed Mortars, and Animal Feeds.

CIF import price of Calcium Foramte levels in September 2025 ranged between USD 450-550/MT with upward price moderation being contributed by elevated ocean freight, inventory levels, and moderate shipping schedules. In the domestic market, similar levels of price softness can be seen with buyers remaining underwhelmed and distributors holding reasonable inventories.

Turkey: Calcium Formate import prices CIF Mersin, Turkey, Grade- Industrial Grade (98% min purity).

During the third quarter of 2025, the Turkish market for imports of Calcium Formate CIF continued to show signs of a soft market, buoyed largely by the lower FOB price trend from China. Calcium Formate price trend was driven by consistent production from Chinese production hubs and reduced demand from various downstream sectors such as construction, dry-mixed mortars, and animal feed.

Calcium Formate import prices in September 2025 ranged from USD 500–650/MT, with freight costs, inventory levels, and calendar queues all contributing to moderate price softening. Even the domestic market in Turkey mirrored this softness, as buyers were cautious and distributors held ample stocks.

Vietnam: Calcium Formate import prices CIF Haiphong, Vietnam, Grade- Industrial Grade (98% min purity).

In the third quarter of 2025, Vietnam’s Calcium Formate CIF imports demonstrated a weak market outlook, which was a result of the softening FOB price trend from China. The Calcium Formate price trend was influenced by strong production at several large production centers in China and weak downstream demand in construction, dry-mixed mortars, and animal feed.

In September 2025, the import prices of Calcium Formate were in the range of USD 450–550/MT, with transportation, inventory level, and shipment having a moderating influence. The domestic market in Vietnam also demonstrated similar weakness as buyers remained cautious and distributors were generally well stocked.

Argentina: Calcium Formate import prices CIF Buenos Aires, Argentina, Grade- Industrial Grade (98% min purity).

Imports of Calcium Formate CIF into Argentina in Q3 2025 showed evidence of a weak market sentiment primarily due to lowering FOB price trends from China. Calcium Formate price trend was dictated by steady production from major Chinese manufacturers as well as softer demand from downstream sectors such as construction, dry-mixed mortars, and animal feed.

Pricing for Calcium Formate imports in Argentina was at USD 550-650/MT in September 2025, and freight charges, as well as inventory levels and scheduling for shipments, were contributing factors for the moderation of prices. Domestic market conditions in Argentina exhibited a similar softness as buyers held back and distributors had adequate stocks.

USA: Calcium Formate import prices CIF Houston, USA, Grade- Industrial Grade (98% min purity).

The USA’s Calcium Formate CIF imports saw weaker market conditions in Q3 2025, driven primarily by the lower FOB price trend from China. Calcium Formate price trend in China was driven by steady production levels in many of the key manufacturing regions and the continued softening of downstream demand from the construction sector, dry-mixed mortars, and the animal feed industry.

Import prices for Calcium Formate averaged USD 550-650 per MT during the month of September 2025, with freight, stock levels, and shipping schedules contributing to steady price moderation. Similar market conditions were seen domestically in the USA, as consumers remained cautious while distributors had significant stocks.