Price-Watch’s most active coverage of Fluff pulp price assessment:

- Untreated Softwood (Brightness ≥ 86%) FOB Houston, USA

- Untreated Softwood (Brightness ≥ 86%) CIF Genoa (USA), Italy

- Untreated Softwood (Brightness ≥ 86%) CIF Hamburg (USA), Germany

- Untreated Softwood (Brightness ≥ 86%) CIF Shanghai (USA), China

- Untreated Softwood (Brightness ≥ 86%) CIF Nhava Sheva (USA), India

- Untreated Softwood (Brightness ≥ 86%) Ex-Mumbai, India

Fluff Pulp Price Trend Q3 2025

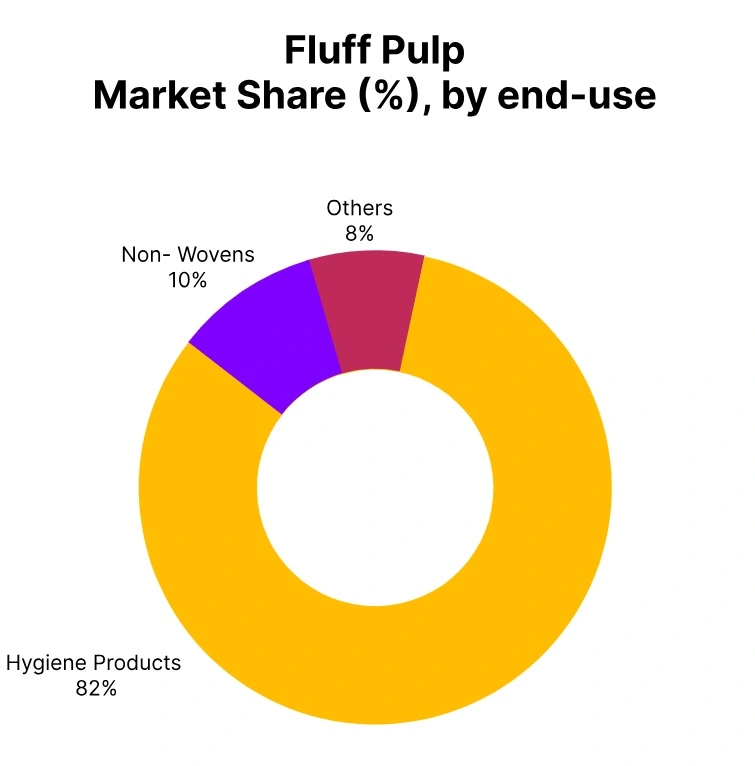

In Q3 2025, the global Untreated Softwood Fluff Pulp market remained largely stable, supported by balanced supply and steady demand from hygiene, tissue, and specialty paper manufacturers. In North America, export prices held firm as producers maintained consistent production and inventory levels, while regional buyers continued regular offtake. Europe recorded modest price gains or stability, reflecting healthy demand and occasional logistics constraints, with downstream consumption remaining steady.

Across Asia, Fluff Pulp price trends were mixed East Asia maintained neutral levels amid sufficient inventories and balanced supply-demand conditions, while South Asia saw notable upward movement driven by robust seasonal demand and competitive sourcing amid limited vessel availability. Overall, the market demonstrated steady trading activity through the quarter, with Fluff Pulp price trend largely supported by equilibrium between supply and measured procurement across major regions.

United States: Fluff Pulp price in the USA, Grade: Untreated Softwood (Brightness ≥ 86%).

In Q3 2025, the Fluff Pulp (Untreated Softwood) export price in the USA has remained nearly stable amid balanced global demand from absorbent hygiene and specialty paper manufacturers. FOB Houston prices have inched up by 0.1%, trading between USD 940–970 per metric ton. Suppliers have reported steady production rates and ample inventory levels, while buyers have maintained regular offtake across North American and Latin American markets. Logistics conditions have been favourable, supporting consistent shipment schedules.

Overall sentiment has been neutral, with neither significant upward nor downward price pressure during the quarter. The Fluff Pulp price trend in the USA has shown minimal fluctuation amid balanced supply and demand. In September 2025, Fluff Pulp prices in the USA have remained within USD 940–970 per metric ton, reflecting overall stability.

Italy: Fluff Pulp price in Italy imported from the USA, Grade: Untreated Softwood (Brightness ≥ 86%).

In Q3 2025, the Fluff Pulp (Untreated Softwood) import price in Italy has risen modestly amid firm demand from tissue and specialty paper producers. CIF Genoa prices have increased by 0.4%, ranging between USD 980–1100 per metric ton. European buyers have faced steady supply flows from the USA but have competed for vessel space amid seasonal logistics constraints.

Downstream consumption has held steady, driven by hygiene product manufacturers, while inventory levels have remained moderate. The slight Fluff Pulp price trend uptick has reflected healthy demand and tight freight capacity during the quarter. The Fluff Pulp price trend in Italy has indicated a steady upward tone supported by firm demand. In September 2025, Fluff Pulp prices in Italy have stood within USD 980–1100 per metric ton, maintaining stable performance.

Germany: Fluff Pulp price in Germany imported from the USA, Grade: Untreated Softwood (Brightness ≥ 86%).

In Q3 2025, the Fluff Pulp (Untreated Softwood) import price in Germany has remained stable due to balanced supply and demand. CIF Hamburg prices have stayed flat quarter-on-quarter at USD 990–1100 per metric ton. Import volumes from the USA have been consistent, with downstream hygiene and specialty paper industries maintaining regular procurement.

Freight and logistics conditions have eased slightly compared to the previous quarter, but overall buying sentiment has stayed cautious amid ample onshore inventories. The net result has been minimal price movement and a steady trading environment. The Fluff Pulp price trend in Germany has remained stable amid balanced fundamentals. In September 2025, Fluff Pulp prices in Germany have hovered around USD 990–1100 per metric ton, reflecting ongoing steadiness.

China: Fluff Pulp price in China imported from the USA, Grade: Untreated Softwood (Brightness ≥ 86%).

In Q3 2025, the Fluff Pulp (Untreated Softwood) import price in China has held steady as demand from hygiene product and tissue manufacturers has matched stable supply. CIF Shanghai prices have remained unchanged at USD 990–1100 per metric ton. American shipments have filled available port slots smoothly, and downstream buyers have maintained steady consumption. Inventory levels at mills and converters have been sufficient to meet ongoing production needs, while freight costs have stabilized after mid-quarter.

Overall, market conditions have been balanced, with pricing remaining effectively neutral. The Fluff Pulp price trend in China has exhibited steady behaviour amid consistent demand. In September 2025, Fluff Pulp prices in China have continued within USD 990–1100 per metric ton, showing balanced trading conditions.

India: Fluff Pulp price in India imported from the USA, Grade: Untreated Softwood (Brightness ≥ 86%).

According to Price-Watch, In Q3 2025, the Fluff Pulp (Untreated Softwood) import price in India has recorded a strong increase amid robust demand from hygiene and absorbent product manufacturers. CIF Nhava Sheva prices have climbed 3.2% to USD 1000–1100 per metric ton. Buyers have competed for limited vessel slots and spot volumes as downstream consumption has accelerated, driven by seasonal hygiene product production.

Inventory drawdowns have prompted replenishment purchases despite elevated freight costs. The firming price has reflected tight supply dynamics and heightened offtake across key end-use segments. The Fluff Pulp price trend in India has shown a firm upward tone supported by strong demand. In September 2025, Fluff Pulp prices in India have stayed between USD 1000–1100 per metric ton, maintaining an upward trajectory.