As of August 2024, ethylene prices are fluctuating around $1,200 per metric ton, reflecting a 5% increase from the previous month. In Q1 and Q2 2024, global supply was constrained by maintenance shutdowns in South Korea and Saudi Arabia, reducing output by approximately 3 million metric tons. Geopolitical tensions in the Middle East further tightened the market by disrupting naphtha supplies, a key feedstock for ethylene production.

In Q3 2024, the ethylene market continues to experience upward price pressure due to ongoing supply limitations and strong demand from the packaging and automotive sectors. Packaging demand has surged by 4% year-on-year, driven by the growth in e-commerce and food packaging. However, the construction sector has seen a 2% decline in demand due to economic uncertainties.

Looking ahead to Q4 2024 and beyond, the U.S. Gulf Coast is expected to add 1.5 million metric tons of ethylene production annually, which may help stabilize prices. Despite this, the market is projected to remain volatile through 2030, influenced by factors such as geopolitical developments, supply chain adjustments, and evolving demand dynamics.

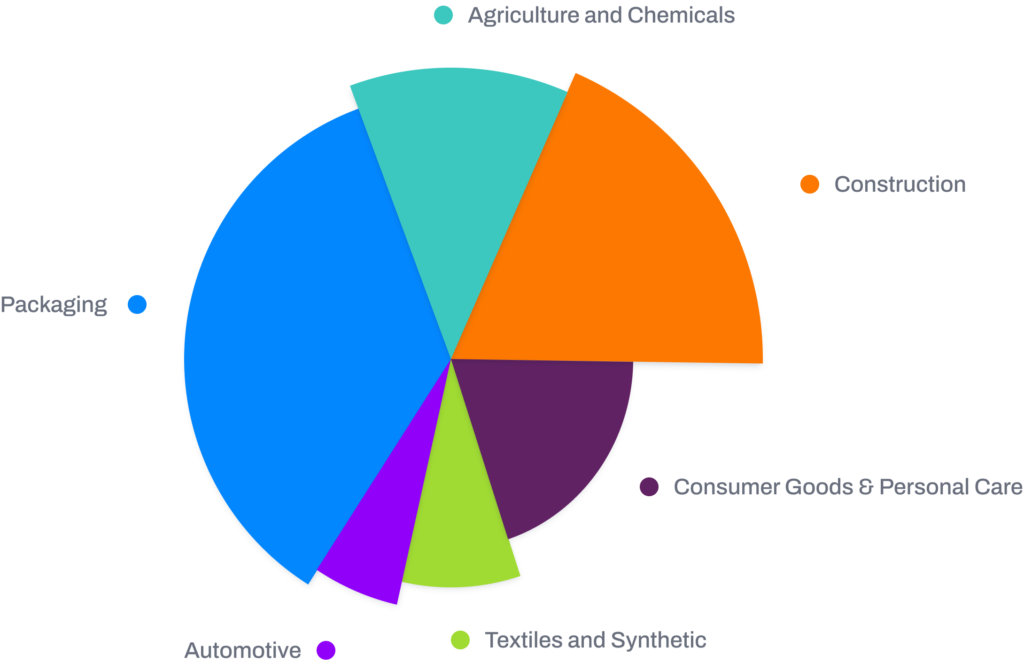

Ethylene End-Use Industry Share

Ethylene Supply Outlook to 2040

Global Capacity Expansion

The global ethylene production capacity is set to grow at a compound annual growth rate (CAGR) of 3-4% through 2040. The majority of this growth will come from key regions like the U.S., China, and the Middle East, with emerging production hubs in Southeast Asia and India.

Sustainability and Green Ethylene

The focus on producing green ethylene from bio-based feedstocks, like ethanol, is growing. Brazil, a leader in bioethanol, is ramping up its capacity for bio-based ethylene, paving the way for a more sustainable supply chain.

Geopolitical and Environmental Influence

Geopolitical factors and environmental regulations will significantly impact the future of ethylene production. Countries that adopt cleaner, more efficient ethylene production processes and lower carbon footprints will have a competitive advantage, particularly in regions like Europe, where carbon pricing and sustainability are key concerns.

Emerging Market Opportunities

Identifying regions with growing demand and expanding production capacities can help manufacturers and suppliers tap into new markets, gaining a foothold in high-growth areas.

Strategic Location Planning

Managing Cost Risks

Managing Cost Risks

Future Challenges

By analyzing ethylene supply dynamics, businesses can anticipate potential challenges such as feedstock shortages, regulatory changes, and shifting consumer demand. This insight helps companies pivot quickly and stay resilient in the face of supply chain disruptions.

Future-Proof Your Business with price-watch

By closely monitoring ethylene supply and price trends, businesses can secure their operations against market fluctuations and stay ahead of the competition. Whether it’s tracking competitor moves like geographic expansions or investments in renewable ethylene technologies, or staying on top of environmental regulations, understanding ethylene dynamics is essential to success in a rapidly evolving market. Ensure your business is positioned for future growth by leveraging ethylene supply analysis to optimize operations, manage risks, and tap into emerging opportunities.