Price-Watch’s most active coverage of Germanium price assessment:

- Purity: 99.99% FOB Shanghai, China

- Purity: 99.99% CIF Houston_China, USA

- Purity: 99.99% CIF Hamburg_China, Germany

Germanium Price Trend Q3 2025

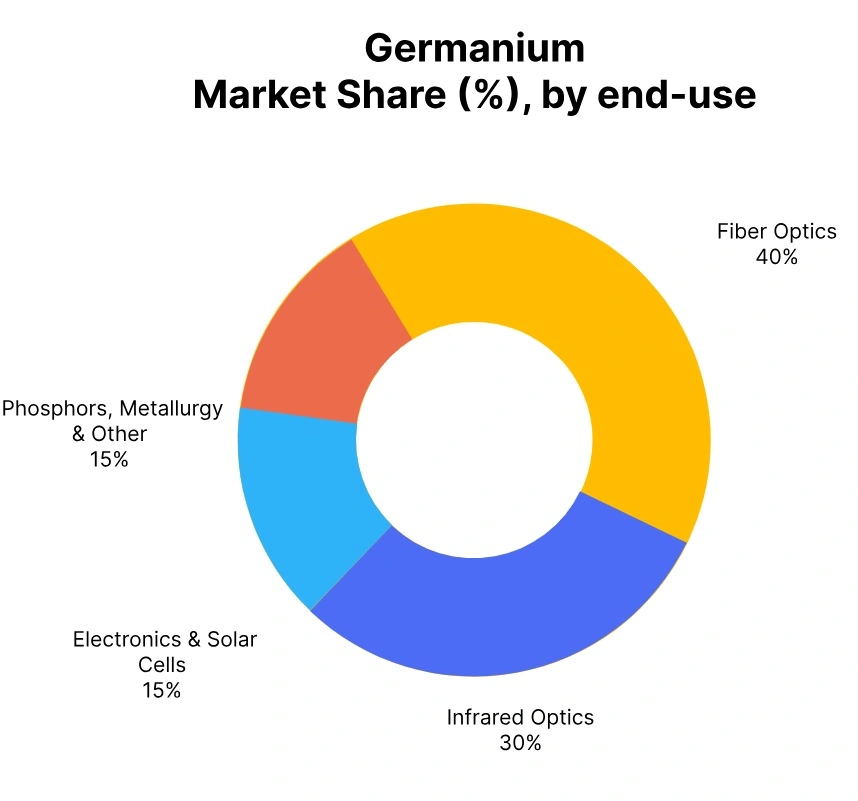

The global Germanium market saw an increase in the third quarter of 2025, with historic prices up roughly 5.82% from the second quarter of 2025. This price increase has been driven primarily due to firm demand from the fibre optics, infrared optics and semiconductors sectors. Major producers in China, USA and Germany displayed stable demand from electronics and defence applications, contributing to tight supply levels in the spot market.

In addition, rising feedstock prices and limited refined supply contributed to an overall optimistic sentiment in pricing. In addition, photovoltaic manufacturers procured additional material, anticipating demand increases in the future. Overall, the quarter displayed a globally optimistic trend, supported by strong industrial fundamentals and limits in supply chains.

China: Germanium Export prices FOB Shanghai, China Purity 99.99%.

In Q3 2025, the germanium price trend in China rose, as prices inclined by 4.86% compared to the previous quarter, supported by stronger demand from the semiconductor, fibre optics, and infrared optics industries. Renewed procurement from electronics manufacturers and steady export activity to North America and Europe boosted market sentiment.

Additionally, limited supply availability and rising production costs contributed to the price uptick. Producers operated at stable capacity levels while prioritizing high-purity material output, resulting in a firm and positive market trend throughout the quarter. Germanium prices in China inclined by 1.45% in September 2025, mainly supported by firm demand from the semiconductor, fiber optics, and solar industries amid improving downstream activity.

Limited smelter output and tight raw material availability further contributed to the upward momentum in prices. Overall, the germanium market in China during Q3 2025 reflected a positive trend, with expectations of continued strength in Q4 driven by expanding applications in electronics and renewable energy sectors.

Germany: Germanium Import prices CIF Hamburg, Germany, Purity 99.99%.

In Q3 2025, the germanium price trend in Germany inclined as prices increased by 5.35% compared to the previous quarter, driven by robust demand from the semiconductor, photovoltaic, and infrared optics industries. Increased consumption from advanced electronics and renewable energy applications, coupled with tighter global supply, supported the upward movement in prices.

Import dependence on Chinese material and elevated refining costs further contributed to the price incline. Overall, market sentiment remained positive, with producers and traders maintaining a bullish outlook amid firm industrial demand and constrained availability.

Germanium prices in Germany rose by 7.31% in September 2025, primarily driven by robust demand from the semiconductor, infrared optics, and photovoltaic sectors amid tightening supply conditions. Limited availability of refined material and rising procurement from technology manufacturers further supported the sharp upward price movement.

Overall, the germanium market in Germany during Q3 2025 exhibited a strong bullish trend, with expectations of sustained firmness in Q4 as industrial and renewable energy applications continue to expand.

USA: Germanium Import prices CIF Houston, USA, Purity 99.99%.

According to PriceWatch, In the third quarter of 2025, the germanium price trend in the USA remained firm, increasing by 7.26% from the prior quarter as a result of increased demand from the semiconductor, fibre optics, and defence technology sectors. Improved procurement from advanced electronics and solar cell manufacturers, in conjunction with tighter global supply and limited imports from China and Europe, drove prices higher.

Moreover, the cost of production remained high due to costly energy and refining. Overall sentiment in the market has been bullish as buyers obtained inventories based on future demand in downstream markets. Germanium prices in the US increased by 7.58% in September 2025 with strong demand from the semiconductor, defence, and solar energy sectors, supported by constrained global supply.

As a result of further procurement from high-tech and renewable sector manufacturers and limited import availability, the Germanium market in the USA in Q3 2025 showed a solid upward trend with expectations of continued strength into Q4 as a result of sustained demand from the technological and clean energy sectors.