Price-Watch’s most active coverage of Dysprosium price assessment:

- Purity: 99%min. FOB Shanghai, China

- Purity: 99%min. CIF Rotterdam (China), Netherlands

- Purity: 99%min. CIF Nhava Sheva (China), India

- Purity: 99%min. CIF Houston (China), USA

Dysprosium Price Trend Q3 2025

In Q3 2025, global dysprosium price trend have shown signs of softening, moving slightly downward after recording notable gains earlier in the year. This moderation has been driven primarily by weaker demand from the electric vehicle and wind energy sectors, coupled with increased supply expectations from non-Chinese producers entering the market.

Additionally, temporary inventory overhang and the easing of export constraints in China have contributed to downward pressure on prices. Although overall price levels have remained relatively high, the quarter has marked a transition toward milder pricing, as market sentiment has turned more cautious amid broader economic uncertainty.

Netherlands: Dysprosium Import prices CIF Rotterdam (China), Netherlands, Grade- Purity:99%.

In Q3 2025, the dysprosium market in the Netherlands has been expected to experience a slight 0.53% decline compared to Q2, reflecting a modest decrease in demand amid persistent supply constraints. Despite this dip, Dysprosium price trend have remained relatively stable, supported by tight global supply particularly due to China’s export restrictions and continued strategic stockpiling across Europe.

While demand from sectors such as electric vehicles and wind energy has shown some softening, the long-term fundamentals underpinning dysprosium prices have remained strong, sustained by green energy initiatives and the EU’s efforts to secure rare earth supply chains.

Notably, dysprosium prices in the Netherlands have risen by 3.39% in September 2025, driven by growing demand from the EV and wind energy sectors, both of which rely heavily on rare earth elements for magnet production. Furthermore, supply constraints from key exporters, especially China stemming from tighter export policies and environmental regulations have intensified upward pressure on prices.

USA: Dysprosium Import prices CIF Houston (China), USA, Grade- Purity:99%.

In Q3 2025, the U.S. dysprosium market has experienced a slight 0.13% price decline from Q2, signaling a stabilization in the market following earlier fluctuations. This modest decrease has reflected a more balanced supply–demand dynamic, supported by increased domestic production efforts and diversification of supply chains, particularly as demand from the electric vehicle and renewable energy sectors has moderated.

While prices have remained relatively stable, ongoing geopolitical factors and advancements in alternative materials have continued to shape the outlook for future market movements. Notably, dysprosium price trend in the U.S. have risen by 3.41% in September 2025, driven by heightened demand for this critical rare earth element used in advanced technologies such as EVs and renewable energy systems. Moreover, supply chain constraints and geopolitical developments have likely constrained availability, exerting upward pressure on prices.

China: Dysprosium Export prices FOB Shanghai, China, Grade- Purity:99%.

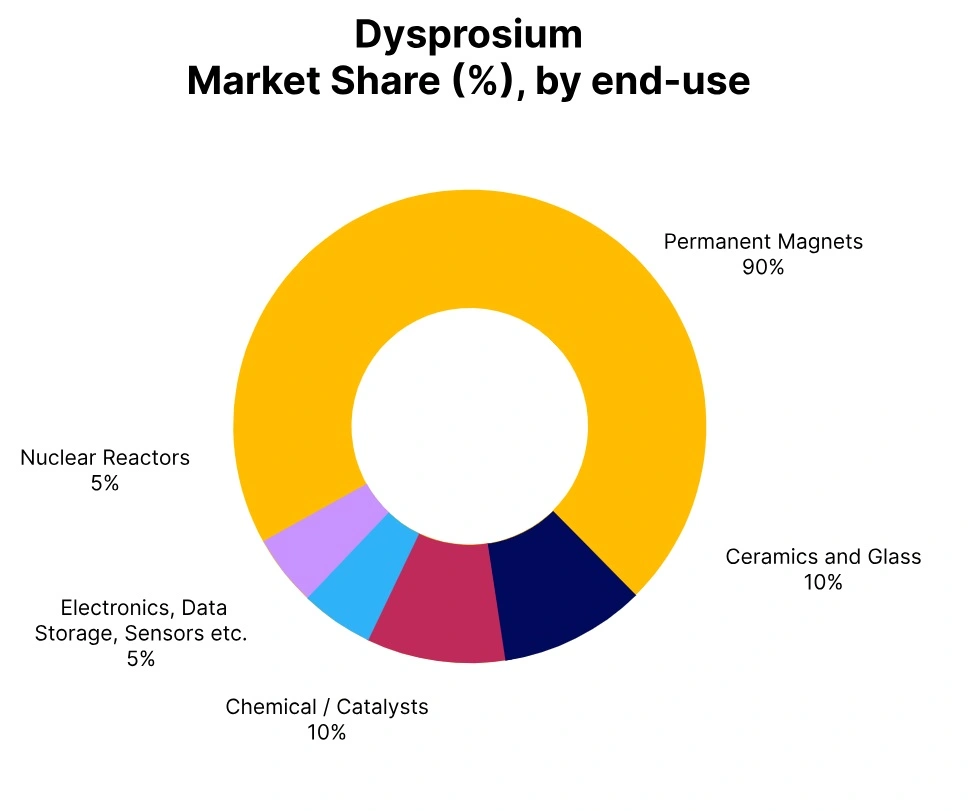

According to Price-Watch, in Q3 2025, dysprosium price trend in China have slipped by about 3.9% from the previous quarter, reflecting weaker momentum from key downstream sectors such as permanent magnets and electric vehicles. Ongoing export restrictions have kept sentiment cautious, curbing overseas orders and tempering domestic demand.

Dysprosium oxide prices have eased by roughly 2–4% over the quarter, marking a clear shift from the earlier firmness seen this year. Even so, the correction has been limited. Tight supply management, strategic stockpiling, and cost-linked price floors have helped prevent a steeper fall.

Interestingly, by September 2025, Dysprosium price trend in China turned upward again rising about 2.3% as stricter environmental enforcement on rare earth mining began to squeeze supply. The rebound also mirrors renewed buying from the EV and wind energy sectors, both of which remain long-term anchors for dysprosium demand.

India: Dysprosium Import prices CIF Nhava Sheva (China), India, Grade- Purity:99%.

According to Price-Watch, in Q3 2025, dysprosium price trend in India have slipped by around 1.2% from the previous quarter. The dip mainly reflects slower procurement from sectors such as electric vehicles and permanent magnet manufacturing, with buyers staying cautious amid global economic uncertainty.

Even so, Dysprosium price trend have held up better than expected. Ongoing global supply tightness, heavy import dependence, and a bit of speculative restocking by manufacturers expecting shortages have kept the market firm. The mismatch between steady dysprosium price trend and weaker demand shows how supply pressures continue to dominate India’s rare earth segment.

By September 2025, Dysprosium price trend in India turned upward again up roughly 3.4% as global supply chains tightened and demand from the renewable and EV industries picked up. Add to that the geopolitical tensions and export restrictions from major producers, and it’s clear why the market still feels the squeeze despite softer consumption.