Price-Watch’s most active coverage of Fatty Alcohol Ethoxylates (FAE) price assessment:

- C10 based Surfactant Grade(99% min) FOB Shanghai, China

- C10 based Surfactant Grade(99% min) CIF Nhava Sheva (China), India

- C10 based Surfactant Grade(99% min) CIF Busan (China), South Korea

- C10 based Surfactant Grade(99% min) CIF Sydney (China), Australia

Fatty Alcohol Ethoxylates (FAE) Price Trend Q3 2025

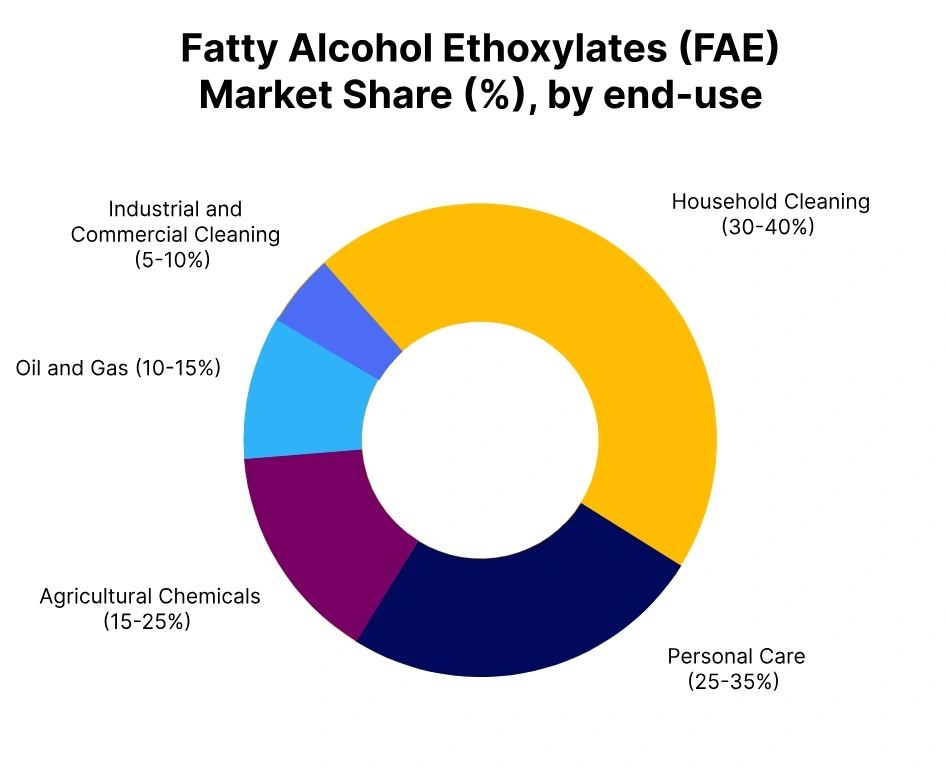

In Q3 2025, the global Fatty Alcohol Ethoxylates (FAE) market exhibited moderate stability with regional variations. The price trend for FAE varied by 0-2% during the July-September 2025 quarter, influenced by stable feedstock costs, energy prices, and regional supply chain dynamics. Though there were some fluctuations in upstream factors, steady demand from industries like personal care, cleaning, and textiles helped maintain price stability. Ongoing expansions in production capacity and adjustments in supply chains are expected to contribute to stable prices in the upcoming quarter.

China: Fatty Alcohol Ethoxylates (FAE) Export price from China, C10 based (purity 80%) Grade.

In the third quarter of 2025, Fatty Alcohol Ethoxylate price in China is experiencing a modest increase. Seasonal demand recovery, particularly in sectors like detergents and personal care, is driving higher consumption, specifically in the second half of the quarter. This surge in demand is absorbing some of the oversupply from the previous quarter, contributing to the price uptick. Freight movement is better, although global shipping costs remain higher than average.

Chinese exporters are balancing production to prevent excess inventory buildup, and feedstock costs, particularly for Ethylene, remain stable. Geopolitical uncertainties concerning trade relations could introduce volatility, but seasonal demand from Asia and the Middle East is supporting moderate growth. Fatty Alcohol Ethoxylate price trend in China reflects a modest increase of 0.93% in Q3 2025.

India: Fatty Alcohol Ethoxylates (FAE) import price in India from China, C10 based (purity 80%) Grade.

According to Price-Watch, In India, the Fatty Alcohol Ethoxylate price is also seeing a moderate increase in the third quarter of 2025. Post-summer demand from personal care and textiles is driving consumption as production goes up for the end-of-year season. Chinese producers are changing their output to meet rising demand, helping to balance the oversupply situation. Freight rates are improving slightly, with reduced congestion, even though global shipping costs continue to influence import costs.

Geopolitical uncertainties remain, but they have less impact on demand in India. Feedstock prices, particularly for Ethylene, are slowly increasing, exerting upward pressure on production costs. The Fatty Alcohol Ethoxylate price trend in India is displaying a 1.77% increase in Q3 2025.

South Korea: Fatty Alcohol Ethoxylates (FAE) import price in South Korea from China, C10 based (purity 80%) Grade.

In South Korea, the Fatty Alcohol Ethoxylate price is stabilizing with a small increase in the third quarter of 2025. Seasonal demand recovery in personal care, detergent, and textile sectors is helping to absorb oversupply, resulting in a moderate price uptick. Freight conditions are improving slightly, even though global supply chain uncertainties continue to impact shipping costs.

Chinese producers are adjusting their output to align with seasonal demand. Feedstock costs, especially fatty alcohol and Ethylene, remain stable, with minor fluctuations tied to global oil prices. Geopolitical and economic factors, such as trade relations with China, may influence the market, but the overall trend is positive. The Fatty Alcohol Ethoxylate price trend in South Korea is reflecting a 0.97% increase in Q3 2025.

Australia: Fatty Alcohol Ethoxylates (FAE) import price in Australia from China, C10 based (purity 80%) Grade.

In Australia, Fatty Alcohol Ethoxylate price is recovering slightly in the third quarter of 2025. A seasonal increase in demand from personal care, detergent, and textile sectors is boosting consumption and helping to absorb oversupply. But Chinese producers may continue to face inventory management issues, potentially stabilizing prices rather than seeing a significant increase. Freight rates are easing marginally as the peak shipping season ends, but global shipping costs remain elevated due to supply chain issues.

Feedstock costs for Ethylene are stable, though moderate production cost growth is expected due to slight increases in global oil prices. Geopolitical uncertainties, particularly regarding trade relations between China and major markets, are affecting export conditions, but overall, the market is experiencing a slight price uptick. The Fatty Alcohol Ethoxylate price trend in Australia is showing a 0.47% increase in Q3 2025.