Price-Watch’s most active coverage of Hydrogen Peroxide price assessment:

- Industrial Grade (50%) Ex-Mumbai, India

- Industrial Grade (50%) FOB Laem Chabang, Thailand

- Industrial Grade (50%) FOB Busan, South Korea

- Industrial Grade (50%) CIF Kaohsiung (South Korea), Taiwan

- Industrial Grade (50%) Ex-Vadodara, India

- Industrial Grade (50%) Ex-Mettur, India

- Industrial Grade (50%) Ex-West India, India

- Industrial Grade (50%) Ex-East India, India

- Industrial Grade (50%) Ex-North India, India

- Industrial Grade (50%) Ex-South India, India

- Industrial Grade (>27.5%) Ex-Shanghai, China

Hydrogen Peroxide (H₂O₂) Price Trend Q3 2025

Throughout Q3 2025, the global Hydrogen Peroxide market exhibited mixed price movements in key global regions, with a relatively balanced supply and fluctuating demand. In general, Hydrogen peroxide price trend eased in Q3 2025, declining 3% overall on account of a cautious buying mentality, ample inventories, and generally weak downstream activity. Other price support came from freight costs and import/export competitiveness.

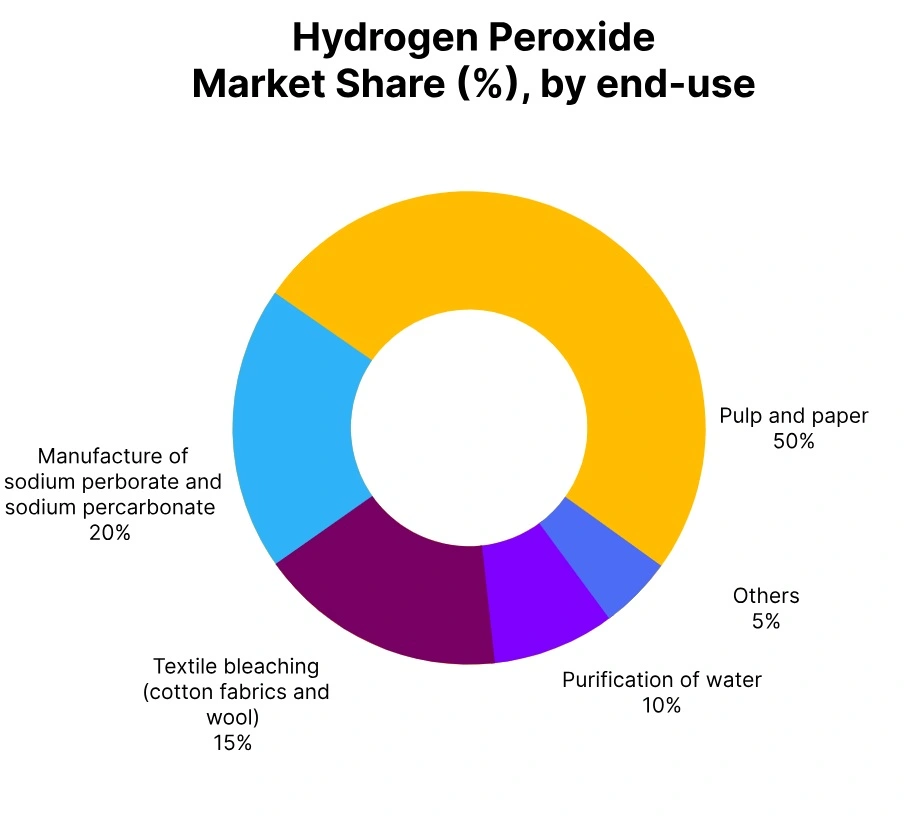

Overall, stable (balanced) supply has helped contain prices from dropping more steeply. Although demand led to short-term price fluctuations, underlying market fundamentals remain supported through demand from industries such as textiles, pulp/paper, and water treatment. Changes in supply chains and strategic buying will contribute to relative stability in the market for the foreseeable future.

Thailand: Hydrogen peroxide Export prices FOB Laem Chabang, Thailand, Grade- Industrial Grade (50%).

In Q3 2025, The Hydrogen Peroxide prices in Thailand remained largely stable, with a slight decline of 0.11%, ranging between USD 465–500 per MT. The Hydrogen Peroxide price trend in Thailand has been shaped by steady supply conditions, moderate freight costs, and cautious market sentiment amid a volatile environment. Competitive pressures among exporters, weak buying interest, and moderate consumption kept prices under mild downward pressure.

In September 2025, Hydrogen Peroxide prices in Thailand saw minor fluctuations by 4.20%, reflecting limited demand, cautious purchasing behavior, and an overall subdued market outlook throughout the quarter, as both buyers and sellers maintained a conservative approach to avoid surplus accumulation and price instability.

South Korea: Hydrogen Peroxide Export prices FOB Busan, South Korea, Grade- Industrial Grade (50%).

In Q3 2025, The Hydrogen Peroxide prices in South Korea increased moderately by 1.48%, with a quarterly price range of USD 370–400 per MT. The Hydrogen Peroxide price trend in South Korea has been supported by stable supply conditions, efficient regional logistics, and consistent production levels that maintained market balance.

Selective improvements in downstream demand provided additional upward momentum, while market participants remained cautiously optimistic amid broader Far East Asia fluctuations. However, in September 2025, Hydrogen Peroxide prices in South Korea witnessed a moderate decline of 4.48%, reflecting steady demand growth, reliable supply, and a positive but careful market outlook through the quarter.

Taiwan: Hydrogen Peroxide Import prices CIF Kaohsiung, Taiwan, Grade- Industrial Grade (50%).

In Q3 2025, The Hydrogen Peroxide prices in Taiwan showed a marginal increase of 0.70%, trading between USD 410–450 per MT. The Hydrogen Peroxide price trend in Taiwan has been supported by lower freight charges from Q2 to Q3, which eased import costs, alongside stable supply conditions. Moderate demand fluctuations have absorbed without major disruptions, while buyers maintained prudent procurement strategies.

In September 2025, Hydrogen Peroxide prices in Taiwan continued their moderate decline by 4.66%, reflecting balanced market dynamics, stable operating rates, and an overall steady price trajectory throughout the quarter, as both producers and buyers maintained cautious market approaches to sustain equilibrium amid changing regional trade conditions.

India: Domestically Traded Hydrogen Peroxide price in Mumbai, India, Grade- Industrial grade (50%).

According to Price-Watch, The Hydrogen Peroxide price trend in India decreased significantly by 19.6% in Q3 2025, reaching a price range of USD 290-350/MT for the quarter. The price trajectory has been influenced by generally stable supply, fluctuating demand across key end-use sectors, and mixed buying sentiment.

While reasonably strong consumption from textiles, paper, and water treatment sectors supported prices at times, weak activity in printing and papermaking, inventory destocking, and, overall, a surplus of supply weighed down on the price trajectory.

In September 2025, Hydrogen peroxide prices in India softened another 5.21%, reflecting competitive selling, cautious buying, and ongoing volatility, with buyers encouraged retraining their volume risk appetite given tentative shifts toward price stabilization.

China: Domestically Traded Hydrogen Peroxide price in Shanghai, China, Grade- Industrial Grade (>27.5%).

In Q3 of 2025, the Hydrogen Peroxide (H2O2) price trend in China registered a decrease of 1.66%, with a quarterly price movement range of USD 92–102 per metric ton. The Hydrogen Peroxide (H2O2) price trend in China has been driven by a general supply-demand balance, which has been favoured late in the quarter by brief supply support resulting from increasing freight rates and offset by softening demand downstream.

In China, the pace of prices continued to remain stable to slightly higher on steady industrial consumption through the early part of the quarter, and the pace of prices fell later in the time period as weakened prices emerged associated with confirmed excess supply and inventories.

At the end of the quarter in September 2025, Hydrogen Peroxide prices in China improved slightly, with a moderate increase of 2.30%. This decrease has been reflected in the Fall 2025 quarter with cautious purchase interest while price thresholds reflected manageable supply flows while market fundamentals gradually softened throughout the quarter.