Price-Watch’s most active coverage of Dimethylformamide (DMF) price assessment:

- (99.9% min) Industrial Grade FOB Shanghai, China

- (99.98%) Industrial Grade FOB Jeddah, Saudi Arabia

- (99.9% min) Industrial Grade CIF Santos_China, Brazil

- (99.9% min) Industrial Grade CIF Buenos Aires_China, Argentina

- (99.9% min) Industrial Grade CIF Haiphong_China, Vietnam

- (99.98%) Industrial Grade CIF JNPT_Saudi Arabia, India

- (99.98%) Industrial Grade Ex-Mumbai, India

Dimethylformamide (DMF) Price Trend Q3 2025

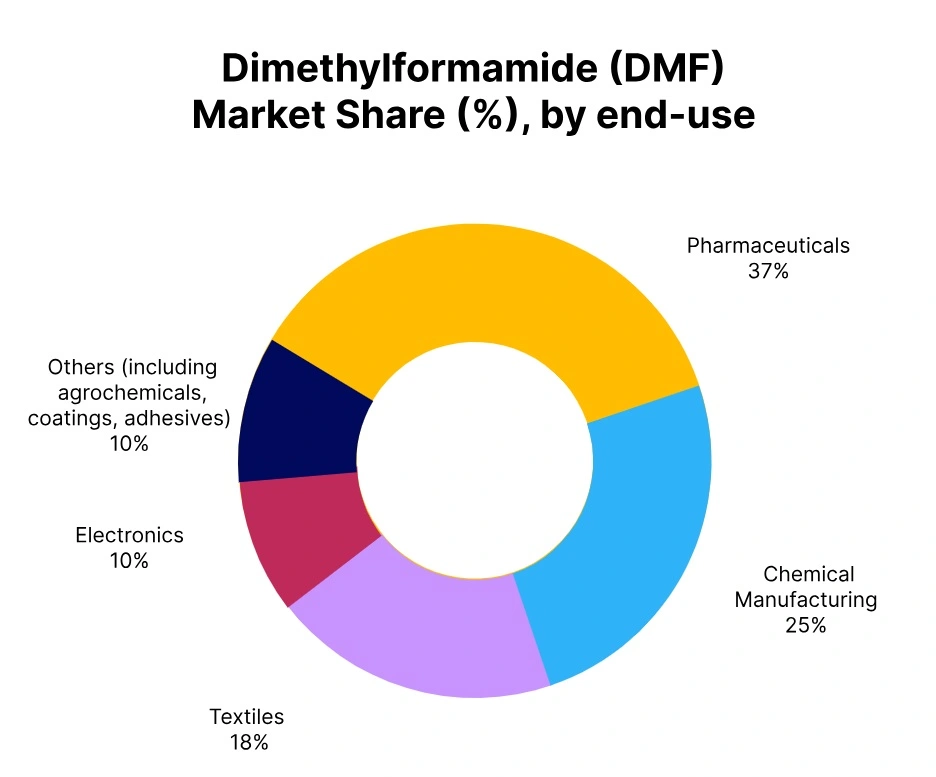

Dimethylformamide (DMF) prices across major markets had mixed price directions Q3 2025. In China, prices showed a slight decline of 0.34%, attributed to lower demand from textiles and pharmaceuticals, along with oversupply. Similarly, DMF prices fell by 7.57% in Saudi Arabia, with lower demand and production plant closures leading this decline.

In contrast, significant increases in price were also recorded in both Brazil and Argentina, at 15.51% and 15.02%, respectively, driven by demand recovery in textiles, coatings, and pharmaceuticals. Vietnam has been the only market with a slight decline of around 0.22%, with price remaining steady despite some demand issues in electronics and textiles. The outlook remains uncertain based on demand and supply chain recovery.

Saudi Arabia: Dimethylformamide Export prices FOB Jeddah, Saudi Arabia, Grade- (99.98%) Industrial Grade.

According to PriceWatch, In Q3 2025, Dimethylformamide (DMF) prices in Saudi Arabia experienced a sharp decline of 7.57%, following a moderate increase of 2.18% in Q2. The Dimethylformamide (DMF) price trend in Saudi Arabia was heavily influenced by a significant reduction in demand from domestic and international markets. This decline was driven by lower production in key sectors, including textiles and coatings, coupled with oversupply conditions.

A scheduled shutdown at a major production plant further disrupted the supply chain, which contributed to price instability. Dimethylformamide (DMF) prices in September 2025 were much lower than in Q2. The outlook for the upcoming quarter depends on the recovery of industrial demand and the resolution of supply disruptions.

Brazil: Dimethylformamide Import prices CIF Santos, Brazil, Grade- (99.9% min) Industrial Grade.

In Q3 2025, Dimethylformamide (DMF) prices in Brazil increased by 15.51%, following a sharp decline of 9.91% in Q2. The Dimethylformamide (DMF) price trend in Brazil was influenced by a rebound in demand from industries such as textiles and coatings, which experienced improved production schedules. This was partly due to stabilization in supply chains, as logistical disruptions were alleviated.

Furthermore, the Brazilian Real’s fluctuation against the US Dollar helped reduce import costs, leading to price adjustments. Dimethylformamide (DMF) prices in September 2025 were notably higher compared to Q2. The market is expected to maintain this upward trajectory as demand continues to recover in key sectors.

Argentina: Dimethylformamide Import prices CIF Buenos Aires, Argentina, Grade- (99.9% min) Industrial Grade.

In Q3 2025, Dimethylformamide (DMF) prices in Argentina saw an increase of 15.02%, following a decrease of 9.31% in Q2. The DMF price trend in Argentina was driven by a recovery in demand from the pharmaceutical and agricultural sectors, which contributed to increased industrial activity. Importantly, the weakening of the Argentine Peso led to higher import costs, further influencing the price increase.

Despite ongoing global supply chain challenges, the demand-side recovery helped stabilize prices. Dimethylformamide (DMF) prices in September 2025 were higher than in the previous quarter. The outlook for Q4 2025 remains positive, assuming continued recovery in the domestic industrial sectors.

China: Dimethylformamide Export prices FOB Shanghai, China, Grade- (99.9% min) Industrial Grade.

During the third quarter of 2025, the price of Dimethylformamide (DMF) in China saw a slight decrease of 0.34% following a modest increase of 0.77% in the second quarter. The decline in DMF price trend in China has mainly been attributed to diminished demand from key end-use sectors such as textiles and pharmaceuticals, which experienced production slowdowns.

Although production levels remained stable, domestic oversupply, and increasing competitive pressure from other exporters weighed on prices. Further implications for the price decline have been receding logistical complexities and rising raw material prices.

In China, the Dimethylformamide (DMF) prices in September 2025 have been lower compared to the previous quarter. The market sentiment remains cautious with good prospects for further price volatility depending on global demand, and supply chain conditions.

Vietnam: Dimethylformamide Import prices CIF Haiphong, Vietnam, Grade- (99.9% min) Industrial Grade.

In the third quarter of 2025, Dimethylformamide (DMF) prices in Vietnam experienced a slight decline of 0.22%, following a more substantial 1.22% decline in the second quarter. The price trend of DMF prices in Vietnam continued to show stability, with little variation beyond modest demand-side concerns.

The price decrease has primarily been a result of declining domestic demand due to slower production in the electronics and textile sectors, while the exchange rate’s impact on imports from China kept any major price change at bay.

In Vietnam, Dimethylformamide (DMF) prices in September 2025 have been marginally lower than that of the second quarter grade. The market is expected to remain steady at the current pricing levels with downward pressure unless demand from key sectors increases in the next quarter.

India: Dimethylformamide Import prices CIF Nhava Sheva, India, Grade- (99.98%) Industrial Grade.

In Q3 2025, prices for Dimethylformamide (DMF) in India fell significantly, by 6.26% in India and 7.33% in Ex-Mumbai, after moderate increases in Q2. Attributed to weaker demand in the textile, pharmaceutical, and chemical sectors, all of which have been running gradually slower production cycles and shorter operational runs. Additionally, the Indian Rupee continued to weaken, driving up import costs.

Moreover, logistical issues, higher feedstock costs, and high inventories added to price pressures on DMF. In September 2025, DMF prices in India have declined on comparison to prices recorded during Q2. The outlook for Q4 2025 is expected to be cautious, as pricing adjustments may be made depending on demand recovery in the domestic market.