Price-Watch’s most active coverage of Ethylene Vinyl Alcohol Copolymer (EVOH) price assessment:

- 32 mole% Ethylene Vinyl Alcohol Copolymer FOB Antwerp, Belgium

- 32 mole% Ethylene Vinyl Alcohol Copolymer FOB Shanghai, China

- 32 mole% Ethylene Vinyl Alcohol Copolymer FOB Tokyo, Japan

- 32 mole% Ethylene Vinyl Alcohol Copolymer FOB Kaohsiung, Taiwan

- 32 mole% Ethylene Vinyl Alcohol Copolymer FOB Texas, USA

- 32 mole% Ethylene Vinyl Alcohol Copolymer CIF JNPT_Japan, India

- 32 mole% Ethylene Vinyl Alcohol Copolymer CIF JNPT_Taiwan, India

- 32 mole% Ethylene Vinyl Alcohol Copolymer Ex-Delhi, India

- 32 mole% Ethylene Vinyl Alcohol Copolymer CIF Jakarta_USA, Indonesia

- 27 mole% Ethylene Vinyl Alcohol Copolymer FOB Houston, USA

- 27 mole% Ethylene Vinyl Alcohol Copolymer CIF Jakarta_USA, Indonesia

Ethylene Vinyl Alcohol Copolymer (EVOH) Price Trend Q3 2025

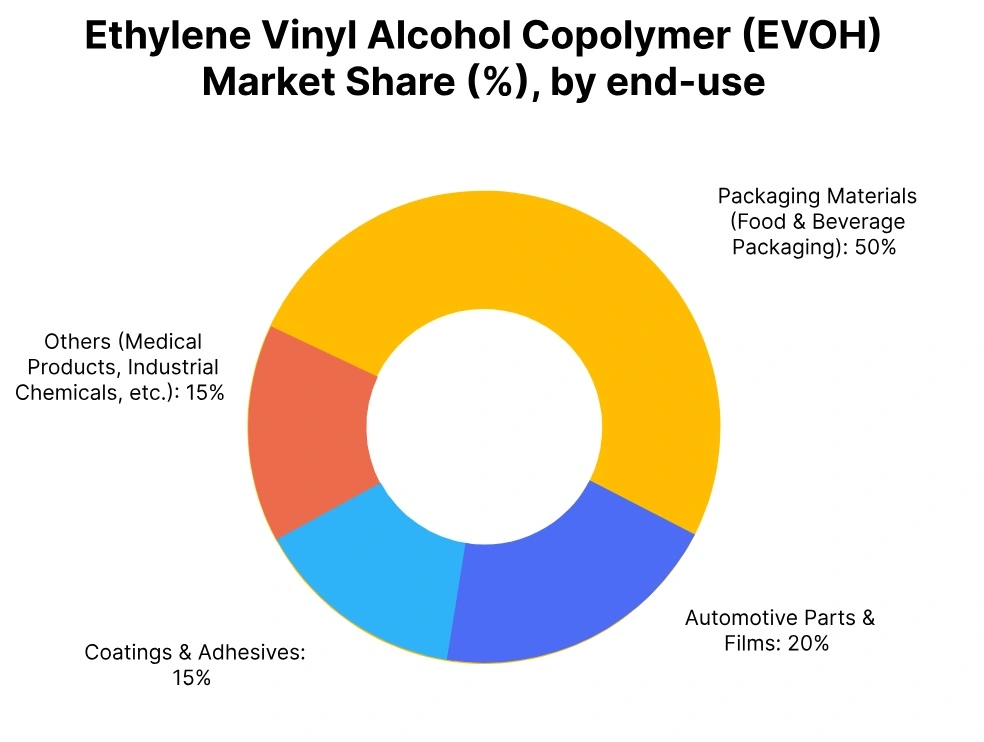

In Q3 2025, the global EVOH market experienced a mix of price increases and decreases across regions. Belgium and the USA saw marginal price rises, while countries like Japan, Taiwan, and Indonesia faced modest declines. These fluctuations were influenced by demand from key industries such as packaging, automotive, and chemicals.

In spite of the broader global slowdown, regions including China and India saw price growth, driven by steady industrial activity. In September 2025, EVOH prices in China and India continued to show positive trends, while other regions experienced more moderate price changes. The EVOH price trend in Q3 2025 highlighted regional differences in industrial demand and market conditions.

Belgium: Ethylene vinyl alcohol copolymer (EVOH) Export prices FOB Antwerp, Belgium, Grade- 32 mole% EVOH.

EVOH prices in Belgium increased by 0.1% in Q3 2025. This rise was driven by consistent demand from key sectors like packaging and automotive, which helped support higher prices. Belgium’s strong position in the European chemical industry allowed it to maintain steady prices despite global economic uncertainties. In September 2025, EVOH prices in Belgium remained stable, reflecting consistent industrial demand.

The Ethylene vinyl alcohol copolymer price trend in Belgium indicated that industrial activity stayed resilient in the region, even as broader global economic challenges continued. The moderate price growth reflected the ongoing strength of Belgium’s manufacturing and chemical industries.

USA: EVOH Export prices FOB Texas, USA, Grade- 32 mole% EVOH and 27 mole% EVOH.

EVOH prices in the USA saw a slight increase of 0.1% in Q3 2025. The rise was driven by steady demand in packaging and chemical industries, both of which assisted in sustain prices. Despite the global slowdown, the US market showed stable demand for EVOH. In September 2025, Ethylene vinyl alcohol copolymer (EVOH) prices in the USA continued to reflect modest growth, in line with steady industrial activity.

According to PriceWatch, the Ethylene vinyl alcohol copolymer (EVOH) price trend in the USA demonstrated that key sectors, particularly packaging, remained strong and contributed to the price increase. The slight rise was indicative of the resilience of these sectors in the face of broader global challenges.

Japan: EVOH Export prices FOB Tokyo, Japan, Grade- 32 mole% EVOH.

EVOH prices in Japan decreased by 0.9% in Q3 2025. This drop was mainly due to minimal demand from industries such as packaging and automotive, both of which faced production slowdowns. Japan’s manufacturing sector struggled, leading to reduced consumption of EVOH. In September 2025, Ethylene vinyl alcohol copolymer (EVOH) prices in Japan continued to face downward pressure, mirroring ongoing slowdowns in these key industries.

According to PriceWatch, the EVOH price trend in Japan mirrored the regional decline, driven by reduced industrial activity and diminished demand for materials like EVOH in production processes. As a result, the price decrease continued throughout the quarter.

Taiwan: EVOH Export prices FOB Kaohsiung, Taiwan, Grade- 32 mole% EVOH.

EVOH prices in Taiwan dropped by 1.0% in Q3 2025, primarily due to slight demand from sectors like packaging and automotive. These industries, which are major consumers of ethylene vinyl alcohol copolymer, faced production slowdowns, contributing to lower prices. Taiwan’s reliance on imports also made it more vulnerable to changes in global price trends, which affected local pricing.

In September 2025, EVOH prices in Taiwan continued to show a downward trend, reflecting the ongoing challenges in these sectors. The EVOH price trend in Taiwan mirrored the broader market slowdown, as reduced consumption from key industries led to lower prices.

China: Ethylene vinyl alcohol copolymer Export prices FOB Shanghai, China, Grade- 32 mole% EVOH.

EVOH prices in China increased by 1.0% in Q3 2025, driven by steady demand from key industries like packaging and automotive. Despite global economic challenges, China’s industrial sectors remained resilient, supporting the price growth. As manufacturing output in China remained stable, EVOH demand continued to rise.

According to PriceWatch, in September 2025, EVOH prices in China continued to reflect this upward trend, showing growth. The Ethylene vinyl alcohol copolymer (EVOH) price trend in China indicated that the market remained strong, with continued demand for packaging materials and other industrial applications helping to drive price increases despite a global economic slowdown.

India: EVOH Import prices CIF Nhava Sheva, India, Grade- 32 mole% EVOH.

EVOH prices in India, importing from Taiwan, went up by 1.4% in Q3 2025. The price rise was driven by steady demand from industries such as packaging, automotive, and chemicals. In spite of the global economic slowdown, India’s industrial consumption of EVOH remained strong, contributing to higher prices. The increase in import costs and rising demand for raw materials further supported the price growth.

According to PriceWatch, in September 2025, EVOH prices in India continued to reflect this upward trend, mirroring the positive demand for packaging materials in the country. The EVOH price trend in India showed resilience, driven by strong demand across key sectors.

Indonesia: Ethylene vinyl alcohol copolymer Import prices CIF Jakarta, Indonesia, Grade- 32 mole% EVOH and 27 mole% EVOH.

EVOH prices in Indonesia, importing from the USA, dipped by 0.4% in Q3 2025. This decrease was largely driven by reduced demand in key sectors like packaging and automotive, which experienced slowdowns in production. As industrial activity in Indonesia slowed, EVOH prices reflected weaker consumption patterns in these sectors.

In September 2025, EVOH prices in Indonesia continued to follow the downward trend, reflecting subdued industrial activity. The Ethylene vinyl alcohol copolymer (EVOH) price trend in Indonesia mirrored the broader market slowdown, influenced by reduced demand from key industries, especially those relying heavily on EVOH for production processes.