Price-Watch’s most active coverage of Copper Cathode price assessment:

- Purity: 99.99% FD-Willich, Germany

- Purity:99.99% Del Alabama, USA

- Purity:99.99% (100*10mm) Ex-Shanghai, China

- Purity:99.99% (1*1mm) Ex-Bhiwandi, India

- Purity:99.99% (100*10mm) FOB Osaka , Japan

Copper Cathode Price Trend Q3 2025

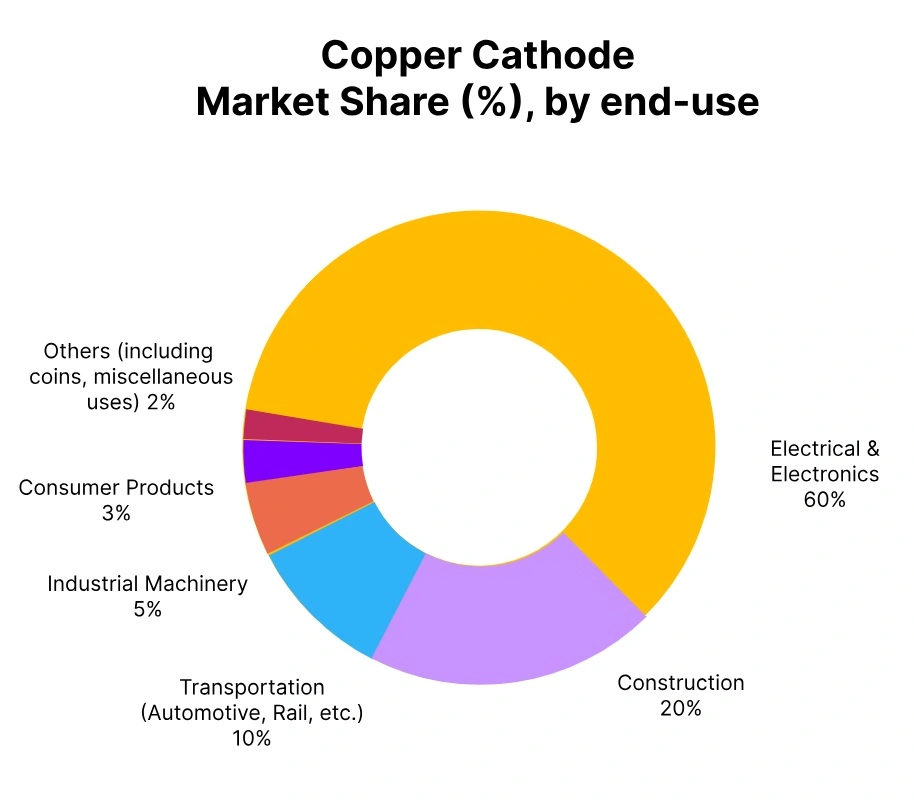

In the third quarter of 2025, the global copper cathode market experienced a modest rise of approximately 1–3% from the previous quarter (Q2 2025) levels. The improvement can be attributed to ongoing demand from renewable energy, electric vehicles (EV), and construction markets, largely in Asia and North America.

Market fundamentals have been further supported by supply interruptions in key regions, including South America, due to labor disruptions and maintenance period shutdowns, which resulted in lower output levels and tighter inventory.

Lastly, improved global gross manufacturing activity and better macroeconomic sentiment provided additional confidence to the market. Furthermore, copper cathode premiums have been seen rising in major import locations like China and India due to restocking. While supply had remained reasonably stable overall, some logistical hiccups in certain regions contributed to selling price inflation.

China: Copper Cathode Domestic prices EX Shanghai, China, Grade- Purity:99.99% (100*10mm).

According to PriceWatch, the copper cathode price trend in China experienced a minor increase in Q3 2025 and remained supportive of the prior quarter. Copper Cathode prices improved by about 0.50% from the previous quarter (Q2 2025), encouraged by steady demand for construction and electronics-related products as well as supply constraints in the market due in part to maintenance shutdowns at smelting facilities.

In September 2025, Copper Cathode prices in China further increased by approx. 1% month on month, driven by heightened downstream procurement activity for seasonal manufacturing, alongside tighter stock levels in warehouses. Improving macroeconomic conditions due to policy stimulus, combined with stronger industrial activity, also contributed to the gradual improvement in prices.

India: Copper Cathode Domestic prices EX Bhiwandi, India, Grade- Purity:99.99% (1*1mm).

According to PriceWatch, in Q3 2025, the Copper Cathode price trend in India experienced slight upward movement, recording an increase of 0.16% compared to Q2. The increase has primarily been attributed to steady demand from the electrical and construction industries, tight global supply conditions and elevated energy costs affecting smelters.

Copper Cathode prices in India continued to build upward toward the end of Q3, and in September 2025, prices increased by approximately 1% due to a pickup in infrastructure development and higher procurement activity ahead of the festive season.

The price increase has also been supportive of constrained supply from key exporting countries due to transportation issues and lower mining levels. Domestic manufacturers continued to see higher input costs, which led to slight price increases for all types of copper.

USA: Copper Cathode Domestic Prices Del Alabama, USA, Grade- Purity:99.99%.

In Q3 2025, the copper cathode price trend in the USA increased a moderate 0.16% from Q2 2025. This small increase has largely been attributed to steady industrial demand from the electrical and construction industries and tighter supply conditions due to ongoing disruptions in surplus areas.

Copper Cathode pricing reacted to these fundamentals in the market and held in despite a weakening macroeconomic backdrop. In September 2025, Copper Cathode prices in the US increased by a sharper 1% due to increased buying ahead of year-end infrastructure projects and a restocking of inventories.

Germany: Copper Cathode Domestic Prices FD-Willich, Germany, Grade- Purity:99.99%.

The copper cathode price trend product in Germany during Q3 2025 showed a moderate upward trend, with a price increase of 0.80% compared to Q2 2025. This price increase can be largely attributed to tight supply conditions, robust demand by major industrial end-user sectors, and elevated cathode premiums in the German market.

Limited spot offers and expectations of continued supply-side constraints contributed to bullish market sentiment throughout the quarter. However, the Copper Cathode prices in Germany decreased by around 0.20% in September 2025 due to mild demand moderation and cautious buying activity amid ongoing macroeconomic uncertainty.

Nonetheless, this decrease in pricing hasn’t alter the fact that the overall directional pricing trend for the quarter was positive, suggesting that the resilience in the Copper Cathode market was underpinned by supply-side constraints, and that producers are still providing firm offering interest, in addition to reports continuing interest from end-use industries such as construction and electronics.

Japan: Copper Cathode Export Prices FOB Osaka, Japan, Grade- Purity:99.99% (100*10mm).

In Japan, the copper cathode price trend recorded a notable increase of 5.45% overall in Q3 2025 after considering the previous quarter. This price rise has mainly been driven by solid industrial demand, especially in the electronics and construction sectors, in combination with heightened global supply constraints. In September 2025, Copper Cathode prices in Japan rose by approximately 4.64% due to further purchasing activity and ongoing fears about securing raw materials.

Furthermore, the weakening of the yen contributed to increased import prices, aiding the bullish price momentum of Copper Cathode. In addition, high energy prices and continued supply chain disruption from leading exporting countries contributed to strengthening price momentum.