Price-Watch’s most active coverage of Corn (Maize) price assessment:

- Maize FOB Santos, Brazil

- Maize FOB North West Iowa, USA

- Maize FOB Rosario, Argentina

- Maize FOB Port of Ravenna, Italy

- Maize FOB Port of Odesa, Ukraine

- Maize Ex-Chhindwara, India

Corn (Maize) Price Trend Q3 2025

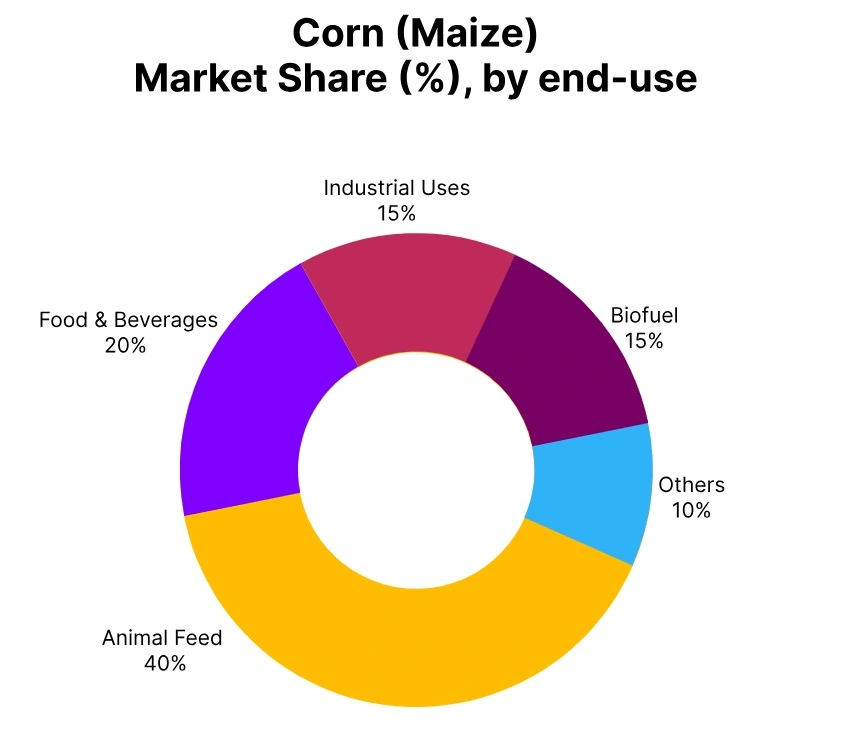

In Q3 2025, the global Corn (Maize) market exhibited stability with regional variations. Price trend for Corn (Maize) fluctuated 5-10% which was moved by strong harvests in the USA, Brazil and Ukraine, limited local supplies in Italy and stable production in India, alongside fluctuating demand from feed, ethanol, and industrial sectors. Export competition from South America and logistical factors in key ports influenced regional price movements. Despite some volatility, consistent consumption and targeted procurement strategies in domestic and international markets supported market balance. Seasonal harvests, growing export commitments and regional demand patterns are expected to guide global Corn price trends in the upcoming quarter.

Brazil: Corn (Maize) Export prices FOB Santos, Brazil.

In Q3 2025, Corn (Maize) prices in Brazil showed a decline amid ample domestic supply and moderated export demand. Corn (Maize) price trend in Brazil during the quarter were influenced by strong harvest yields, favourable weather conditions across main producing regions, and softer global feed demand. Despite some cost pressures from logistics and currency fluctuations, the market experienced downward adjustment with abundant availability supporting the price range of USD 188-205 per metric ton.

Ongoing shifts in export dynamics and regional trade flows are expected to influence market stability into the next quarter. In September 2025, Corn (Maize) prices in Brazil were decreased by 11.96% due to ongoing supply chain adjustments and regional trade dynamics are expected to maintain stable pricing into the next quarter.

USA: Corn (Maize) Export prices FOB Northwest Iowa, USA.

In Q3 2025, Corn (Maize) prices in the USA declined amid abundant domestic supply and softening demand. Corn (Maize) Price trend in USA though the quarter was swayed by record-breaking harvests across the Midwest, leading to elevated stock levels in key storage hubs. Domestic demand from the livestock feed and ethanol sectors remained subdued due to slower production and reduced processing margins. Strong competition from other regional markets further limited export opportunities for U.S. producers. Despite smooth transportation prices managed around USD 155-176 per metric ton. In September 2025, Corn (Maize) prices in USA dipped by 9.28% as market trends are likely to be shaped by planting plans for the next season, domestic consumption patterns and evolving export commitments.

Argentina: Corn (Maize) prices FOB Rosario, Argentina.

In Q3 2025, Corn (Maize) prices in Argentina declined moderately through steady domestic production and tempered export demand. Corn (Maize) Price trend in Argentina during the quarter were influenced by favourable weather conditions supporting healthy yields, combined with strong local stock levels that eased supply pressures. Export shipments slowed slightly due to competitive pricing from neighbouring countries, while domestic demand from livestock feed and industrial users remained stable. Despite some logistical challenges in port operations, the market recorded a price range of USD 167-180 per metric ton. In September 2025, Corn (Maize) prices in Argentina decreased by 4.92% as seasonal harvest progress and export commitments are expected to guide market trends in the next quarter.

Italy: Corn (Maize) prices FOB Port of Ravenna, Italy.

In Q3 2025, Corn (Maize) prices in Italy increased amid tighter domestic supply and rising demand. Corn (Maize) Price trend in Italy during the quarter were influenced by limited local harvests and strong buying from the livestock feed and milling sectors. Higher input costs, including transportation and storage, contributed to the upward price movement. Additionally, increased imports from other European countries faced competition and logistical constraints, supporting stronger domestic pricing. Consequently, prices ranged between USD 285-309 per metric ton. In September 2025, Corn (Maize) prices in Italy increased by 8.35% as market trends are likely to be shaped by upcoming harvest yields, import flows and continued demand from feed and industrial users.

Ukraine: Corn (Maize) prices FOB Port of Odesa, Ukraine.

In Q3 2025, Corn (Maize) prices in Ukraine edged higher amid balanced domestic supply and strengthening export demand. Corn (Maize) Price trend in Ukraine during the quarter were shaped by steady harvests across key agricultural regions, improving port and transport operations, and increasing interest from traditional overseas buyers. Supportive domestic demand from the feed and processing sectors also contributed to the upward movement. As a result, prices ranged between USD 215-258 per metric ton. In September 2025, Corn (Maize) prices in Ukraine went up by 3.53% as crop conditions, export shipments and regional market dynamics are expected to influence price trends in the coming months.

India: Corn (Maize) prices Ex-Chhindwara, India.

In Q3 2025, Corn (Maize) prices in India remained relatively stable amid steady domestic production and moderate demand. Corn (Maize) Price trend in India during the quarter were influenced by steady harvests in major growing states, adequate stock levels, and stable buying from the livestock feed and poultry sectors. Limited fluctuations in transportation and storage costs also contributed to market stability. Consequently, prices ranged between INR 21,000-22,400 per metric ton.

Moving forward, market trends are likely to be swayed by upcoming sowing progress, domestic consumption patterns and regional trade flows. In September 2025, Corn (Maize) prices in India increased by 0.38% as market participants are expected to closely monitor monsoon patterns and government procurement policies, which may influence price movements in the upcoming quarter.