Price-Watch’s most active coverage of Cyclopentane price assessment:

- IG (95% min) CIF Nhava Sheva (Japan), India

- IG (95% min) FOB Tokyo, Japan

- IG (95% min) CIF Barranquilla (China), Colombia

- IG (95% min) FOB Shanghai, China

- IG (95% min) CIF Nhava Sheva (China), India

- IG (95% min) CIF Haiphong (China), Vietnam

- IG (95% min) CIF Manzanillo (China), Mexico

Cyclopentane Price Trend Q3 2025

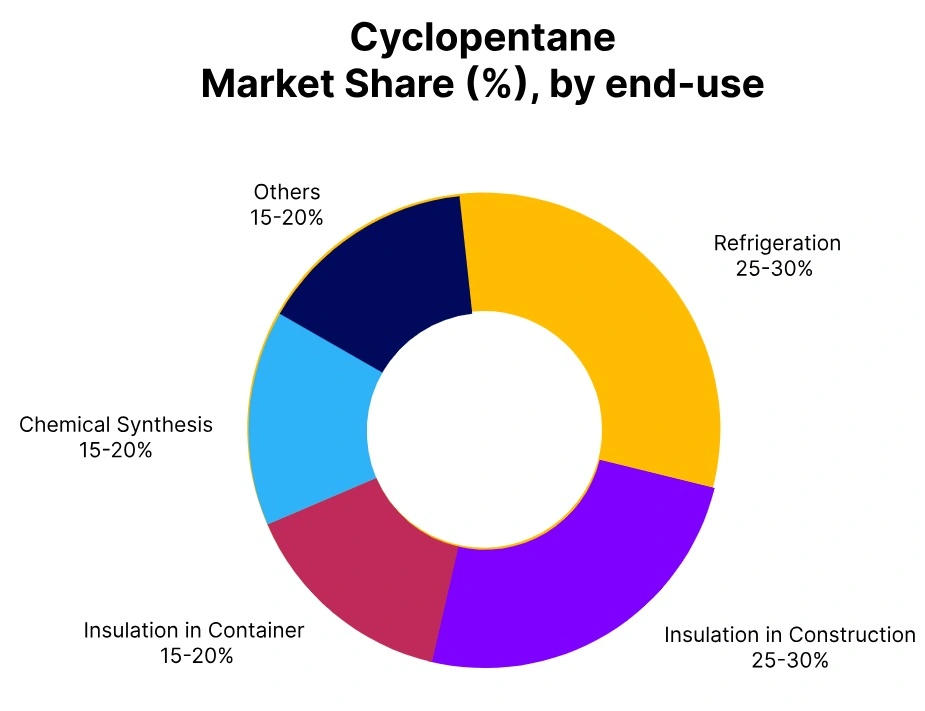

According to PriceWatch, in Q3 2025, the global Cyclopentane price trend registered a moderate increase of around 1–2%, supported by steady demand from the insulation, refrigeration, and foam manufacturing sectors. The Cyclopentane price remained relatively stable through most of the quarter but edged higher toward the end due to firm consumption levels in Asia and Europe, along with marginal increases in upstream feedstock costs.

While supply remained generally balanced, producers in key markets adjusted offers slightly upward to reflect rising operational and compliance costs. By September, the Cyclopentane price in major trading hubs had inched up, indicating a mildly bullish sentiment in the global market. If demand holds steady into Q4, this gradual upward price trend may continue.

Japan: Cyclopentane Export prices FOB Tokyo, Japan, Grade- Industrial Grade (95% min).

According to PriceWatch, in Q3 2025, the Cyclopentane price trend in Japan saw a 1.5% increase, supported by steady regional demand and slightly firmer production costs. The Cyclopentane price in Japan edged upward as domestic manufacturers passed on minor cost pressures stemming from raw materials and energy inputs, while demand from the insulation and refrigeration sectors remained consistent.

Although supply levels were stable, limited spot availability and cautious inventory management contributed to the upward adjustment in offer prices. In September 2025, Cyclopentane price in Japan market reported a firmer pricing tone, with the overall Cyclopentane price reflecting balanced fundamentals and modest bullish sentiment.

China: Cyclopentane Export prices FOB Shanghai, China, Grade- Industrial Grade (95% min).

According to PriceWatch, during Q3 2025, Cyclopentane prices in China rose by approximately 1.5%, supported by consistent demand from key sectors such as refrigeration and insulation. The Cyclopentane price trend in China remained firm throughout the quarter as producers slightly raised offers in response to marginal increases in feedstock and utility costs.

While supply remained adequate, controlled production and steady overseas inquiries helped maintain an upward pricing tone. In September, Cyclopentane price in Shanghai reflected this gradual increase, with the market showing signs of mild strengthening and balanced fundamentals heading into Q4.

India: Cyclopentane Import prices CIF Nhava Sheva, India, Grade- Industrial Grade (95% min).

According to PriceWatch, in Q3 2025, Cyclopentane price trend in India saw an increase of 3–4%, mainly driven by rising FOB prices from both Tokyo, Japan and Shanghai, China, alongside the impact of an unfavourable USD/INR exchange rate. The Cyclopentane price in India moved higher as exporters in both regions raised offer levels in response to stable demand and increased production costs.

At the same time, the depreciation of the Indian Rupee against the U.S. Dollar added to the landed cost of imports, amplifying the overall upward pressure. In September, Cyclopentane price in Indian market buyers were facing noticeably higher import prices, with the combined effect of stronger FOB values and currency fluctuations reflected in the final price levels.

Mexico: Cyclopentane Import prices CIF Manzanillo, Mexico, Grade- Industrial Grade (95% min).

In Q3 2025, Cyclopentane price trend in Mexico declined by approximately 2.5%, primarily due to a reduction in freight costs. The Cyclopentane price in the Mexico market eased slightly as lower shipping rates from Asia to Latin America helped offset otherwise stable FOB export prices.

By September, the decreased logistics costs had been fully factored into landed prices, making imports more competitively priced without any significant shifts in supply or demand fundamentals. In September 2025, Cyclopentane price in Mexico drop was freight-driven, offering some relief to regional buyers amid otherwise steady market conditions.

Columbia: Cyclopentane Import prices CIF Barranquilla, Columbia, Grade- Industrial Grade (95% min).

In Q3 2025, Cyclopentane price trend in Colombia declined by approximately 5%, primarily due to a sharp drop in freight rates. The Cyclopentane price in the Colombia market eased as shipping costs from Asia to Latin America fell significantly during the quarter, reducing the overall landed cost for importers despite relatively stable FOB values.

Lower logistics expenses had fully reflected in contract and spot pricing, making imported cargoes more competitive. In September 2025, Cyclopentane price in Columbia showed trend correction that was largely freight driven, with supply and demand fundamentals remaining mostly unchanged.

Vietnam: Cyclopentane Import prices CIF Haiphong, Vietnam, Grade- Industrial Grade (95% min).

In Q3 2025, Cyclopentane price trend in Vietnam recorded a 1.5% increase, mainly driven by higher FOB prices from China. The Cyclopentane price in Vietnam moved slightly upward as Chinese suppliers raised export offers in response to stable demand and marginal increases in production costs.

While freight rates remained relatively steady, the rise in export values from key Chinese ports like Shanghai directly impacted the landed cost for Vietnamese importers. In September 2025, Cyclopentane price in Vietnam increase was evident across both spot and contracted volumes, reflecting firm supply-side dynamics despite moderate regional demand.