Price-Watch’s most active coverage of Ethylene Acrylic Elastomer (AEM) price assessment:

- MV 29 FOB Houston, USA

- MV 29 CIF Laem Chabang (USA), Thailand

- MV 29 CIF Shanghai (USA), China

- MV 29 CIF Mersin (USA), Turkey

- MV 29 CIF Santos (USA), Brazil

- MV 29 CIF Jakarta (USA), Indonesia

- MV 29 CIF Antwerp (USA), Belgium

- MV 29 CIF Nhava Sheva (USA), India

Ethylene Acrylic Elastomer (AEM) Price Trend Q3 2025

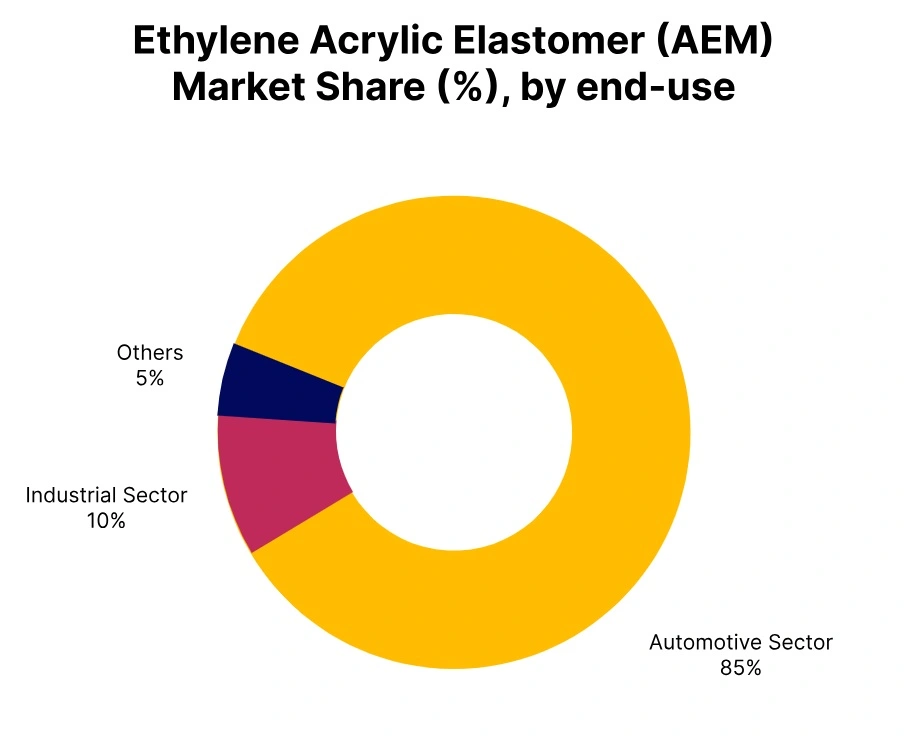

In Q3 2025, the global Ethylene Acrylic Elastomer (AEM) market has experienced a general decline in prices, with various regions reflecting a 2% drop in pricing trends. The overall market has been influenced by a combination of factors, including weaker demand from key sectors like automotive and industrial manufacturing, which have contributed to the downward pressure on prices. Raw material price fluctuations and sufficient supply in certain regions have further added to market softness.

Despite steady production levels in most regions, the reduced demand and shifts in global supply chains have played a significant role in the market decline. As the price trend has reflected broader economic uncertainties, companies across regions have adjusted their strategies to manage these market dynamics. The global market has shown signs of caution, with stakeholders closely monitoring the situation for any signs of stabilization.

USA: Ethylene Acrylic Elastomer Export prices FOB Houston, USA, Grade- MV 29.

According to the PriceWatch, in Q3 2025, the Ethylene Acrylic Elastomer (AEM) prices in the USA have experienced a declining market trend with 2% price drop, driven by weakening demand and fluctuating market conditions. Global economic uncertainties, raw material cost shifts, and regional supply have influenced the market’s movement. Despite stable production levels, the reduced demand from automotive and industrial sectors has contributed to this decline.

In September 2025, the Ethylene Acrylic Elastomer (AEM) prices in the USA have continued their downward movement, with a 2% decline from the previous month. The ongoing price decrease has suggested that the challenges faced in Q3 have persisted into the following month, with limited indications of recovery.

Thailand: Ethylene Acrylic Elastomer Import prices CIF Laem Chabang (USA), Thailand, Grade- MV 29.

In Q3 2025, the Ethylene Acrylic Elastomer (AEM) price trend in Thailand has followed a declining market trajectory, with a 2% drop in prices. The market has been influenced by weaker demand, especially in sectors reliant on durable elastomers like automotive and manufacturing. Raw material volatility and shifting global supply-demand conditions have played a key role in this price decline.

Despite a stable supply in the region, the reduction in demand from key industries has contributed to the softening market trend. In September 2025, the Ethylene Acrylic Elastomer (AEM) prices in Thailand have continued their downward movement, with a 2% decrease from the previous month, indicating that the market’s bearish sentiment has persisted into the following month.

China: Ethylene Acrylic Elastomer (AEM) Import prices CIF Shanghai (USA), China, Grade- MV 29.

In Q3 2025, the Ethylene Acrylic Elastomer price trend in China has experienced a 2.5% decline. This price movement has been driven by weaker demand in key sectors like automotive and industrial manufacturing, alongside fluctuating raw material prices. The decline in the Chinese market has been exacerbated by global supply chain disruptions and shifting demand patterns.

Despite steady production levels, the reduction in demand has put downward pressure on AEM prices. In September 2025, the Ethylene Acrylic Elastomer prices in China have continued the bearish price trend, with a 2% decline, reflecting ongoing softness in the market. This persistent downward trend has highlighted ongoing challenges faced by the AEM market in China, with limited signs of stabilization.

Turkey: Ethylene Acrylic Elastomer (AEM) Import prices CIF Mersin (USA), Turkey, Grade- MV 29.

In Q3 2025, the Ethylene Acrylic Elastomer price trend in Turkey has shown a 2% decline, driven by reduced demand and shifts in global market dynamics. Despite stable supply levels, the sluggish demand from key industries such as automotive and manufacturing has contributed to the price drop. The volatility of raw material prices and broader economic conditions have played a role in the market downturn.

In September 2025, the Ethylene Acrylic Elastomer prices in Turkey have continued their decline, with a 2% drop compared to the previous month. This extended bearish market trend has suggested that the challenges in the Turkish market have persisted into the following month.

Brazil: Ethylene Acrylic Elastomer (AEM) Import prices CIF Santos (USA), Brazil, Grade- MV 29.

In Q3 2025, the Ethylene Acrylic Elastomer (AEM) price trend in Brazil has experienced a 2% decline, reflecting softer demand in the country’s key sectors, including automotive and industrial manufacturing. The global supply dynamics of AEM and fluctuating raw material prices have contributed to this market movement. Despite steady production rates, the lack of significant demand growth has put downward pressure on prices.

In September 2025, the ethylene acrylic elastomer (AEM) prices in Brazil have continued to experience a 2% price decrease, indicating that the decline has persisted. This continued price drop has pointed to sustained softness in Brazil’s AEM market, with little sign of recovery.

Indonesia: Ethylene Acrylic Elastomer (AEM) Import prices CIF Jakarta (USA), Indonesia, Grade- MV 29.

In Q3 2025, the Ethylene Acrylic Elastomer (AEM) prices in Indonesia have followed a declining price trend, with a 2.5% drop in prices. This decline has been driven by reduced demand across key sectors that rely on high-performance elastomers, including automotive and manufacturing. The market has also been impacted by global supply chain disruptions and fluctuations in raw material costs.

In September 2025, the Ethylene Acrylic Elastomer (AEM) price trend in Indonesia has continued to fall, with a further 2% decrease from the previous month. The sustained downturn has suggested that the Indonesian market has been facing ongoing challenges, with continued market pressure likely to persist unless demand improves or supply conditions stabilize.

Belgium: Ethylene Acrylic Elastomer Import prices CIF Antwerp (USA), Belgium, Grade- MV 29.

In Q3 2025, the Ethylene Acrylic Elastomer price trend in Belgium has followed a declining market trajectory, with a 2% decrease in prices. The market has been influenced by a combination of factors, including weaker demand in the automotive and industrial sectors, as well as fluctuations in raw material costs.

In September 2025, the Ethylene Acrylic Elastomer prices in Belgium have continued to experience a 2% price decline from the previous month, reinforcing the ongoing bearish trend. The price drop has reflected broader global market conditions and has suggested that Belgium’s AEM market has likely continued to face pressure in the near term.

India: Ethylene Acrylic Elastomer (AEM) Import prices CIF Nhava Sheva (USA), India, Grade- MV 29.

According to the PriceWatch, in Q3 2025, the Ethylene Acrylic Elastomer (AEM) price trend in India has shown relative stability, with only marginal changes in the market. The AEM prices in India have maintained a steady course despite global market fluctuations, reflecting consistent demand from automotive and industrial sectors. Factors such as local economic conditions, currency fluctuations, and global supply-demand dynamics have influenced the overall price trend in India.

However, in September 2025, the Ethylene Acrylic Elastomer (AEM) prices in India have experienced a slight 1% decline compared to the previous month. This change has been attributed to global shifts in raw material prices and supply chain disruptions, which have put downward pressure on the market.