Price-Watch’s most active coverage of Copper Clad Aluminium (CCA) Wire price assessment:

- 2UEW/155-0.15mm FOB Shanghai, China

- 2UEW/155-0.15mm CIF Busan (China), South Korea

- 2UEW/155-0.15mm CIF Hai Phong (China), Vietnam

Copper Clad Aluminium (CCA) Wire Price Trend Q3 2025

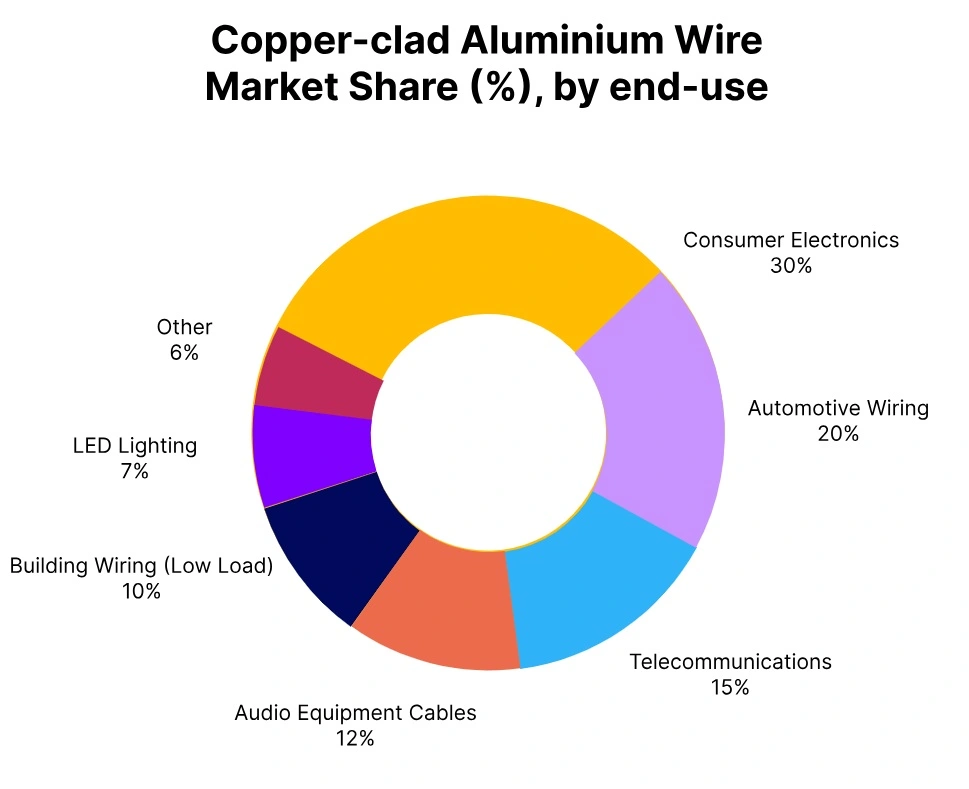

In Q3 2025, prices of Copper Clad Aluminium (CCA) wire have slipped slightly, down by roughly 1% from the last quarter. The fall mainly comes from muted orders in telecom, consumer electronics, and auto wiring, while aluminium supply has stayed stable or a touch higher. Copper prices have been their usual volatile self, but aluminium’s steadiness has kept the overall decline from deepening.

In Asia, tougher competition among producers has pushed some to cut prices just to hold their ground. Even so, the CCA wire market hasn’t lost its footing. Its lower cost, lighter weight, and growing use in high-efficiency applications have kept demand from falling too far. It’s a quiet quarter, but the fundamentals still look steady beneath the surface.

China: Copper Clad Aluminium Wire Export prices FOB Shanghai, China, Grade- 2UEW/155-0.15mm.

According to PriceWatch, in Q3 2025, Copper Clad Aluminium wire prices in China have moved slightly lower, down about 1% from the previous quarter. The drop has mostly come from slower orders in the electronics and construction sectors, a steady raw material supply, and a quieter manufacturing pace through the summer.

By September 2025, Copper Clad Aluminium wire prices in China had inched back up around 1.5%, helped by a small rise in domestic buying and firmer global copper prices that lifted production costs. Even with that late lift, the overall tone of the quarter has stayed a bit bearish.

Buyers have mostly held back, waiting to see how broader economic conditions and commodity prices play out. Producers have kept their inventories tight, wary of further swings ahead. The market has held together, but just barely more on caution than confidence.

South Korea: Copper Clad Aluminium Wire Import prices CIF Busan (China), South Korea, Grade- 2UEW/155-0.15mm.

In Q3 2025, Copper Clad Aluminium wire prices in South Korea have edged down by about 1% from the previous quarter. The decline has come mainly from weaker demand in the domestic construction and electronics sectors, while global copper prices have stayed largely stable, providing little cost support. Steady aluminium prices have added to the downward pressure.

By September 2025, Copper Clad Aluminium wire prices in South Korea have shown a mild rebound of around 1%, driven by increased procurement from cable manufacturers gearing up for year-end production.

The short-term lift has also been helped by tighter inventories and a few logistical hurdles in sourcing raw materials. Even with this late recovery, overall sentiment throughout the quarter has remained cautious, reflecting a slow macroeconomic backdrop and restrained market confidence.

Vietnam: Copper Clad Aluminium Wire Import prices CIF Hai Phong (China), Vietnam, Grade- 2UEW/155-0.15mm.

In the third quarter of 2025, the copper clad aluminium (CCA) wire price trend in Vietnam has fallen marginally, by approximately 1% compared to the previous quarter. This price decline has been due to weak demand from both the domestic electronics and electrical sectors, well as continuing moderate inflows of imports and stable inventory levels in Vietnam.

Manufacturers have reporting limited purchasing activity in a cautious market setting, which has also contributed to further downward pressure on price levels. However, by September 2025, copper clad aluminium wire prices in Vietnam have risen nearly 1% with support from a recovery in downstream demand as well as a slight increase in the global price of copper.

There has also been partial short-term relief from consistent reduction in supply from a couple of regional producers who have been facing raw material supply constraints. Overall, the CCA wire market in Vietnam have remained stable despite the weak consumption levels, as the supply side remains constrained.