Price-Watch’s most active coverage of Copper Wire price assessment:

- ETP 11000 (3mm) Ex-Bhiwandi, India

- ETP C110-3mm FD-Willich, Germany

- ETP C110-3mm Del Alabama, USA

- ETP 11000-6mm Ex-Shanghai, China

Copper Wire Price Trend Q3 2025

The global copper wire market observed a mixed price pattern in Q3 2025 against Q2 2025, fluctuating within a range of 1–2%. The variance has been attributed to regional demand shifts, macroeconomic uncertainty, and raw copper price fluctuations.

Some markets in Asia, particularly China and India, saw prices rise slightly due to stable industrial demand with solid infrastructure activity, while certain regions of Europe saw slight price declines on slower construction output and a more cautious buying pattern.

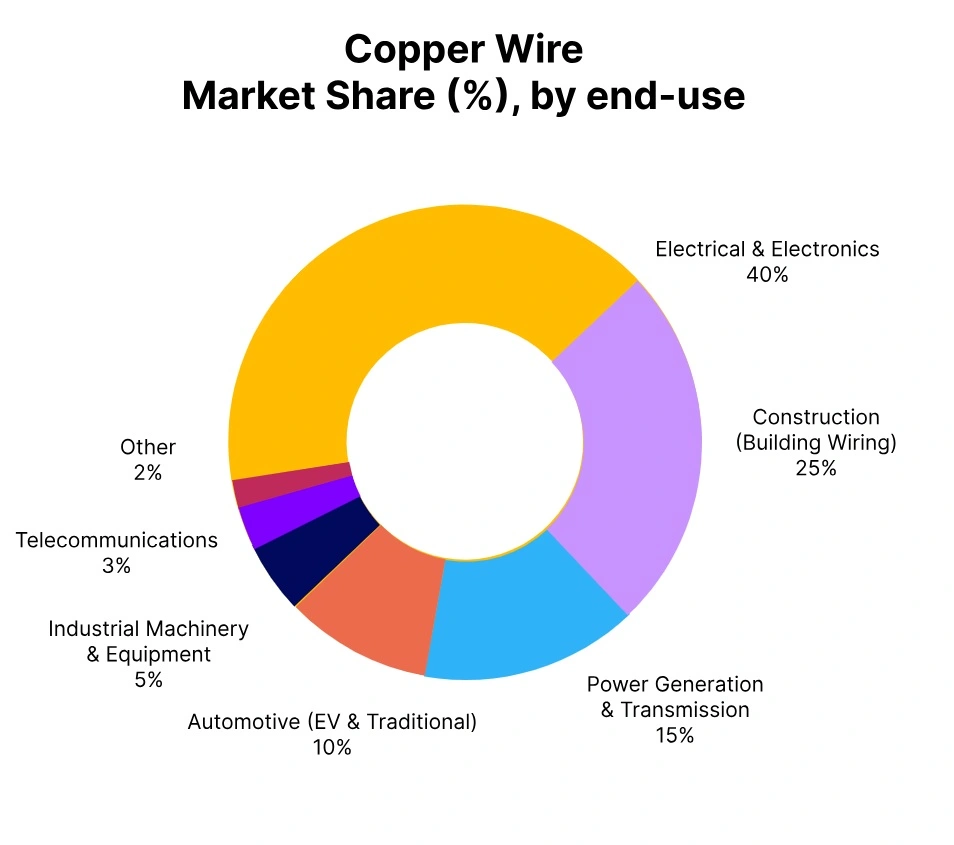

Supply-side variables that contributed to price variances included tight mining output and rising smelting costs. The renewable energy and EV sectors continued to boost overall demand and helped mitigate price declines in both markets through continued demand even with short-term headwinds.

Overall, the copper wire market has been relatively resilient in the face of continued variable economic conditions that reflect both supply constraints and steady downstream demand in key applications including construction, power transmission, and electronics manufacturing.

China: Copper Wire Domestic prices EX Shanghai, China, Grade- ETP 11000-6mm.

The copper wire price trend in China during Q3 2025 showed a modest upward trajectory overall, with a 1% increase compared to Q2 2025, driven by sustained demand from the construction and electronics sectors, along with tight supply conditions. However, the gains were not consistent throughout the quarter.

Copper wire prices experienced a decline of 2% in September 2025, primarily due to a seasonal slowdown in manufacturing activity and a slight rebound in domestic copper inventories. Despite this dip, market sentiment remained largely optimistic amid expectations of infrastructure spending and stable export orders. Import data suggested firm demand, especially from Southeast Asia, which helped support prices earlier in the quarter.

India: Copper Wire Domestic prices EX Mumbai, India, Grade- ETP C12000-3mm.

According to PriceWatch, in Q3 2025, Copper wire price trend in India displayed a slight overall reduction, easing by 0.12% quarter over quarter compared to Q2 2025. The decrease has primarily been due to moderate demand from the construction and electrical sectors, along with a comfortable level of global copper inventories and steady mine output. An underlying uncertain economic environment has also been affecting the price of copper wire, with significant industrial buyers constrained in their purchasing.

Nevertheless, a turnaround in copper wire prices in India in the month of September saw prices increase by 1% month on month, reflecting an acceleration in infrastructure activity leading up to the festive period, as well as modest disruptions in the global supply chain. The momentum at the quarter’s end partially recouped earlier losses on copper wire prices, but it was not sufficient to change the underlying average for the quarter significantly.

USA: Copper Wire Domestic Prices Del Alabama, USA, Grade- ETP C110-3mm.

According to PriceWatch, during Q3 2025, the copper wire price trend in the U.S. market exhibited a marginal decline overall of 1.5% compared to Q2 2025, driven primarily by reduced demand in industrial sectors particularly related to construction and automotive use, coupled with a slight increase in domestic inventory levels. Downward price pressure exacerbated by global economic uncertainties and limited export activity also occurred during July and August.

Copper wire prices in the US began to recover gradually in September 2025, increased by 0.20% month over month primarily due to revived demand in the renewable energy space, along with expectations of tighter supply for South American mines caused by possible labor disruptions. Although the price declined slightly during the quarterly period, the month-over-month prices in September indicate a possible stabilization.

Germany: Copper Wire Domestic Prices FD-Willich, Germany, Grade- ETP C110-3mm.

The copper wire price trend in the German market in Q3 2025 continued a slightly downward trajectory, decreasing by 1.5% since Q2 2025. The overall decline in copper wire prices in Germany has been mainly fueled by a sluggish manufacturing sector and limp demand from Germany’s main buyers of the product, the automotive and construction sectors.

Even with a combination of better supply chain efficiencies and stable imports into Germany during July and August that supported lower price levels, copper wire prices in Germany have risen very slightly into September 2025 by 0.50% as industrial orders increased temporarily and global geopolitical uncertainties fueled supply tightness in the near future. While the overall quarterly price trends remain negative, the copper wire price recovery in September suggests a potential shift in market sentiment.