Price-Watch’s most active coverage of Expandable Polystyrene (EPS) price assessment:

- General Grade (Bead Size: 0.5-1.10) FD Hamburg, Germany

- General Grade (Bead Size: 0.5-1.10) FD Amsterdam, Netherlands

- General Grade (Bead Size: 0.5-1.25) CIF Jebel Ali (China), United Arab Emirates

- General Grade (Bead Size: 0.5-1.25) FOB Shanghai, China

- General Grade (Bead Size: 0.5-1.25) CIF Jeddah (China), Saudi Arabia

- General Grade (Bead Size: 0.5-1.25) CIF Bangkok (China), Thailand

- High Expansion (Bead Size: 0.5-1) Ex-Mumbai, India

Expandable Polystyrene Price Trend Q3 2025

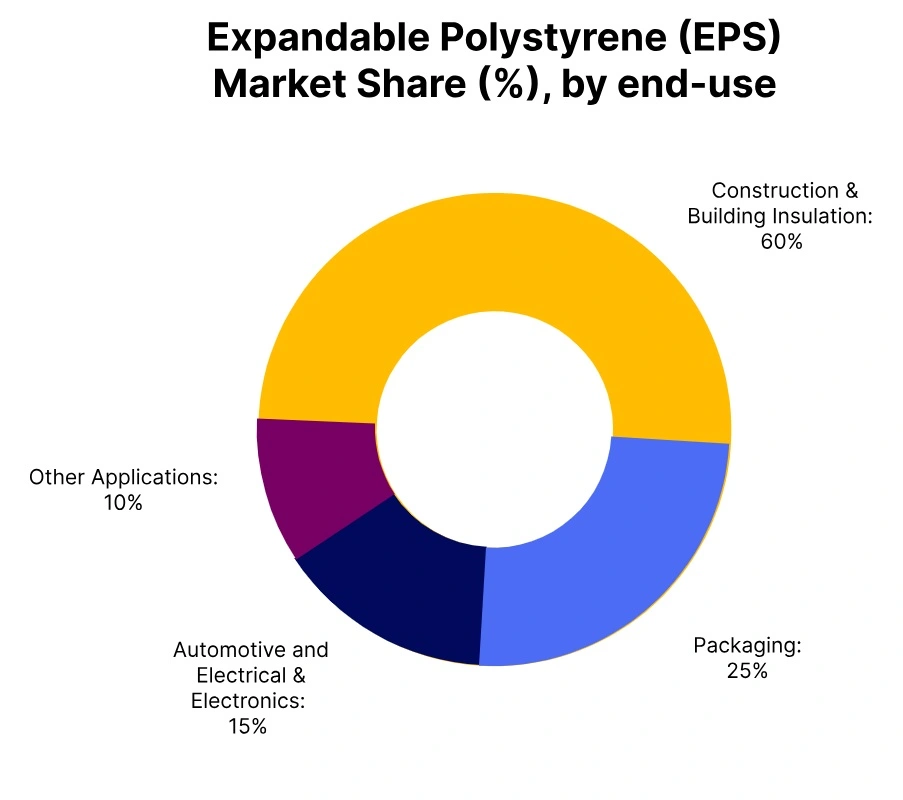

In Q3 2025, the global expandable polystyrene price trend has been consistently showing a downward trajectory across multiple regions. Prices have been continuously declining due to weaker demand from downstream industries such as construction and packaging. The expandable polystyrene price trend has been influenced by an oversupply in many markets, combined with a slowdown in economic activity globally.

While supply levels have been remaining stable, the lack of significant demand from key sectors has been keeping prices under pressure. The expandable polystyrene price trend has also been affected by ongoing uncertainties in global markets, including rising raw material costs and fluctuating freight prices. Overall, the EPS price trend has been indicating a broader market slowdown, where regional price decreases have been remaining consistent across most regions.

Germany: Expandable Polystyrene Domestically Traded prices FD Hamburg, Germany, Grade General Grade (Bead Size: 0.5-1.10).

In Germany, the expandable polystyrene price trend has been showing a significant decline of 7.3% in Q3 2025, with prices having been ranging between 1800–1820 USD. The EPS price trend in Germany has been influenced by low demand in key industries such as packaging and construction. As the market has been continuing to face economic challenges, procurement activity has been weakening.

The expandable polystyrene price trend has been reflecting this downturn, as suppliers have been finding it difficult to maintain price stability in the face of reduced demand. Despite stable supply, the market has been experiencing an oversupply of product, contributing to the continuous decline in prices. The EPS price trend in Germany has been reflecting the broader European slowdown and uncertainty.

In September 2025, Expandable polystyrene prices in Germany have been decreasing by 2.8%. Prices have been weakening as sluggish demand from the packaging and insulation sectors has been coinciding with comfortable stock levels across the region. The downturn in Styrene Monomer costs, following lower Crude Oil and Naphtha values, has been reducing production expenses for manufacturers, prompting competitive price adjustments.

Additionally, mild weather conditions and weaker construction activity in Germany have been dampening overall consumption. Market participants have been reporting that converters have been adopting a cautious approach toward fresh procurement amid economic uncertainty and steady material availability.

Netherlands: EPS Domestically Traded prices FD Amsterdam, Netherlands, Grade General Grade (Bead Size: 0.5-1.10).

In the Netherlands, the expandable polystyrene (EPS) price trend has been showing a similar decline of 7.6% in Q3 2025, following a downward movement observed in neighbouring Germany. The EPS price trend has been shaped by weak demand, especially in sectors like packaging and construction, which have been struggling due to economic uncertainty. Prices have been falling consistently, as the market has not been seeing the necessary uptick in demand to counterbalance the steady supply.

The expandable polystyrene (EPS) price trend in the Netherlands has also been affected by sluggish procurement activities, as industries have been holding off on purchases amidst the broader market slowdown. The EPS price trend has been continuing downward, signalling a challenging market environment for suppliers.

In September 2025, EPS prices in the Netherlands have been decreasing by 2.7%. The decline has been primarily influenced by lacklustre domestic demand and sufficient supply across the Benelux region. Softer feedstock Styrene values, coupled with limited cost support from upstream markets, have been keeping producers under pressure to reduce their quotations.

Buyers have been remaining hesitant to build inventories ahead of seasonal slowdowns, while distributors have been attempting to clear older stocks. Additionally, competition among regional producers has been intensifying as neighbouring European markets have been mirroring a similar downtrend. The combination of reduced downstream activity and muted export inquiries has been leading to an overall bearish sentiment.

UAE: Expandable polystyrene (EPS) Imported prices CIF Jebel Ali, UAE from China, Grade General Grade (Bead Size: 0.5-1.25).

According to the PriceWatch, in the United Arab Emirates, Expandable polystyrene imported prices have been seeing a moderate decrease of 2.5% in Q3 2025. The expandable polystyrene price trend has been driven by a combination of weak demand in the packaging sector and a generally slow recovery in construction activity. The EPS price trend in the UAE has been reflecting a market where purchasing activity has not been picking up significantly, despite relatively stable supply.

This sluggish demand has been resulting in continuous downward pressure on prices. The EPS price trend has been more muted than in Europe, but the overall market has still been showing signs of cautious pricing behaviour as downstream industries in the region have been holding back on large-scale procurements.

In September 2025, EPS prices in the UAE have decreased by 0.3%. The market has been witnessing a marginal decline as weaker demand from domestic processors has been coinciding with stable supply availability. Imports from China have been softening amid falling export offers driven by sluggish Chinese consumption and slightly lower freight rates on key shipping routes.

Buyers in the UAE have been adopting a conservative procurement strategy, preferring to utilize existing inventories rather than commit to new orders at prevailing levels. Competitive pricing from other Asian suppliers has been further restricting upward movement.

China: Expandable polystyrene Export prices FOB Shanghai, China, Grade General Grade (Bead Size: 0.5-1.25).

According to the PriceWatch, in China, expandable polystyrene export prices have been showing a decline of 3.4% in Q3 2025. The EPS price trend has beern reflecting weakened demand from global markets, particularly from the packaging and construction sectors. The EPS price trend in China has been influenced by oversupply, where production has been outpacing demand, resulting in a steady reduction in prices.

As international demand for Polystyrene has not been increasing significantly, the EPS price trend in China has been continuing to show a downward trajectory. Despite stable supply, the expandable polystyrene price trend has been pressured by the global slowdown and the lack of large-scale procurement from key international buyers. In September 2025, EPS prices in China have decreased by 1.9%.

The fall in prices has been attributed to easing feedstock Styrene costs and weaker domestic demand across key consumption sectors, including packaging and consumer goods. With downstream converters having been operating at reduced rates, producers have been lowering offers to encourage sales and sustain export competitiveness.

International inquiries from the Middle East and Southeast Asia have been remaining limited, further dampening sentiment. Moreover, sufficient domestic inventories and restricted logistics activity ahead of the holiday season have been adding to the bearish tone. Traders have been reporting increased competition among suppliers seeking to move material before quarter-end.

Saudi Arabia: EPS Imported prices CIF Jeddah, Saudi Arabia from China, Grade General Grade (Bead Size: 0.5-1.25).

According to the PriceWatch, in Saudi Arabia, EPS imported prices have been going down by 2.2% in Q3 2025, following a moderate decline in the expandable polystyrene price trend. The EPS price trend in Saudi Arabia has been influenced by softer demand from industries like packaging and construction. While supply levels have been remaining steady, procurement activity has been staying low, contributing to a price decline.

The EPS price trend in Saudi Arabia has been continuing to show a downward movement, with market participants having been hesitant to make large purchases in light of economic uncertainty. This mild reduction in prices has been reflecting the broader challenges facing the region, with slower-than-expected recovery in key industrial sectors.

In September 2025, Expandable polystyrene prices in Saudi Arabia have increased by 0.1%. Prices have been edging slightly higher as regional demand from packaging and construction segments has been holding firm despite global softness. Chinese exporters have been maintaining steady offers supported by consistent buying interest from Saudi converters. Limited spot cargoes in the export market have been providing mild support to prices, while freight rates have been remaining stable.

Buyers in Jeddah have been continuing to secure moderate quantities to meet ongoing requirements, contributing to a balanced market structure. Although overall trading volumes have been remaining modest, sentiment has been staying cautiously positive amid stable regional consumption. It has been advised to secure short-term requirements as expandable polystyrene prices have been remaining steady with limited volatility ahead.

Thailand: EPS Imported prices CIF Bangkok, Thailand from China, Grade General Grade (Bead Size: 0.5-1.25).

In Thailand, EPS imported prices have been decreasing by 3.1% in Q3 2025, following the broader EPS price trend across Asia. The expandable polystyrene price trend has been showing a reduction in line with weakened demand in both the construction and packaging sectors. The market has not been seeing the necessary uptick in procurement, keeping prices under pressure.

The EPS price trend in Thailand has been largely driven by the same factors affecting other Asian markets, with stable supply levels not having been preventing the ongoing price declines. The EPS price trend in Thailand has been reflecting a global slowdown in demand, resulting in a consistent reduction in prices across key sectors. In September 2025, EPS prices in Thailand have decreased by 4.00%.

Prices have been dropping sharply as oversupply conditions from Chinese exporters have been meeting subdued demand in Thailand’s packaging and appliance sectors. Freight rate reductions and aggressive price competition among suppliers have been amplifying the downtrend. Domestic converters have been delaying new purchases amid expectations of further declines, while inventory levels have been remaining sufficient to cover short-term consumption.

Market participants have also been citing limited construction activity and lower feedstock costs as contributing factors to the bearish tone. Sellers have been compelled to reduce offers to stimulate buying interest. It has been suggested to procure cautiously as EPS prices have been likely remaining weak through the upcoming trading sessions.

India: EPS Domestically Traded prices Ex-Mumbai, India, Grade High Expansion (Bead Size: 0.5-1).

According to the PriceWatch, in India, EPS domestically traded prices have been seeing a significant decline of 9.4% in Q3 2025, marking one of the sharpest reductions in the EPS price trend for the quarter. The EPS price trend in India has been driven by a substantial decrease in demand from industries such as packaging, construction, and insulation.

The EPS price trend in India has been reflecting a market that has been underperforming, as economic difficulties and reduced consumer spending have been limiting industrial activity. Despite stable supply, the EPS price trend in India has been continuing downward, driven by the lack of strong purchasing activity and the broader economic slowdown. This sharp decline in prices has been reflecting a more pronounced regional challenge in India compared to other regions.

In September 2025, EPS prices in India have dropped by 0.9%. Domestic EPS prices have been slipping marginally amid moderate demand from insulation, packaging, and consumer goods manufacturers. Stable styrene monomer prices have been limiting cost support for producers, while converters have been purchasing conservatively given steady inventory positions.

The market has been remaining influenced by lower international benchmarks, with competitive imports having been exerting mild downward pressure. Seasonal demand constraints and cautious sentiment among downstream players have been restricting trading momentum.

Distributors have been focusing on clearing existing stocks ahead of the upcoming quarter, keeping overall sentiment subdued. It has been recommended to cover only immediate needs as EPS prices have been anticipated to stay range-bound with limited upside potential in the near term.