Price-Watch’s most active coverage of Copper Rod price assessment:

- ETP 11000-20mm Ex-Shanghai, China

- ETP C12000-20mm Ex-Mumbai, India

- ETP C110-20mm Del Alabama, USA

- ETP C110-20mm FD-Willich, Germany

Copper Rod Price Trend Q3 2025

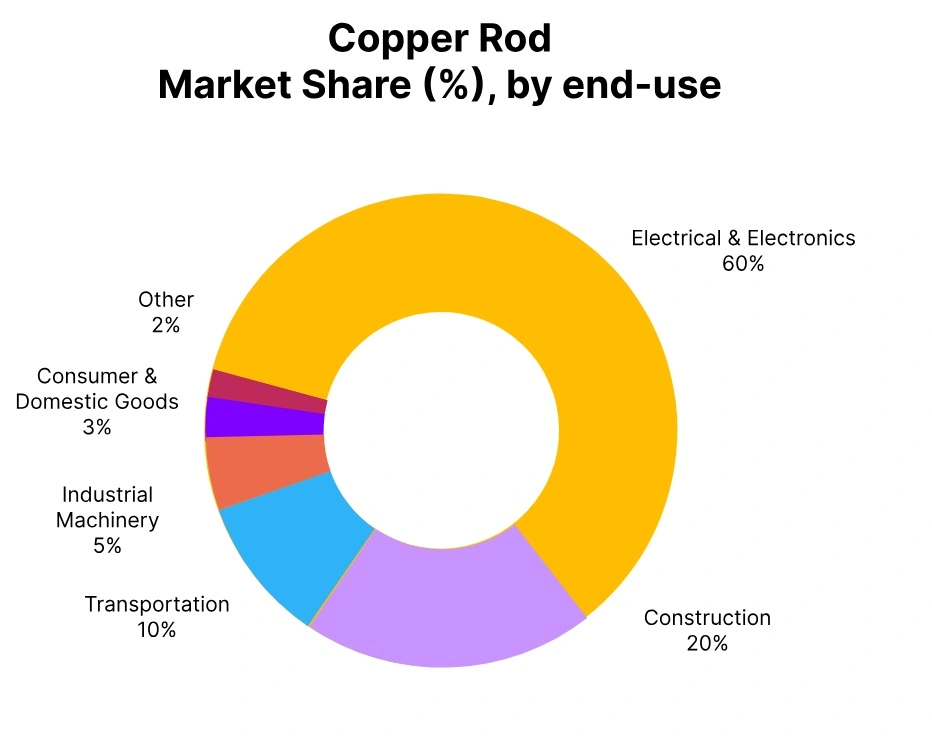

In the third quarter of 2025, the global copper rod market saw a slight price increase of 1-2% from the second quarter. This price increase has primarily been due to steady demand for electrical and construction applications, coupled with tightness in the refined copper supply. The price trend signals robust investment in renewable energy, electric vehicle infrastructure, and electrical grid upgrades, particularly in Asia and North America.

Given the continued macroeconomic uncertainty and fluctuating energy prices that affect the demand outlook, ongoing strong consumption in the downstream has been supportive along with some restocking activity.

Further, in China, marginal production constraints, coupled with environmental regulations, also provided some supply-side constraints that added to the price improvement. While the price increase has been modest, it reflects a certain degree of resiliency in the copper rod segment, despite the somewhat negative industrial outlook across a broader market perspective.

China: Copper Plate Domestic prices EX Shanghai, China, Grade- ETP 11000-20mm.

According to PriceWatch, the copper rod price trend in China during Q3 2025 demonstrated a consistent upward movement, reflecting a near 2% increase in the market from the previous quarter. The Copper Rod price has been buoyed by steady domestic demand from the construction and electrical industries, along with tightening supply driven by maintenance shutdowns around key smelters and limited supply of scrap.

In September 2025, Copper rod prices in China increased by 1.5% as manufacturing activity rebounded from an earlier slowdown, increases in raw material prices, firm demand, and ongoing infrastructure and green energy investments supported consumption growth while sustaining positive price momentum.

Furthermore, prices of copper on a global scale remained firm due to supply concerns in some of the major producing countries and a weakening U.S. dollar, which made copper relatively attractive for buying.

India: Copper Plate Domestic prices EX Mumbai, India, Grade- ETP C12000-20mm.

According to PriceWatch, the copper rod price trend in India during Q3 2025 showed a modest upward trajectory, with prices increasing by approximately 0.5% compared to Q2 2025. This growth was largely supported by steady demand from the power and construction sectors, coupled with tight supply conditions due to ongoing global disruptions in copper ore mining.

In September 2025, the Copper Rod prices in India have increased by 0.3%, driven by increased procurement activity ahead of festive infrastructure projects and a slight uptick in global copper futures.

Additionally, the depreciating rupee added to the import cost of raw copper, indirectly pushing domestic prices higher. While the overall quarterly increase remained moderate, market sentiment was cautiously optimistic, anticipating further firming of prices in the coming months.

USA: Copper Plate Domestic Prices Del Alabama, USA, Grade- ETP C110-20mm.

According to PriceWatch, the copper rod price trend in the U.S. market increased consistently throughout the third quarter of 2025, resulting in an overall price increase of roughly 2% (compared to second quarter 2025). This price increase has mainly been driven by continuing demand from the construction and electrical industries and a tight supply due to planned maintenance at smelters and lower levels of imports.

The Copper Rod price experienced upward pressures from robust prices associated with global copper cathode pricing and rising prices of rear commodities related to energy use in the production process. In the U.S. market, Copper Rod prices rose about 0.2% in September, in small part due to a recovering market following the typically quiet summer holiday period, even though some stresses were felt on the demand side.

Continued strong prices for scrap copper helped to support pricing stability on the supply side, and market optimism was supported by continued macroeconomic stability, subdued inflation, and steady manufacturing data.

Germany: Copper Plate Domestic Prices FD-Willich, Germany, Grade- ETP C110-20mm.

In Q3 of 2025, the Copper Rod price trend in Germany indicated a slight upward trend overall, growing approximately 2% in comparison to Q2 of 2025. The increase in prices was attributed to ongoing demand from the construction and electrical industries, as well as a continued concentrated supply of copper across the globe from significant mining disruptions in dominant production regions.

The Copper Rod price in Germany showed a marginal increase in September 2025 of around 0.2%, suggesting a continuation of stable industrial activity, as well as slightly increased energy input costs influencing copper rod production. Also, the consistent demand for copper-based products was reinforced by increased investment in renewable energy projects and electric vehicle construction.

Overall, while there were some peaks and troughs during Q3 with raw copper pricing globally, the German market remained relatively insulated due to domestic consumption. In addition, there was a slight uptick in export orders.