Price-Watch’s most active coverage of Carbon Fibre price assessment:

- Industrial Grade Fibre Standard Modulus Tow (12K) FOB Busan, South Korea

- Industrial Grade Fibre Standard Modulus Tow (12K) CIF Port Klang (South Korea), Malaysia

- Industrial Grade Fibre Standard Modulus Tow (12K) CIF Nhavasheva (South Korea), India

- Industrial Grade Fiber Standard Modulus Continuous Tow 50K (Epoxy-Compatible) FOB Manzanillo, Mexico

- Industrial Grade Fiber Standard Modulus Continuous Tow 50K (Epoxy-Compatible) CIF Mersin (Mexico), Turkey

- Industrial Grade Fiber Standard Modulus Continuous Tow 50K (Epoxy-Compatible) CIF Nhavasheva (Mexico), India

Carbon Fibre Price Trend Q3 2025

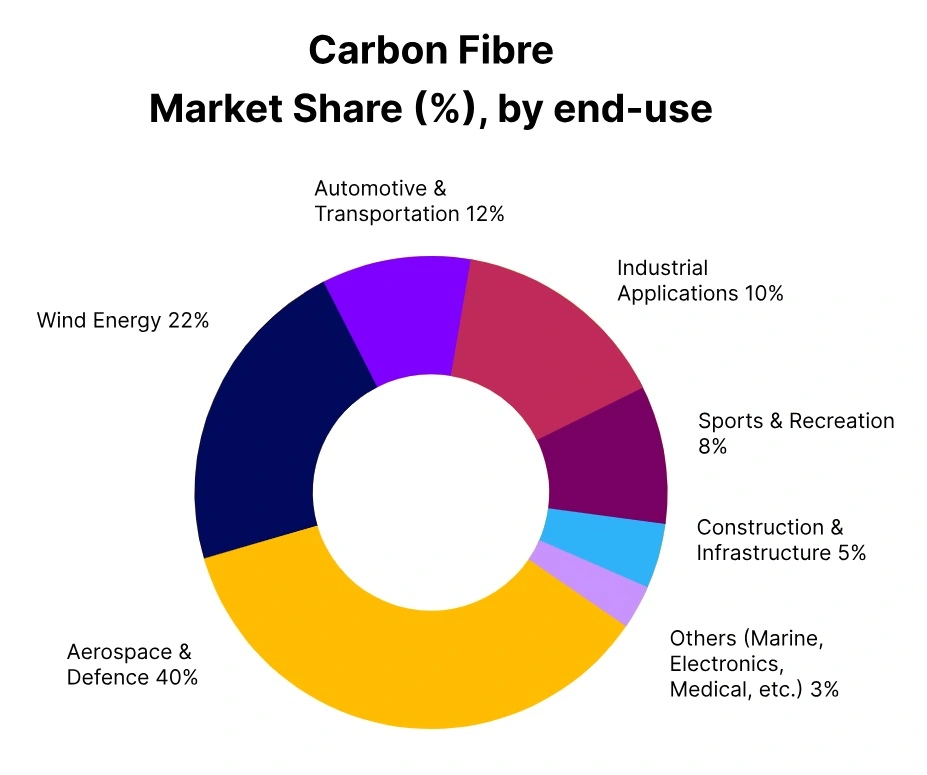

In Q3 2025, the global market for industrial-grade, standard modulus carbon fibre continuous tow has been experiencing a moderate correction across major regions. In Mexico, Carbon Fibre price trends have softened amid subdued activity in wind-energy and industrial composite sectors, while supply has remained stable. Turkey has seen a decline with easing prices reflecting slightly weaker demand in automotive and industrial applications.

In India, Carbon Fibre prices have been under pressure due to muted domestic demand and cautious liquidity management, though supply chains have remained steady. Overall, the market is navigating a consolidation phase, characterized by measured price adjustments, stable availability, and cautious inventory management, with short-term trends expected to remain balanced.

Mexico: Carbon Fibre Industrial Grade Fiber Standard Modulus Continuous Tow 50K (Epoxy-Compatible) FOB Manzanillo Grade Price Trend.

In Q3 2025, Carbon fibre continuous tow in Mexico has been declining, averaging around USD 14635/MT, down about 2.4% from the previous quarter. The drop has been driven by slower activity in wind-energy and industrial composite sectors, along with cautious buyer restocking. Supply has been stable, supported by steady production and capacity expansions, keeping availability adequate.

Carbon Fibre price trend continuous Tow 50K in Mexico have decreased by 4% in September 2025, while raw material and energy costs have remained stable, and international competition has been adding pressure on prices. Buyers have been deferring long-term orders amid uncertainty. Overall, the market has been in a consolidation phase, awaiting demand recovery in the coming months.

Tukey: Carbon Fibre Industrial Grade Fiber Standard Modulus Continuous Tow 50K (Epoxy-Compatible) CIF Mersin (Mexico) Grade Price Trend.

In Q3 2025, Turkey has been experiencing a 2% decline in CIF imports of carbon fibre continuous tow from Mexico compared to the previous quarter, reflecting a slight softening in demand from the automotive and industrial sectors. Carbon Fibre price trend continuous Tow 50K in Turkey have been falling by 4% in September 2025, easing procurement costs for buyers.

Supply has been remaining sufficient, ensuring stable market availability despite the reduction in import volumes. The market has been adjusting gradually as manufacturers have been managing inventories cautiously and moderating end-user consumption. Overall, the quarter has been showing a moderate market correction, with short-term stability expected to continue.

India: Carbon Fibre Industrial Grade Fiber Standard Modulus Continuous Tow 50K (Epoxy-Compatible) CIF Nhava Sheva (Mexico) Grade Price Trend.

In Q3 2025, India’s continuous‑tow carbon fibre market has been experiencing a quarter-on-quarter decline of around 2%, primarily due to subdued domestic demand and limited liquidity among downstream users. The 50K grade has been most impacted, with Carbon Fibre price trend falling by approximately 4% in September 2025 to the range of USD 14100–14200/MT, reflecting ongoing cost adjustments ahead of a potential demand rebound. Supply chain conditions have remained relatively stable, preventing any significant shortages despite the softening in prices.

Manufacturers have been exercising caution in managing inventories, responding to uncertainty in key end-use sectors such as automotive components and wind-turbine blade production. Overall, the market is undergoing a moderate correction, with short-term conditions expected to remain steady rather than volatile.

South Korea: Carbon Fibre Industrial Grade Fibre Standard Modulus Tow (12K) FOB Busan Grade Price Trend

In Q3 2025, South Korea’s carbon-fibre market has been experiencing a modest recovery, with prices for 12K grade material having been improving by around 4% quarter-on-quarter to reach about 20620 USD/MT. Demand has been strengthening from hydrogen-fuel tank manufacturing, EV lightweighting, and wind-energy components, helping stabilize overall sentiment after a subdued first half.

In September 2025, however, Carbon Fibre price trends have been slipping by roughly 2% compared with August, reflecting temporary softness in monthly procurement and cautious inventory management among downstream converters. Despite persistent competition from low-cost suppliers, stable aerospace and industrial applications have been supporting a gradual normalization of prices through the quarter.

Malaysia: Carbon Fibre Industrial Grade Fibre Standard Modulus Tow (12K) CIF Port Klang (South Korea) Grade Price Trend

According to Price-Watch, In Q3 2025, Malaysia’s imported prices for 12K grade carbon fibre have been showing a steady upward trend, having increased by around 4% quarter-on-quarter to reach about 20760 USD/MT (CIF Port Klang). Demand from industrial composites, pressure-vessel producers, and auto-component manufacturers has been remaining firm throughout the quarter, supporting the overall improvement.

However, in September 2025, Carbon Fibre price trends have been declining by around 2% from August, as buyers have been adjusting inventories and moderating their monthly procurement. Overall, Malaysia’s imported 12K market has been demonstrating greater stability, with demand and import activity continuing to strengthen over the quarter.