Price-Watch’s most active coverage of Hastelloy price assessment:

- C-276 Del Alabama, USA

- C-276 FD Hamburg, Germany

- C-276 FOB Shanghai, China

- C-276 Ex-Mumbai, India

Hastelloy Price Trend Q3 2025

Overall, the global Hastelloy prices have headed in a positive direction in Q3 2025 as supply tightens and demand increases. A few select regions, especially those that have supply constrained and have softer demand, notably the US and Germany, are seeing relatively stable prices during this time.

China and India have been exhibiting some modest price upticks amidst inventory drawdown and stronger industrial activity. The global Hastelloy market have been projected to see steady growth through technological innovations and increased demand for corrosion resistant alloys in extreme conditions.

China: Hastelloy Plate Export prices FOB Shanghai, China, Grade- C-276.

According to PriceWatch, in Q3 2025, the price trend in China’s Hastelloy market saw a 3.89% increase from Q2 prices, attributed to tighter supply influenced by production cuts and environmental policies, as well as steady demand from the automotive and new energy vehicle sectors. The price increase in Q3 demonstrates the combination of growth in domestic industrial activity, and tight supply, which differentiates China’s market from relatively stable prices elsewhere in the world.

The positive hastelloy price trend of Hastelloy in China is expected to continue with ongoing demand and limited supply, although there may still be some price volatility as a result of broader economic developments. In China, the 3.23% increase of Hastelloy prices earlier in September 2025 resulted from an increase in raw material prices, in addition to an increase in demand in key industrial sectors. Moreover, a tighter supply chain and stronger environmental regulation have contributed to lower rates of production, resulting in increased prices.

India: Hastelloy Plate Domestic prices EX- Mumbai, India, Grade- C-276.

According to PriceWatch, in Q3 2025, Hastelloy price trend in India increased by 2.13% from Q2 2025 due to continued supply shortages of key raw materials such as nickel and molybdenum along with increasing production costs and substantial logistics charges.

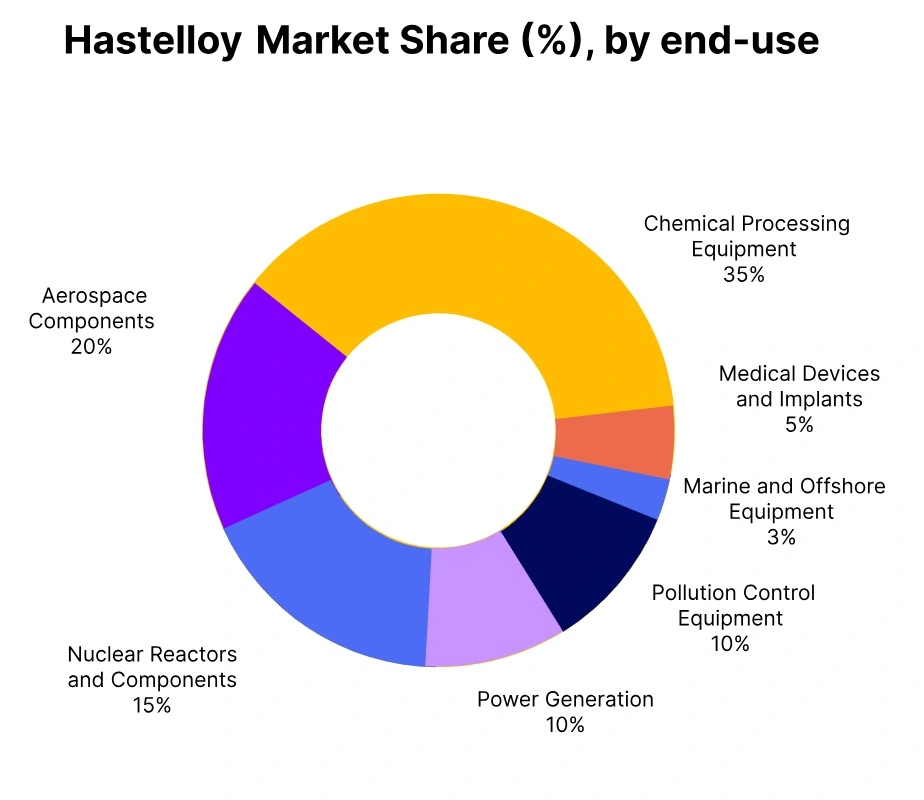

This growth in price has been important due to renewed demand for industries that require Hastelloy for its corrosion resistant abilities, namely aerospace, chemical processing, and power generation. A slight decline in price in the previous quarter notwithstanding, the overall outlook for the market remains very positive for sustained price growth, as supply demand fundamentals continue to tighten.

In September 2025, Hastelloy prices in India increased by 2.44% in India largely due to elevated raw material costs and ongoing disruptions in the supply chain for Hastelloy. Additionally, demand in industries such as aerospace and chemical processing have bolstered that growth.

Germany: Hastelloy Plate Domestic prices FD Hamburg, Germany, Grade- C-276.

In Q3 2025, the hastelloy price trend in Germany showed a moderate increase of 1.77% compared to Q2 2025, driven by ongoing supply constraints, rising production costs, and steady industrial demand despite some sector slowdowns. Supply disruptions, including operational challenges and logistical issues, tightened availability, while rising raw material prices, especially nickel and molybdenum, exerted upward pressure on costs.

Although demand in key sectors like automotive and construction softened due to economic uncertainties, overall market sentiment remained cautiously positive, supporting the observed price uptick. The 1.14% increase in Hastelloy prices in Germany in September 2025 have shown rising production costs, including raw material shortages and higher energy expenses. Additionally, increased demand in key industries such as aerospace and chemical processing have further driven the price adjustment.

USA: Hastelloy Plate Domestic Prices Del Alabama, USA, Grade- C-276.

In Q3 2025, the hastelloy price trend in the USA showed a 2.6% increase from Q2 2025, driven primarily by supply constraints due to renewed steel tariffs and steady demand from aerospace and chemical processing sectors. While automotive demand softened, limited raw material availability and reduced foreign competition tightened the market, supporting higher prices.

Global factors, such as rising prices in China due to supply shortages, also influenced the U.S. market outlook, which points to continued price stability and potential modest growth heading into Q4 2025. The 1.45% increase in Hastelloy prices in the USA during September 2025 reflected rising raw material costs and supply chain challenges impacting production expenses. Additionally, growing demand in industries such as aerospace and chemical processing have contributed to the price adjustment.