Price-Watch’s most active coverage of Guar Gum price assessment:

- Food Grade Powder (Viscosity 5000cps-6000cps), Ex-Jodhpur, India

- Food Grade Powder (Viscosity 5000cps-6000cps), FOB JNPT, India

- Food Grade Powder (Viscosity 5000cps-6000cps), CIF Shanghai (India), China

- Food Grade Powder (Viscosity 5000cps-6000cps), CIF Houston (India), USA

- Food Grade(Viscosity 5000cps-6000cps), CIF Hamburg (India), Germany

- Food Grade(Viscosity 5000cps-6000cps), CIF Santos (India), Brazil

Guar Gum Price Trend Q3 2025

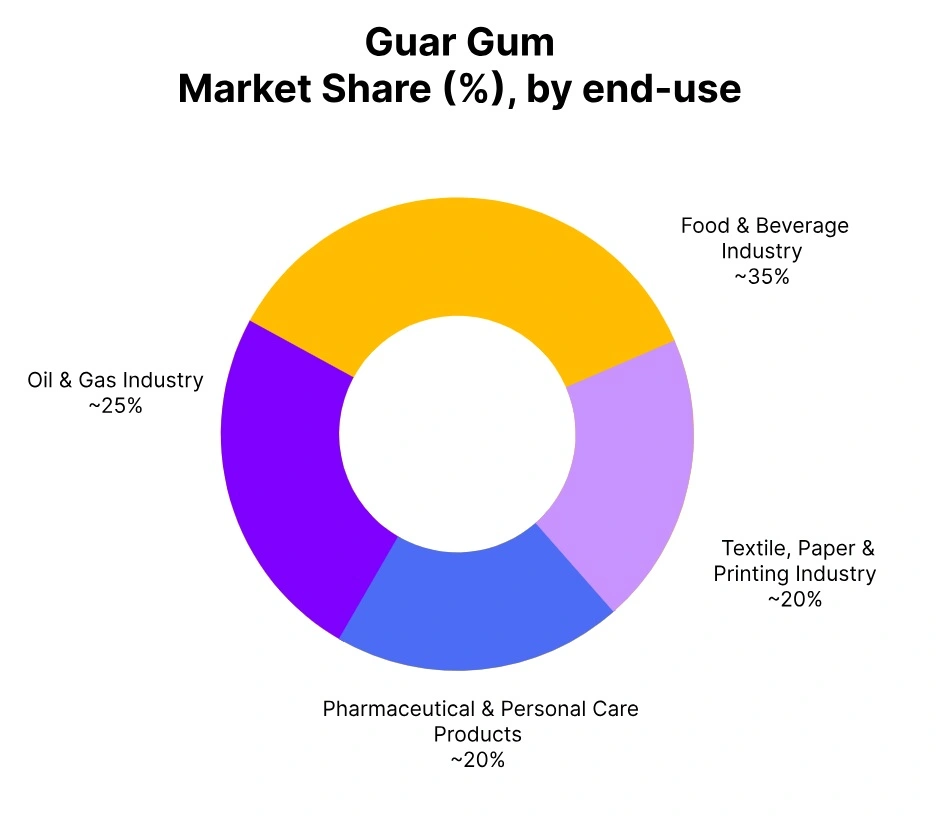

In Q3 2025, the global guar gum market saw a decline in prices, driven by reduced demand across key sectors like food processing and beverages. Economic slowdowns driven by trade tensions, higher tariffs, policy uncertainty, and waning stimulus as industries reduced procurement and consumer spending remained subdued. In South Asia, domestic prices dropped due to stable supply and lower domestic demand, which was mirrored in international markets like East Asia, North America, Europe, and South America.

Logistical challenges, including higher freight costs and delays, also played a role in limiting trade activity. The overall market faced oversupply conditions, with exporters from South Asia continuing to offer ample stock despite weakening demand, resulting in consistent price decreases across regions during the quarter.

India: Guar Gum Exported Price in India, Food Grade Powder (Viscosity 5000cps–6000cps).

According to PriceWatch, in Q3 2025, Guar Gum price in India has witnessed a mild downturn, pressured by slower buying from key Asian and Western markets. The easing of freight congestion and consistent raw material supplies have contributed to stable export flows, though weaker international food additive demand has limited price resilience. In September 2025, Guar Gum prices in India have declined by 2.64% compared to the previous month.

FOB JNPT prices have stood in the range of USD 1300–1600 per metric ton, marking a quarterly dip of –5.20%. A similar Guar Gum price trend in India has been observed for domestically traded material in Jodhpur. Traders have reported steady shipments to long-term buyers, while overall export sentiment has remained restrained by soft global consumption trends.

China: Guar Gum Imported Price in China from India, Food Grade Powder (Viscosity 5000cps–6000cps).

According to PriceWatch, in Q3 2025, Guar Gum price in China has recorded a moderate contraction, reflecting reduced buying interest from the domestic food and beverage sectors. Stable shipments from Indian exporters have ensured sufficient supply, while sluggish downstream offtake has kept inventory levels high. In September 2025, Guar Gum prices in China have fallen by 2.67% compared to the previous month.

CIF Shanghai prices have hovered between USD 1300–1600 per metric ton, denoting a quarterly fall of –6.15%. Market activity has remained lacklustre as traders have observed muted consumption in bakery and dairy stabilization applications, aligning with the overall Guar Gum price trend in China.

United States: Guar Gum Imported Price in United States from India, Food Grade Powder (Viscosity 5000cps–6000cps).

In Q3 2025, Guar Gum price in the United States has edged down amid subdued demand from processed food and pet-care segments. Indian supply channels have operated smoothly, preventing any substantial inventory tightening across Gulf Coast warehouses. In September 2025, Guar Gum prices in the United States have dropped by 4.73% compared to the previous month.

CIF Houston prices have ranged from USD 1400–1800 per metric ton, marking a quarterly decrease of –5.74%. Buyers have maintained cautious purchasing strategies, anticipating stable availability and minimal short-term price support, consistent with the overall Guar Gum price trend in the United States.

Germany: Guar Gum Imported Price in Germany from India, Food Grade Powder (Viscosity 5000cps–6000cps).

In Q3 2025, Guar Gum price in Germany has weakened slightly due to well-stocked inventories and reduced orders from European food formulation industries. Consistent imports from India have maintained comfortable availability across key ports. In September 2025, Guar Gum prices in Germany have decreased by 3.26% compared to the previous month.

CIF Hamburg prices have settled between USD 1400–1700 per metric ton, showing a quarterly dip of –5.57%. Market sentiment has remained cautious as processors have focused on optimizing operating rates amid weak demand in bakery thickening applications, aligning with the overall Guar Gum price trend in Germany.

Brazil: Guar Gum Imported Price in Brazil from India, Food Grade Powder (Viscosity 5000cps–6000cps).

In Q3 2025, Guar Gum price in Brazil has recorded a modest decline under the influence of steady imports from India and slower drawdowns from domestic food stabilizer sectors. The Brazilian market has noted balanced freight conditions and stable supply chains. In September 2025, Guar Gum prices in Brazil have fallen by 2.87% compared to the previous month.

CIF Santos prices have been assessed between USD 1400–1700 per metric ton, reflecting a quarterly fall of –6.06%. End-user demand has remained limited, with buyers refraining from large-volume purchases amid weak consumption in confectionery and beverage formulations, in line with the broader Guar Gum price trend in Brazil.