Price-Watch’s most active coverage of Caustic Soda price assessment:

- Flakes, >97% (Industrial Grade) Ex-Bharuch, India

- Lye (48-50%) Ex-Bharuch, India

- Flakes, >97% (Industrial Grade) FOB Qingdao, China

- Lye (48-50%) FOB Qingdao, China

- Lye (32%) FOB Qingdao, China

- Lye FOB Yokohama, Japan

- Flakes, >97% (Industrial Grade) FOB Jeddah, Saudi Arabia

- Flakes, >97% (Industrial Grade) FOB Jebel Ali , United Arab Emirates

- Lye FOB Houston, USA

- Lye (48-50%) CIF Sydney (China), Australia

- Lye CIF Santos (USA), Brazil

- Lye CIF Manzanillo (USA), Mexico

- Flakes, >97% (Industrial Grade) Ex-West India, India

- Lye (48-50%) Ex-West India, India

- Flakes, >97% (Industrial Grade) Ex-North India, India

- Lye (48-50%) Ex-North India, India

- Flakes, >97% (Industrial Grade) Ex-East India, India

- Lye (48-50%) Ex-East India, India

- Flakes, >97% (Industrial Grade) Ex-Chennai, India

- Lye (48-50%) Ex-Chennai, India

- Flakes, >97% (Industrial Grade) Ex-South India, India

- Lye (48-50%) Ex-South India, India

- Flakes, >97% (Industrial Grade) Ex-Ranchi, India

- Lye (48-50%) Ex-Ranchi, India

- Flakes, >97% (Industrial Grade) FOB Chittagong, Bangladesh

- Lye FD Hamburg, Germany

Caustic Soda Price Trend Q3 2025

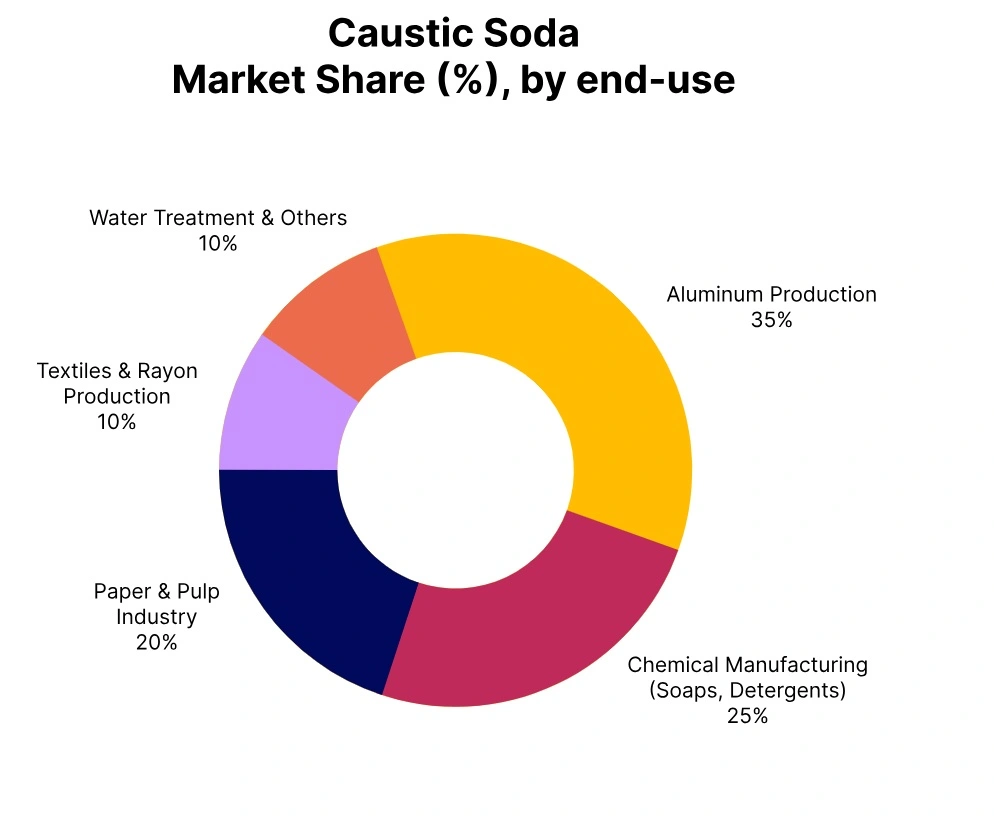

In Q3 2025, the global Caustic Soda market saw moderate fluctuations across regions, with price variations generally within the 8%–12% band, reflecting shifts in energy costs, raw material inputs, and trade flows. Regions with constrained supply or high shipping costs registered more volatility, while established producing hubs maintained relative price stability.

Demand from Alumina, Pulp & Paper, chemical, and cleaning sectors remained solid, providing a steady base. Trade policies, currency movements, and logistical constraints (e.g. container rates, port congestion) also influenced regional price spreads. Overall, despite localized volatility, the Caustic Soda market retained a broadly balanced demand–supply posture through Q3.

Germany: Domestically Traded Caustic Soda price in Hamburg, Germany, Lye.

According to Price-Watch, in Q3 2025, the Caustic Soda price trend in Germany showed a corrective movement as margin pressures and inflation-driven cost resistance limited pricing flexibility. Caustic Soda prices in Germany ranged between USD 430 to 490 per tonne, down by 6.60%. European industrial demand from pulp, cleaning, and chemicals remained steady but price sensitive.

Rising electricity and gas prices in Germany put pressure on local producers, who struggled to pass on costs amid a competitive import landscape. Buyers, expecting softening global prices, delayed bulk orders. Some opted for imports over domestic supply, especially from North Africa and the Middle East.

Cautious forward buying prevailed, with participants maintaining conservative procurement strategies amid restrained sentiment in the regional chemical market. In Q3 September 2025, the Caustic Soda prices in Germany displayed a mildly positive tone as improved downstream activity and seasonal demand supported sentiment. However, margin constraints and inflation-driven caution kept sellers conservative, limiting the extent of any upward momentum.

USA: Caustic Soda Export price from Houston, USA, Lye.

According to Price-Watch, in Q3 2025, the Caustic Soda price trend USA witnessed a moderate decline, reflecting cautious competitive dynamics rather than a collapse in demand. Caustic Soda prices in USA are ranged between USD 430 to 490 per ton, down 1.41 % from previous quarter. U.S. demand from pulp, cleaning, and industrial sectors remained steady yet competitive imports pressured pricing.

Rising energy and transport costs squeezed margins, especially for producers shipping further inland. Inventory levels held up, giving buyers leverage. Some exporters offered discounts to maintain volumes.

In Q3 September 2025, the Caustic Soda prices in the USA experienced a steady tone as moderate gains early in the month, supported by seasonal downstream demand, gradually eased while sentiment remained cautious amid balanced supply and competitive market dynamics.

Australia: Caustic Soda Import price in Sydney, Australia from China, Lye (Purity: 48-50%).

In Q3 2025, the Caustic Soda price trend in Australia showed a sharp upward movement as restricted regional supply and firm demand from mining and chemical sectors tightened availability. Freight rates increased for Caustic Soda imports into Australia from China (CIF Sydney), with prices trading between USD 315 to 355 per metric ton, marking a sharp +12.93% rise.

Elevated shipping costs and limited sourcing options reduced buyer flexibility, while Chinese exporters leveraged conditions to raise offers, compelling importers to absorb higher costs amid a pronounced supply squeeze. This pronounced price rise highlights a clear supply squeeze in the Australian market.

In Q3 September 2025, the Caustic Soda prices in Australia recorded an upward trajectory as constrained regional supply and firm demand, combined with elevated freight costs and logistical challenges, supported stronger sentiment while buying remained cautious amid limited sourcing flexibility and higher import costs.

India: Domestically Traded Caustic Soda price in Bharuch, India, Flakes (Purity: >97%) (Industrial Grade).

In Q3 2025, the Caustic Soda price trend in India faced downward pressure due to tightened margins and increased market competition. Caustic Soda prices in India range from USD 475 to 540 per tonne, marking a decline of 5.64 %. Domestic demand from alumina and chemical industries has been stable but faced weaker export competitiveness due to regional overcapacity.

Rising power costs and logistics charges squeezed margins, and some local producers curtailed output. Though feedstock salt and input electricity remained relatively stable. Price softness in this region suggests cautious sentiment among buyers and sellers alike.

In Q3 September 2025, the Caustic Soda market prices showed gradual recovery after early weakness. Improved downstream demand and controlled inventory releases supported price stability. Sellers avoided aggressive discounting, though overall sentiment remained cautious amid fragile market conditions and sensitive supply-demand dynamics.

China: Caustic Soda Export price from Qingdao, China, Flakes (Purity: >97%) (Industrial Grade).

In Q3 2025, the Caustic Soda price trend in China declined due to competitive pressures in export markets and cautious buyer negotiations. However, stable upstream input costs helped limit the extent of the decrease. Caustic Soda prices in China ranged USD 415 to 465 per tonne, down 4.70 %. Chinese export pressures and regional overcapacity weighed on price.

Local demand from chemical, metallurgical, and pulp industries has been stable, but export margins tightened given freight and energy costs. Some coastal producers reduced loadings to preserve margins. In Q3 September 2025, the Caustic Soda price in China showed mixed trends.

Early in the month, increased supply led to slight upward pressure on prices. However, as the month progressed, pricing turned cautious due to steady supply availability. Shifts in demand, supply conditions, and feedstock movement influenced market behaviour. Overall, sentiment remained guarded throughout the period.

Japan: Caustic Soda Export price from Yokohama, Japan, Lye.

In Q3 2025, Caustic Soda prices in Japan ranged USD 375 to 410 per tonne, with prices down 4.62 %. Japanese import demand softened, partly due to slowdowns in downstream chemical and pulp sectors. Domestic capacity and alternative suppliers competed aggressively. Higher freight and restricted shipping slots added cost headwinds.

Caustic Soda price trend in China declined amid competitive export market pressures and cautious buyer negotiations. In Japan, buyers leveraged weakened demand to seek price concessions. Although input cost pressures persisted, they have been insufficient to counterbalance the demand slump, reflecting tight margins and cautious sentiment in the lye market.

In Q3 September 2025, Japan’s Caustic Soda prices saw cautious optimism. Early supply chain constraints supported firmer sentiment, but buyers used weak demand to seek concessions. Despite input cost pressures, tight margins and fragile stability kept overall market conditions guarded and conservative.

Bangladesh: Caustic Soda Export price from Chittagong, Bangladesh, Flakes (Purity: >97%) (Industrial Grade).

In Q3 2025, The caustic soda price trend in Bangladesh had slightly moved downward, since buyers have been experiencing financial pressures, increasing price sensitivity and buying cautiously. The market has been functioning but remained under pressure with limited ability to aggressively restock or buy forward. The price of Caustic Soda in Bangladesh ranged between USD 460-520 per tonne, down by 8.25%.

Although the local operational requirement for the textile and detergent industries remained stable, low foreign exchange allocations and a weaker taka limited the volume of imports. Port charges and freight rates remained high, which further inflated landed costs. Exporters offered discounts to clear their cargo as a result of cautious buying.

In Q3 September 2025, the Caustic Soda prices in Bangladesh showed a weakening trend as financial limitations among buyers and reduced industrial demand subdued market activity. Surplus domestic output and limited downstream offtake further weighed on overall sentiment throughout the period.

Saudi Arabia: Caustic Soda Export price from Jeddah, Saudi Arabia, Flakes (Purity: >97%) (Industrial Grade).

In Q3 2025, the Caustic Soda price trend in Saudi Arabia showed a modest rise, reflecting balanced market conditions where neither buyers nor sellers exerted strong pressure. Caustic Soda prices in Saudi Arabia are sold in the USD 500 to 560 range per tonne, edging up 0.23 %.

Regional Middle East demand, especially for desalination and chemical sectors, provided a steady base. Some exporters facing port congestion or shipping delays held firm on margins. Feedstock availability has been adequate, and energy costs remained favorable in the region, supporting stability.

In Q3 September 2025, Saudi Arabia’s Caustic Soda prices saw modest upward pressure early due to increased downstream activity and harvest season. This positive momentum continued, but buying interest remained limited as market balance kept sentiment cautious yet steady throughout the month.

UAE: Caustic Soda Export price from Jebel Ali, UAE, Flakes (Purity: >97%) (Industrial Grade).

In Q3 2025, the Caustic Soda price trend in UAE showed a tiny rise, underscoring robust baseline demand and limited pricing flexibility in a relatively stable trade corridor. Caustic Soda prices in UAE have ranged between USD 530 to 590 per tonne, up marginally by 0.21 %. The Persian Gulf region saw steady industrial activity, particularly in petrochemicals and water treatment, anchoring demand.

Logistics and export routes remained functional, and local producers managed to maintain supply continuity. Slight freight cost increases have been passed through. In Q3 September 2025, Caustic Soda prices in the UAE showed a slight rise, supported by improved baseline demand and limited pricing flexibility. Early in the month, higher downstream consumption and harvest dynamics strengthened sentiment, which sellers cautiously maintained throughout the period.

Brazil: Caustic Soda Import price in Santos, Brazil from USA, Lye.

In Q3 2025, the Caustic Soda price trend in Brazil reflected a minor downward shift as softer demand prompted moderate discounting across the market. Freight rates increased for Caustic Soda imports into Brazil from USA (CIF Santos), with prices ranging from USD 480 to 540 per metric ton, reflecting a 1.06% decline. Despite steady demand from the pulp & paper and alumina sectors, importers faced growing competition from domestic producers and rising logistics costs.

The overall sentiment remained steady, with buyers adopting a cautious approach amid balanced supply and gradual consumption slowdown. Upstream costs for salt and energy remained largely stable, limiting room for aggressive price reductions. Overall, the price movement reflected cautious repositioning by suppliers rather than any significant weakening in market fundamentals.

In Q3 September 2025, the Caustic Soda prices in Brazil maintained a largely stable tone as moderate discounting and softer demand balanced steady supply. Freight stability supported neutral sentiment, though overall market confidence remained cautious amid subdued downstream momentum.

Mexico: Caustic Soda Import price in Manzanillo, Mexico from USA, Lye.

In Q3 2025, the Caustic Soda price trend in Mexico showed a mild downward adjustment as competitive market pressures outweighed stable end-user demand. Despite adequate consumption levels, sellers offered minor concessions to maintain market share amid balanced regional supply conditions.

Freight rates saw a stable decrease for Caustic Soda imports into Mexico from USA (CIF Manzanillo), with prices ranging from USD 490 to 560 per metric ton, reflecting a 2.00% decline. While industrial demand particularly from the chemical and sanitation sectors remained steady, importers pushed for sharper discounts due to lower freight costs and the presence of competitive local supply.

Currency volatility and trade duties added layers of complexity to procurement decisions. To retain market share, exporters offered modest price concessions. In Q3 September 2025, the Caustic Soda prices in Mexico remained steady as consistent supply and stable freight supported a balanced tone. Competitive dynamics prompted minor adjustments, while steady end-user demand kept overall sentiment cautious yet relatively firm.