Price-Watch’s most active coverage of Fumaric Acid price assessment:

- (98.5% min) Technical Grade Powder FOB Shanghai, China

- (98.5% min) Technical Grade Powder CIF Nhava Sheva China, India

- (98.5% min) Technical Grade Powder CIF Haiphong China, Vietnam

- (98.5% min) Technical Grade Powder CIF Santos China, Brazil

- (98.5% min) Technical Grade Powder CIF Jakarta China, Indonesia

- (98.5% min) Technical Grade Powder CIF Houston China, USA

- (98.5% min) Technical Grade Powder CIF Manzanillo China, Mexico

- (98.5% min) Technical Grade Powder CIF Manila China, Philippines

Fumaric Acid Price Trend Q3 2025

In Q3 2025, Fumaric Acid prices went down to across most countries due to weak demand and oversupply. The Philippines saw the steepest drop at 11%, followed by the USA (10%), Indonesia (9%), and China and Mexico (8% each).

Vietnam recorded a 7% decline, matching India’s 5% fall. On the other hands, Brazil was the only market to witness a price increase of 7%, driven by steady demand and limited supply. China’s price decrease stemmed from sluggish demand and oversupply, while India faced weak industrial activity and competition from imports.

Vietnam and Indonesia were impacted by sufficient inventories and reduced demand. The USA and Mexico experienced subdued purchasing, and the Philippines saw slower buying sentiment. Brazil’s strong demand supported its upward trend.

China: Fumaric Acid Export Prices FOB Shanghai, China, Grade- (98.5% min) Technical Grade.

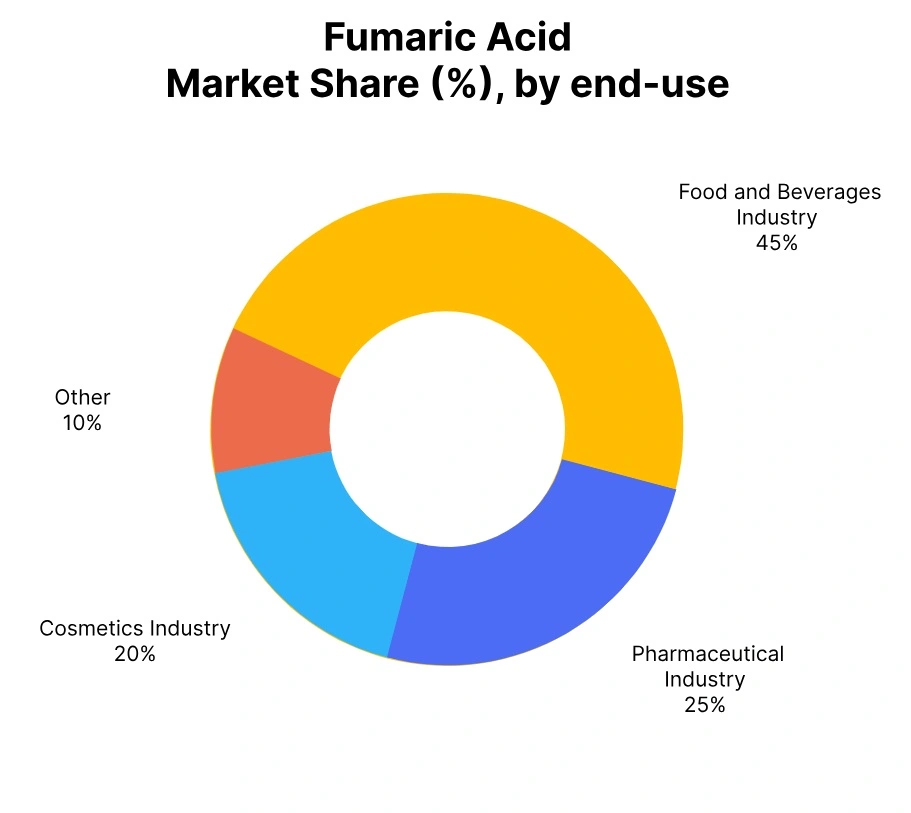

According to Price-Watch, in Q3 2025, Fumaric Acid price in China declined by 8% in contrast to the previous quarter, continuing the downward trend observed in Q2 2025, where prices had already fallen by 7%. The Fumaric Acid price trend in China was mainly influenced by sluggish demand from downstream industries such as food and beverages, cosmetics, and pharmaceuticals.

In spite of stable production rates, oversupply in the domestic market, coupled with weak export activity, exerted pressure on prices. Furthermore, high inventory levels and a slow recovery in global consumption further weighed on market sentiment.

Fumaric Acid price in September 2025 reflected these bearish market conditions, leading to a noticeable drop. The sustained softness in key end-use industries is expected to shape pricing dynamics in the upcoming quarter.

India: Fumaric Acid Import prices CIF Nhava Sheva, India, Grade- (98.5% min) Technical Grade.

According to Price-Watch, in Q3 2025, the Fumaric Acid price in India went down by 5% compared to the previous quarter, continuing the downward trajectory observed since Q2. The Fumaric Acid price trend in India was affected by sluggish activity in the pharmaceutical and cosmetics industries, while the food and beverages sector maintained moderate demand.

Competitive import offers from China and ample domestic stock levels led to a drop in procurement urgency. Fumaric Acid prices in September 2025 reflected this bearish outlook, due to decreased support from local buyers. Despite the decrease, some short-term demand from food processing provided minimal resistance to the overall softening of the market.

Vietnam: Fumaric Acid Import prices CIF Haiphong, Vietnam, Grade- (98.5% min) Technical Grade.

The Fumaric Acid price in Vietnam dipped by 7% in Q3 2025 compared to Q2, due to slow demand and easing freight constraints. The Fumaric Acid price trend in Vietnam moved downward as inventories stayed sufficient to meet the requirements of the food and beverages and cosmetics industries.

Lower raw material costs in China supported a fall in export offer prices. Fumaric Acid prices in September 2025 mirrored this softness, with buyers refraining from bulk procurement.

Pharmaceutical grade fumaric acid imports declined, indicating lower production output. Weak downstream activity contributed to the negative pricing environment despite seasonal fluctuations in food processing demand.

Brazil: Fumaric Acid Import prices CIF Santos, Brazil, Grade- (98.5% min) Technical Grade.

In Q3 2025, Fumaric Acid price in Brazil saw a 7% increase compared to the previous quarter, driven by steady demand from the food and beverages and cosmetics industries. The Fumaric Acid price trend in Brazil was swayed by tight supply conditions from China and a rise in freight costs.

Local demand remained stable, particularly from the pharmaceutical industry, which supported market sentiment despite slower industrial output. As a result, Fumaric Acid prices in September 2025 reflected the upward pressure.

Seasonal procurement in the food sector and limited inventory buildup from Q2 also contributed to price resilience during the quarter. Market participants continued to review Chinese export activity and logistical constraints for Q4 projections.

Indonesia: Fumaric Acid Import prices CIF Jakarta, Indonesia, Grade- (98.5% min) Technical Grade.

The Fumaric Acid price in Indonesia fell by 9% in Q3 2025 compared to Q2, reflecting less industrial demand and increased product availability from China. The Fumaric Acid price trend in Indonesia showed a downward trajectory, attributed to slow activity in the cosmetics and pharmaceutical industries, coupled with weakening macroeconomic indicators. In addition, buyers adopted a wait-and-watch approach amid falling global prices.

Fumaric Acid prices in September 2025 continued to drop as inventory pressure increased and imports outpaced consumption. The food sector showed steady but non-aggressive demand. Market participants remained cautious in procurement, contributing to the bearish tone throughout the quarter.

USA: Fumaric Acid Import prices CIF Houston, USA, Grade- (98.5% min) Technical Grade.

In Q3 2025, the Fumaric Acid price in the USA went down by 10% from the previous quarter due to decreased import volumes and a dip in downstream demand. The Fumaric Acid price trend in the USA was bearish, driven by ample inventories and a slowdown in purchasing activity within the food and beverages and pharmaceutical industries.

Lower freight costs and improved logistical efficiency from China added to the downward price momentum. Additionally, the Fumaric Acid price in September 2025 stayed subdued, reflecting weak demand fundamentals.

End-use sectors held back on bulk purchases, anticipating further price drops. Overall, the market sentiment remained cautious, and traders closely tracked developments in international supply dynamics for direction.

Mexico: Fumaric Acid Import prices CIF Manzanillo, México, Grade- (98.5% min) Technical Grade.

In Q3 2025, the Fumaric Acid price in Mexico dipped by 8% compared to Q2, influenced by reduced industrial demand and aggressive pricing from Chinese exporters. The Fumaric Acid price trend in Mexico mirrored a bearish tone as downstream industries, particularly the cosmetics and pharmaceutical sectors, pulled back on raw material purchases.

Market players reported excess stock levels, and Fumaric Acid prices in September 2025 stayed on a downward trend amid stable food industry consumption. Weaker currency dynamics and reduced freight charges further eased import costs. Buyers continued cautious procurement, expecting price stability or further dipsin the coming months. Overall sentiment remained weak across major end-use segments.

Philippines: Fumaric Acid Import prices CIF Manila, Philippines, Grade- (98.5% min) Technical Grade.

In Q3 2025, the Fumaric Acid price in the Philippines went down by 11% compared to the previous quarter due to weak buying sentiments and sluggish demand from the cosmetics and food and beverage industries.

The fumaric acid price trend in the Philippines was affected by an uptake in availability of lower-cost imports from China, prompting local buyers to delay new orders. Downstream industries scaled back production, leading to lower consumption levels.

Fumaric Acid prices in September 2025 stayed on a dipping trend as end-users continued de-stocking. The pharmaceutical sector also displayed moderate demand, failing to provide upward support. Market conditions remained oversupplied, applying further pressure on pricing throughout the quarter.