Price-Watch’s most active coverage of Fluoroelastomer (FKM) price assessment:

- Terpolymer (MV 60) FOB Houston, USA

- Copolymer (MV 53) FOB Tokyo, Japan

- Copolymer (MV 65) FOB Shanghai, China

- Terpolymer (MV 68) FOB Rotterdam, Netherlands

- Copolymer (MV 65) CIF Nhava Sheva (China), India

- Copolymer (MV 53) CIF Nhava Sheva (Japan), India

- Copolymer (MV 65) CIF Haiphong (China), Vietnam

- Terpolymer (MV 60) CIF Jakarta (USA), Indonesia

Fluoroelastomer (FKM) Price Trend Q3 2025

In Q3 2025, global Fluoroelastomer price trend witnessed moderate growth with a 1-2% change in the market in major regions. Japan, South Korea, and Indonesia in the APAC region experienced robust demand from the automotive, chemical, and industrial industries, which led to consistent price hikes. The growth is mainly led by demand for high-performance seals and components that can resist heat, chemicals, and fuel.

North America witnessed a steady market pattern, with modest price increases resulting from continuous demand in the automotive and industrial sectors and stable raw material prices. Europe’s market saw some pressure, but overall demand continued to be strong, which helped cause a more subdued price alteration in the quarter. Worldwide, the Fluoroelastomer industry is resilient, with raw material prices and supply chain operations still driving price trends among these markets.

USA: Fluoroelastomer (FKM) Export prices FOB Houston, USA, Grade- Terpolymer (MV 60).

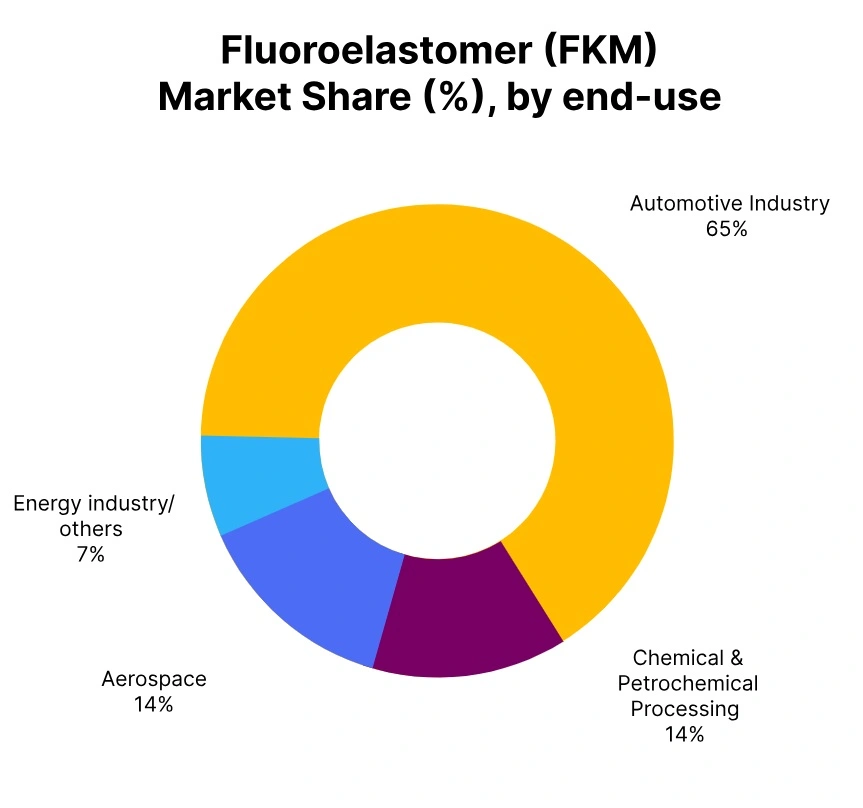

According to PriceWatch, in Q3 2025, USA Fluoroelastomer price trend has been upward with a general 3.08% price increase on FOB Houston basis. US FKM price trend has been sustained by stable demand from major industrial end-use markets, such as automotive, aerospace, and chemical processing, where FKM is extensively used in high-performance seals, gaskets, and components.

Factors such as stable raw material costs, balanced supply-demand conditions, and consistent downstream consumption contributed to the quarterly increase. In September 2025, FKM prices in the US rose by around 0.7% compared to the previous month, driven by continued procurement activity and limited inventory levels among distributors. The Fluoroelastomer price trend in the USA is expected to remain stable to slightly firm heading into the next quarter.

Japan: Fluoroelastomer (FKM) Export prices FOB Tokyo, Japan, Grade- Copolymer (MV 53).

According to PriceWatch, during Q3 2025, Fluoroelastomer (FKM) price trend in Japan increased by 2.61% on FOB Tokyo basis. The Fluoroelastomer price trend in Japan has been boosted during the quarter by firm demand from the automotive and electronics industries, where FKM is used in seals, gaskets, and other high-performance parts demanding good heat and chemical resistance. Good availability of feedstocks and firm downstream consumption underpinned the quarter’s rise.

In September 2025, Fluoroelastomer prices in Japan rose by about 0.3% from the preceding month, as a result of healthy buying activity and balanced supply levels. The trend in Japan for Fluoroelastomer prices is anticipated to stay strong in the near quarter driven by stable industrial demand.

China: Fluoroelastomer (FKM) Export prices FOB Shanghai, China, Grade Copolymer (MV 65).

Fluoroelastomer (FKM) price trend in China dropped by 3.48% on FOB Shanghai basis in Q3 2025. The price trend of FKM prices in China became weaker because of weak demand from the industrial and automotive industries, supported by adequate supply from local producers. Weaker downstream consumption of high-performance elastomers and moderate competition among producers imposed a downward pressure on prices throughout the quarter.

During September 2025, Fluoroelastomer prices in China fell approximately 1.2% from the previous month, driven by cautious purchases and stable availability of feedstocks. The FKM price trend in China will continue to be weak in the short term in face of lacklustre demand recovery.

Netherlands: Fluoroelastomer (FKM) Export prices FOB Rotterdam, Netherlands, Grade Terpolymer (MV 68).

During Q3 2025, Fluoroelastomer (FKM) price trend in the Netherlands fell by 1.8% on FOB Rotterdam basis. The Fluoroelastomer price trend in the Netherlands weakened on account of moderate demand from the automotive and chemical processing industries, together with economic supply levels throughout the region. Stable feedstock prices and subdued downstream activity helped fuel the marginal quarterly decrease in prices.

Fluoroelastomer prices in the Netherlands decreased by approximately 0.5% during September 2025 versus the preceding month, influenced by stable market sentiment and defensive buying by end-use sectors. The Fluoroelastomer price movement in the Netherlands is likely to be stable with modest bearish pressure in the short term.

India: Fluoroelastomer (FKM) import price CIF Nhava Sheva (China), India, Grade- Copolymer (MV 65).

According to PriceWatch, in Q3 2025, Fluoroelastomer (FKM) import prices in India increased by 1.0% CIF Nhava Sheva (China). The FKM price trend in India strengthened due to steady demand from the automotive, chemical, and industrial manufacturing sectors. Improved consumption of sealing materials and gaskets, coupled with moderate import costs and stable currency movement, supported the quarterly increase.

In September 2025, Fluoroelastomer prices in India rose by around 1.3% compared to the previous month, driven by consistent procurement activity and limited inventory among local distributors. The Fluoroelastomer price trend in India is expected to remain firm, supported by sustained demand from downstream industries.

Vietnam: Fluoroelastomer (FKM) import price CIF Haiphong (China), Vietnam, Grade Copolymer (MV 65).

In Q3 2025, Fluoroelastomer (FKM) import prices in Vietnam decreased by 3.0% CIF Haiphong (China). The Fluoroelastomer price trend in Vietnam weakened due to subdued demand from the automotive and industrial sectors, along with sufficient import availability in the domestic market. Lower procurement activity from downstream manufacturers and competitive offers from Chinese suppliers contributed to the quarterly decline.

In September 2025, Fluoroelastomer prices in Vietnam decreased by around 1.1% compared to the previous month, reflecting continued market softness and cautious buying sentiment. The FKM price trend in Vietnam is expected to remain slightly bearish in the near term amid moderate demand conditions.

Indonesia: Fluoroelastomer (FKM) import price CIF Jakarta (USA), Indonesia, Grade Terpolymer (MV 60).

In Q3 2025, Fluoroelastomer (FKM) prices in Indonesia increased by 2.0% CIF Jakarta (USA). The FKM price trend in Indonesia Showed supported by steady demand from the automotive, chemical, and industrial sectors, where fluoroelastomer is used in high-performance seals, gaskets, and components. Moderate procurement activity from downstream manufacturers and limited supply availability contributed to the quarterly increase.

In September 2025, Fluoroelastomer prices in Indonesia rose by around 0.6% compared to the previous month, reflecting sustained buying interest and stable import conditions. The Fluoroelastomer price trend in Indonesia is expected to remain firm in the near term, supported by continued industrial demand.