Price-Watch’s most active coverage of Lithium price assessment:

- Purity: 99.9%min. Ex Shanghai, China

Lithium Price Trend Q3 2025

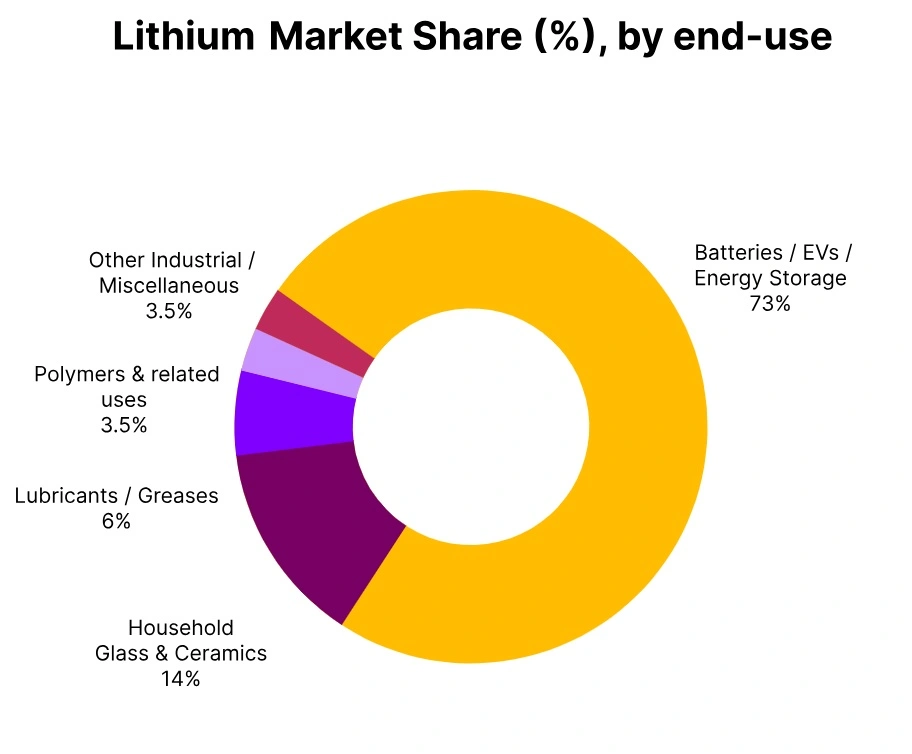

In Q3 2025, the worldwide Lithium Metal market experienced a slight contraction, with overall lithium prices declining approximately 0.24% quarter-quarter. The slight pullback in pricing has primarily been attributed to weaker battery and electronics sector demand along with stabilizing raw material costs. In China, the leading producer and consumer, there have been rising inventory levels and slower downstream procurement from lithium-ion battery producers, which put some modest pressure on prices.

Although the long-term fundamentals remained firm due to ongoing electric vehicle and energy storage application growth, sentiment in the near term remained cautious. Overall, the market remained relatively stable, with minimal volatility, which reflected a brief corrective market phase following prior price surges in prior quarters.

China: Lithium Metal Export prices Ex Sanghai, China, Purity: 99.9%min.

According to Price-Watch, in Q3 2025, the lithium price trend in China declined by 0.24% compared to the previous quarter, reflecting a slight softening in market sentiment. The marginal decline was primarily driven by moderated demand from the battery manufacturing and EV sectors, coupled with stable supply from domestic producers and import sources.

Despite steady raw material and energy costs, cautious procurement by downstream manufacturers and mild inventory accumulation contributed to the downward pressure. Overall, the market remained largely balanced, with a slightly bearish tone prevailing throughout the quarter.

Lithium metal prices in China inclined by 3.35% in September 2025, primarily driven by improved demand from the battery, electric vehicle, and electronics sectors amid robust downstream activity in the later stages of Q3. Tight supply from domestic smelters and constrained raw material availability further supported the upward price movement.