Price-Watch’s most active coverage of Ilmenite price assessment:

- Purity:52%min. FOB Mozambique, Mozambique

- Purity:52%min. CIF Qingdao (Mozambique), China

Ilmenite Price Trend Q3 2025

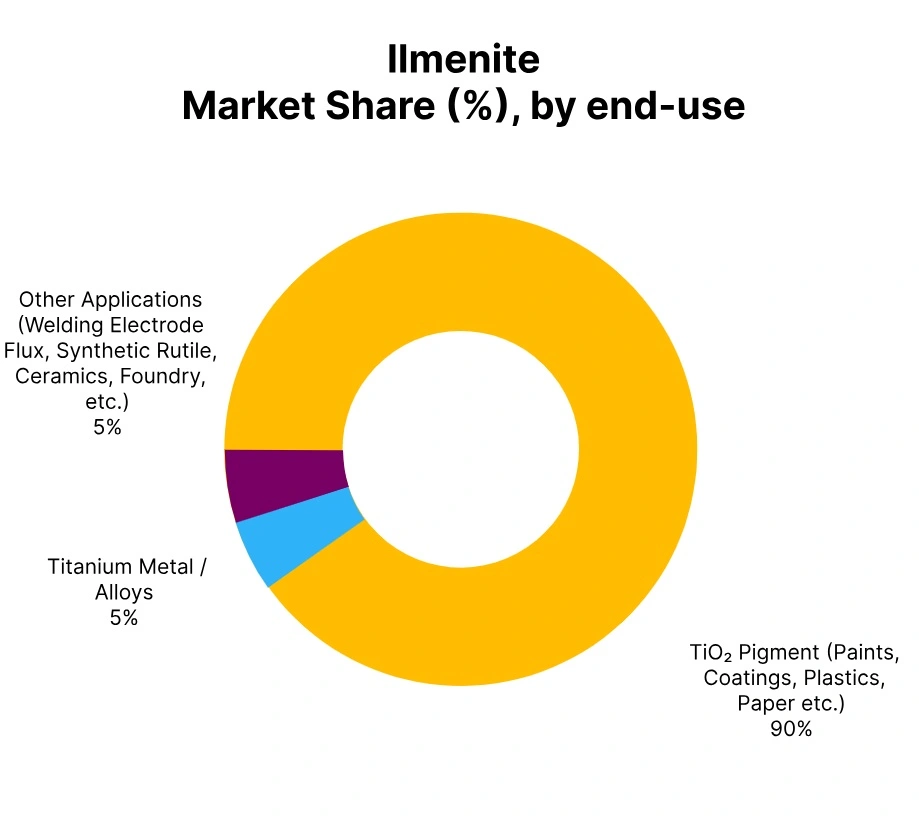

In Q3 2025, the global Ilmenite market displayed a mixed trend, with overall prices declining slightly by around 0.13% from the previous quarter. While some regions witnessed stable demand from the pigment and welding industries, others faced mild downward pressure due to subdued titanium dioxide production activity. In China, marginal oversupply and cautious buying sentiment kept market conditions soft, whereas Mozambique saw relatively firm export offers supported by consistent overseas inquiries.

Weakness in global construction and coatings demand, coupled with moderate feedstock availability, led to limited price fluctuations overall. Despite regional variations, the market largely remained balanced, ending the quarter with a marginal decline and a cautiously neutral outlook.

China: Ilmenite Import prices CIF Qingdao, China, Purity:52%min.

According to PriceWatch, in the third quarter of 2025, Ilmenite prices in China decreased by 0.30% compared to the previous quarter, indicating a minor decline in market sentiment. The modest weakening has primarily been a result of stable, and conservative, demand from the titanium dioxide and welding electrode markets, along with steady supply conditions. While raw material and energy prices have been stable, limited export demand, and conservative consumption downstream limited price action.

Producers continued to operate at normal production levels, and end-users were cautious regarding procurement levels, given stock levels appeared balanced. Overall, the market had a mildly bearish tone, with Ilmenite pricing marginally lower than the previous quarter. In September 2025, Ilmenite prices in China fell by 2.43%, primarily due to weaker demand from both pigment and titanium dioxide sectors due to softer manufacturing activity. Stable local supply levels and build in inventories of Ilmenite also put pressure on prices as export demand remained limited.

Mozambique: Ilmenite Export prices FOB Mozambique, Africa, Purity:52%min.

In Q3 2025, the Ilmenite price trend in Mozambique rose slightly at 0.03% relative to the previous quarter’s prices indicating a stable market with very little serious volatility in the pricing. This slight uptick has been attributed to steady demand from international titanium dioxide producers and continuing shipments to the Asian markets, primarily China and India. Supported by stable mining operations with balanced inventories led to stable pricing.

Adjustments relating to transportation and energy finally resulted in the slight price increase. Overall, the market remained neutral to mildly positive during the quarter, and pricing did demonstrate limited, albeit steady, improvement. In September, however, Ilmenite prices in Mozambique saw a decline of 2.24%. The decline in pricing has largely been attributed to weaker demand from larger consuming countries as well as slower-than-expected demand in global titanium dioxide production.