Price-Watch’s most active coverage of Dipropylene Glycol Monomethyl Ether (DPGME) price assessment:

- IG(99% min) FOB Shanghai, China

- IG(99% min) CIF Nhava Sheva (China), India

- IG(99% min) CIF Haiphong (China), Vietnam

- IG(99% min) Ex-Mumbai, India

Dimethyl Propylene Glycol Methyl Ether (DPGME) Price Trend Q3 2025

In Q3 2025, the global Dimethyl Propylene Glycol Methyl Ether (DPGME) market displayed moderate stability with regional variations. The Dimethyl Propylene Glycol Methyl Ether (DPGME) price trend fluctuated by 3-9% during the July-September 2025 quarter, influenced by consistent feedstock costs, energy prices, and regional supply chain dynamics.

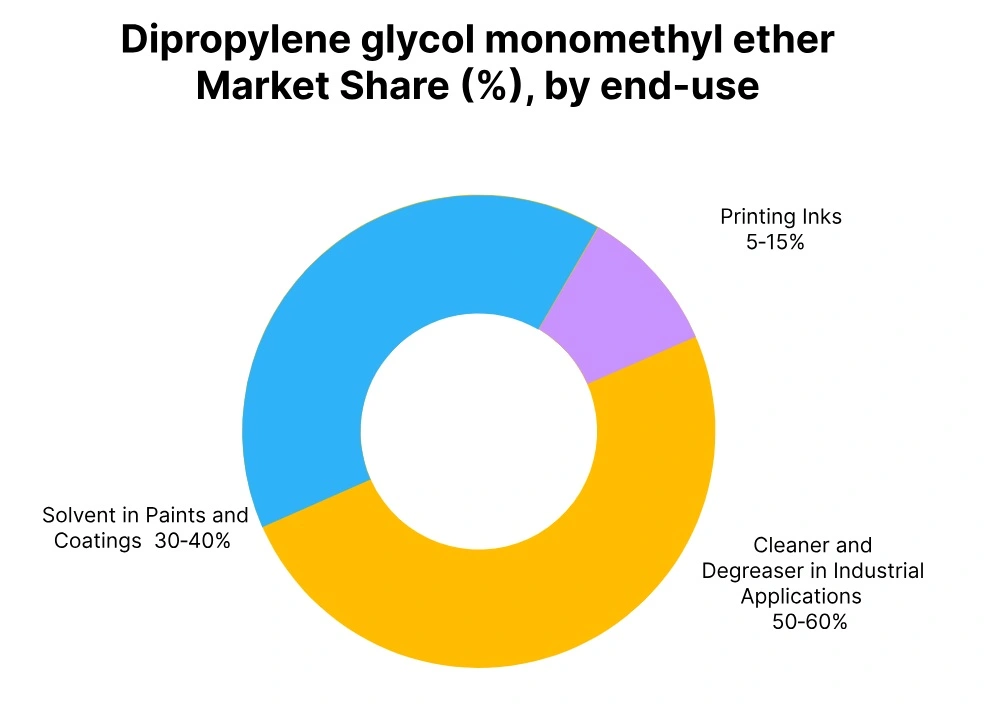

Despite some volatility in upstream factors, robust demand from industries such as coatings, cleaning, and personal care helped maintain price stability in the later stages of the third quarter. Ongoing production capacity expansions and supply chain adjustments are expected to support stable prices in the upcoming quarter.

China: Dimethyl Propylene Glycol Methyl Ether (DPGME) Export price FOB Shanghai, China.

According to Price-Watch, in Q3 2025, Dimethyl Propylene Glycol Methyl Ether (DPGME) price in China decreased by 8.58%, reflecting a mixed market trend. The Dimethyl Propylene Glycol Methyl Ether (DPGME) price trend in China showed tentative signs of recovery, supported by improved downstream demand and more efficient supply management.

July saw renewed buyer confidence, with steady inquiries from coatings and manufacturing industries across Southeast Asia, India, and other import markets. However, August experienced a temporary dip in momentum due to competitive pricing pressure from regional alternatives and limited cost-driven support.

Despite this, in September 2025, Dimethyl Propylene Glycol Methyl Ether (DPGME) prices in China closed the quarter on a firmer note, as production output and actual demand balanced more effectively. Feedstock propylene oxide and methanol values remained steady, supporting consistent production economics without strong cost-push elements.

Freight markets remained smooth, further aiding stable export flows. Overall, Q3 2025 marked a cautious but positive phase for Dimethyl Propylene Glycol Methyl Ether (DPGME) in China, with incremental recovery setting the tone for cautious optimism heading into the final quarter of the year.

Vietnam: Dimethyl Propylene Glycol Methyl Ether (DPGME) import price CIF Haiphong, Vietnam.

In Q3 2025, Dimethyl Propylene Glycol Methyl Ether (DPGME) prices in Vietnam decreased by 8.37%, reflecting early signs of recovery after sustained softness in the first half of the year. The Dimethyl Propylene Glycol Methyl Ether (DPGME) price trend in Vietnam showed a modest improvement in July, driven by renewed buying interest from coatings and manufacturing sectors resuming procurement after earlier hesitation.

However, this recovery remained fragile, with a marginal dip in August as buyers adjusted their import strategies, waiting for more competitive offers. By September 2025, Dimethyl Propylene Glycol Methyl Ether (DPGME) prices in Vietnam stabilized, supported by improved inventory alignment and steady demand across key downstream industries. FOB China trends mirrored this recovery, with exporters maintaining firm offers and consistent trade flows.

Feedstock costs for propylene oxide remained balanced, with methanol providing additional support. Overall, Q3 2025 highlighted a cautious rebound phase, with improved trade activity and demand rebalancing helping restore market confidence.

India: DPM import and domestic price CIF Nhava Sheva, Ex Mumbai, India.

According to Price-Watch, in Q3 2025, Dimethyl Propylene Glycol Methyl Ether (DPGME) prices in India decreased by 5.24% on a CIF basis and by 3.47% on an Ex-Mumbai basis, reflecting signs of recovery supported by seasonal factors and more consistent import flows. The Dimethyl Propylene Glycol Methyl Ether (DPGME) price trend in India saw a modest rebound in July, with downstream industries, particularly paints and coatings, increasing offtake in line with seasonal recovery.

August 2025 experienced a brief dip in Dimethyl Propylene Glycol Methyl Ether (DPGME) prices in India as buyers recalibrated their strategies, waiting for more competitive offers from China, but by September 2025, the market firmed as demand better aligned with supply. Feedstock trends for propylene oxide and methanol remained steady, allowing producers to maintain stable economics. Globally, trade flows normalized, with imports from China continuing but with less intensity.

Meanwhile, in India’s Ex-Mumbai market, the paints and coatings sector drove a gradual rebound, with July showing healthier buyer interest. August introduced a pause as buyers anticipated competitive offers, but September saw a wave of restocking as stable supply and steady downstream demand restored balance. Overall, Q3 2025 marked a period of recalibration, with cautious optimism as improving demand and stable trade flows set the tone for a more balanced market.