Price-Watch’s most active coverage of Inconel price assessment:

- Alloy 625 Del Alabama, USA

- Alloy 625 FD Hamburg, Germany

- Alloy 625 FOB Shanghai, China

- Alloy 625 EX Mumbai, India

Inconel Price Trend Q3 2025

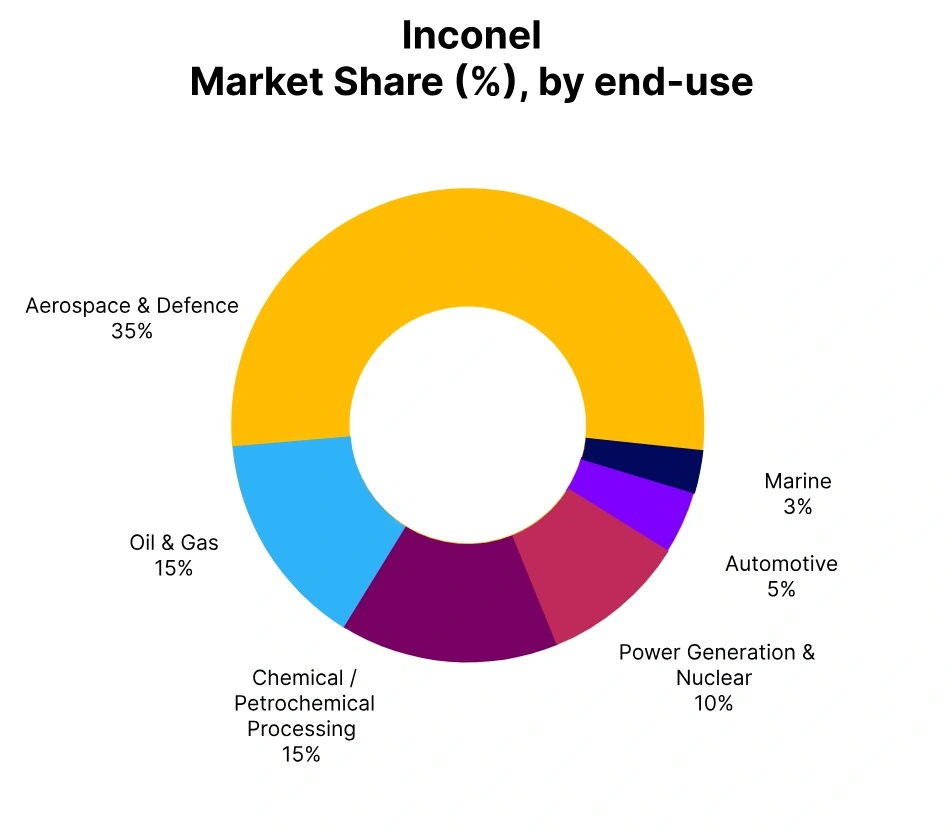

In Q3 2025, Inconel prices are showing a positive trend globally, driven by rising nickel costs, ongoing supply chain constraints, and strong demand from aerospace, automotive, and industrial sectors. Key markets like North America, Europe, and Asia are experiencing price increases, with prices varying by grade but generally trending upward. Supply bottlenecks and raw material shortages continue to support this upward momentum, and analysts expect prices to remain firm in the near term unless significant improvements occur in supply or nickel markets.

Germany: Inconel Domestic prices FD Hamburg, Germany, Grade- Alloy 625.

In Q3 2025, the Inconel price trend in Germany saw a moderate increase of 1.78% compared to Q2, reflecting a positive price trend driven by stabilized nickel costs and steady industrial demand from aerospace and power sectors. After a period of volatility and supply chain challenges in late 2024, the market has begun to stabilize, with manufacturers optimizing production and distribution.

This upward trend indicates cautious optimism for continued moderate growth in Inconel prices in the near term, assuming no major disruptions in raw material supply or demand. The 1.15% increase in Inconel prices in Germany for September 2025 likely reflects rising production costs and increased demand for this high-performance alloy in critical industries. Additionally, supply chain disruptions and raw material shortages may have contributed to the price adjustment.

USA: Inconel Domestic prices Del Alabama, USA, Grade- Alloy 625.

According to Price-Watch, in Q3 2025, the Inconel price trend in U.S. experienced a 2.17% increase compared to Q2, reflecting a steady upward price trend of Inconel. This growth has primarily been driven by rising raw material costs, particularly nickel, combined with stable demand from the aerospace, energy, and industrial sectors.

Supply constraints, certification lead times, and inflationary pressures also supported price firmness. Also, Inconel prices in the US increased by 1.45% due to strengthened industrial demand and tighter supply chain constraints in September 2025.

While the increase has been modest, it signals continued strength in the high-performance alloy segment, with buyers advised to monitor further cost movements and consider strategic procurement to hedge against future volatility. Because Inconel’s cost structure is heavily tied to nickel (and other alloying metals), even a small rise in those raw material prices can ripple through and push processing and procurement costs higher.

China: Inconel Export prices FOB Shanghai, China, Grade- Alloy 625.

According to Price-Watch, China’s Inconel market saw a price trend increase of 3.47% in Q3 2025 compared to Q2, reversing the decline in the previous quarter. Rising global nickel prices and robust demand from important sectors like aerospace and energy have been the main drivers of this growth.

This upward trend has also been bolstered by improved supply chain conditions. In China, Inconel prices in September 2025 increased by 3.24% and has been the result of increased demand in important sectors like energy and aerospace, as well as supply chain issues and rising raw material costs.

This price adjustment has also been influenced by regional production issues and changes in the global market. Overall, it is anticipated that the price trend of Inconel in China will continue to be positive in the near future due to the cost of raw materials and continuous industrial demand.

India: Inconel Domestic prices EX-Mumbai, India, Grade- Alloy 625.

According to Price-Watch, in Q3 2025, the Inconel price trend in India showed a 2.18% increase from Q2 2025 due to improved global nickel price trends, supply chain constraints and steady demand from primary sectors such as aerospace and power generation. Inconel prices in India increased by 2.44% as demand improved in aerospace and industrial sectors coupled with supply chain constraints over the same timeframe.

The upward price trend reflects tighter availability of raw materials and increased production costs along with currency exchange fluctuations contributing to import costs. The Inconel market in India is expected to show moderate growth in the near future, but potential risks, such as economic uncertainty and supply disruptions, may affect future pricing.